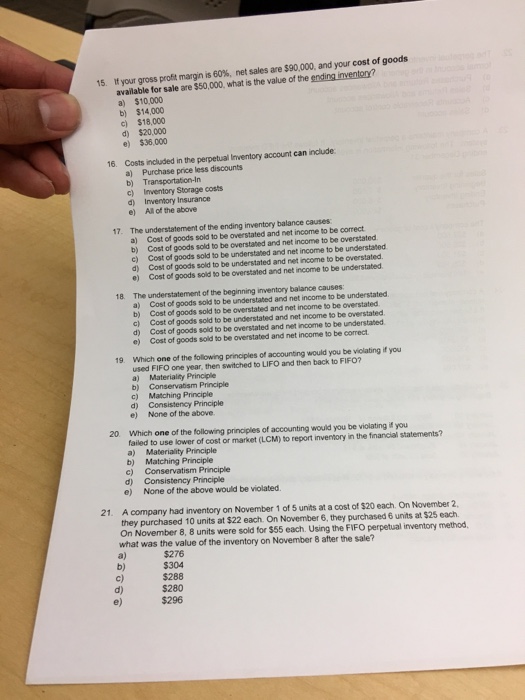

If your gross profit margin is 60%, net sales are $90,000, and your cost of goods available for sale are $50,000, what is the value of the ending inventory? $10,000 $14,000 $18,000 $20,000 $36,000 Costs included in the perpetual inventory account can include Purchase price less discounts Transportation-In inventory Storage costs Inventory Insurance All of the above The understatement of the ending inventory balance causes: Cost of goods sold to be overstated and net income to the correct. Cost of goods sold to be overstated and net income to be overstated. Cost of goods sold to be understated and net income to be understated. Cost of goods sold to be understated and net income to be overstated. Cost of goods sold to be overstated and net income to be understated. The understatement of the beginning inventory balance causes: Cost of goods sold to be understated and net income to be understated. Cost of goods sold to be overstated and net income to be overstated. Cost of goods sold to be understated and net income to be overstated. Cost of goods sold to be overstated and net income to be understated. Cost of goods sold to be overstated and net income to be correct. Which one of the following principles of accounting would you be violating if you used FIFO one year, then switched to LIFO and then back to FIFO? Materiality Principle Conservatism Principle Matching Principle Consistency Principle None of the above Which one of the following principles of accounting would you be violating if you failed to use lower of cost or market (LCM) to report inventory in the financial statements? Materiality Principle Matching Principle Conservatism Principle Consistency Principle None of the above would be violated. A company had inventory on November 1 of 5 units at a cost of $20 each. On November 2, they purchased 10 units at $22 each. On November 6, they purchased 6 units at $26 each. On November 8, 8 units were sold for $55 each. Using the FIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale? $276 $304 $288 $280 $296