Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you were given the choice to receive more or less compounding periods, which would you choose in order to maximize your monetary situation? A.

If you were given the choice to receive more or less compounding periods, which would you choose in order to maximize your monetary situation?

If you were given the choice to receive more or less compounding periods, which would you choose in order to maximize your monetary situation?

A. More B. Less C. Same Amount

Factor Choices:

Factor Choices:

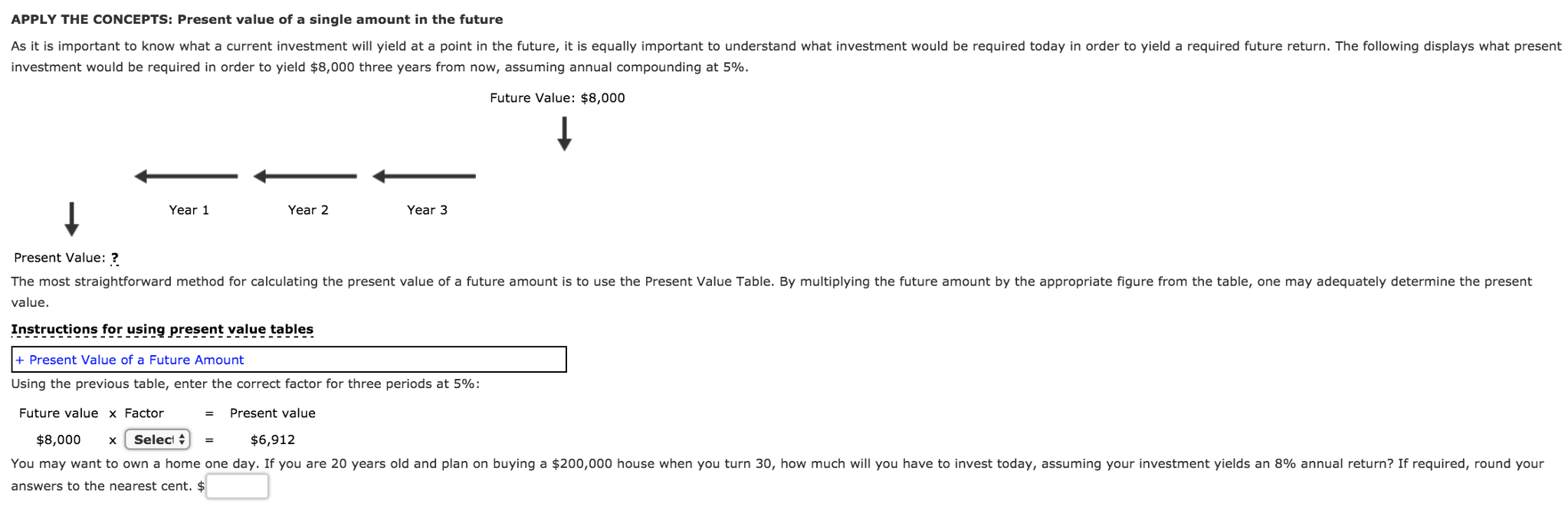

(A. 0.864) (B. 0.751) (C. 0.846) (D. 0.684)

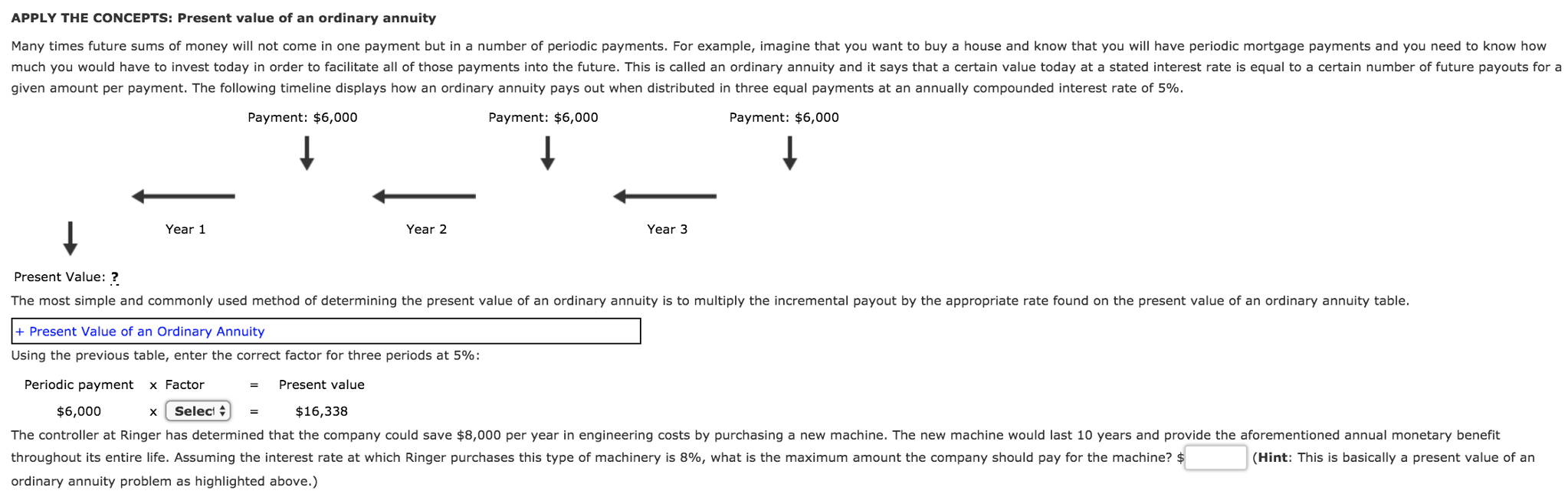

Factor Choices

(A. 0.909) (B. 0.952) (C. 2.723) (D. 3.971)

Assume that the actual cost of the machine is $40,000. Weighing the present value of the benefits against the cost of the machine, should Ringer purchase this piece of machinery?

A.Yes B. No C. Not enough information

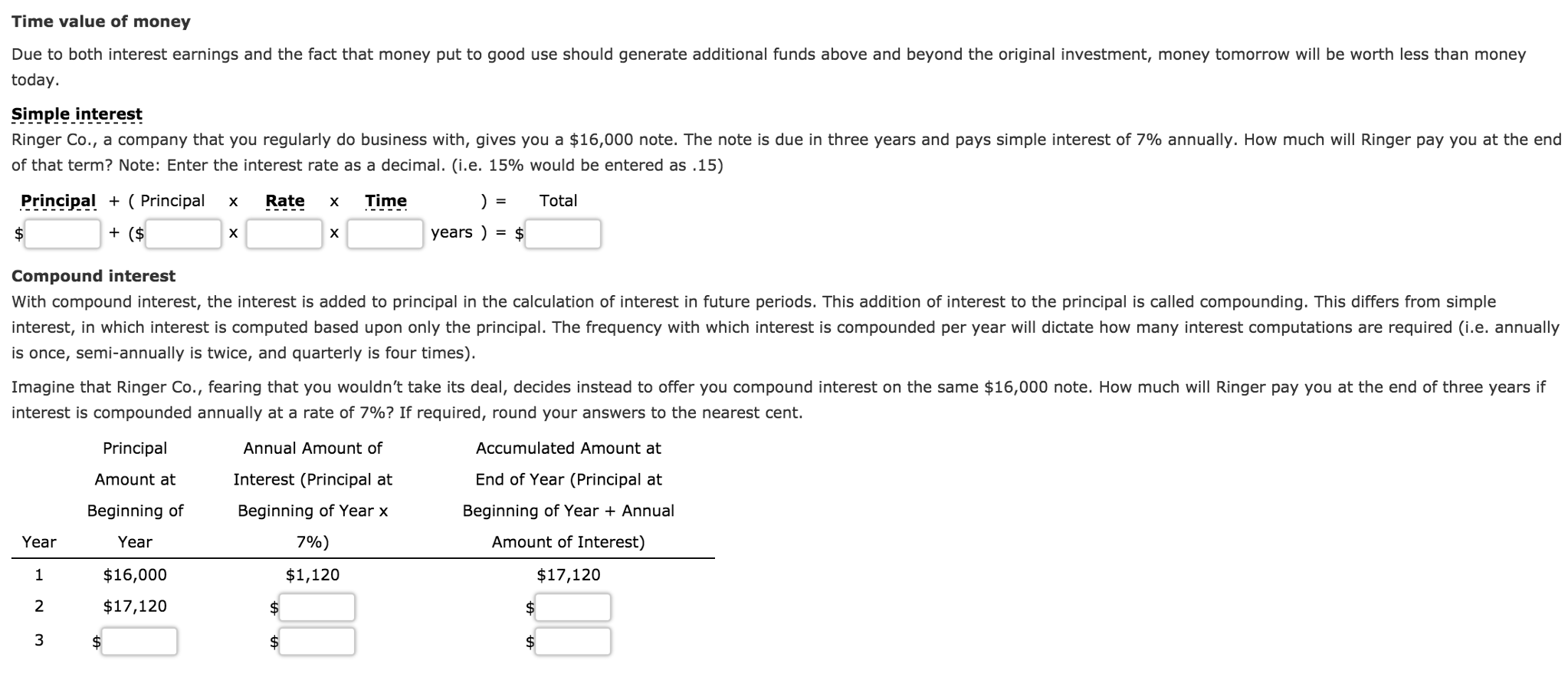

Time value of money Due to both interest earnings and the fact that money put to good use should generate additional funds above and beyond the original investment, money tomorrow will be worth less than money today. Simple interest Ringer Co., a company that you regularly do business with, gives you a $16,000 note. The note is due in three years and pays simple interest of 7% annually. How much will Ringer pay you at the end of that term? Note: Enter the interest rate as a decimal. (i.e. 15% would be entered as .15) Principal( Principal xRate xTime Total years ) = $ Compound interest With compound interest, the interest is added to principal in the calculation of interest in future periods. This addition of interest to the principal is called compounding. This differs from simple interest, in which interest is computed based upon only the principal. The frequency with which interest is compounded per year will dictate how many interest computations are required (i.e. annually is once, semi-annually is twice, and quarterly is four times) Imagine that Ringer Co., fearing that you wouldn't take its deal, decides instead to offer you compound interest on the same $16,000 note. How much will Ringer pay you at the end of three years if interest is compounded annually at a rate of 700? If required, round your answers to the nearest cent. Principal Amount at Beginning of Year $16,000 $17,120 Annual Amount of Interest (Principal at Beginning of Year x 7%) $1,120 Accumulated Amount at End of Year (Principal at Beginning of Year Annual Amount of Interest) $17,120 Year 2 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started