Answered step by step

Verified Expert Solution

Question

1 Approved Answer

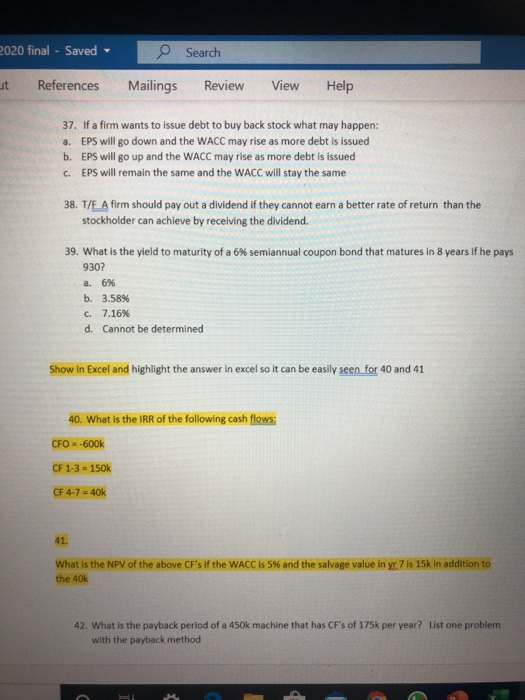

If youre going to answer only one, please leave alone. Thanks!!!!!!!!!!!! 37-38-39 & 42 2020 final - Saved Search ut References Mailings Review View Help

If youre going to answer only one, please leave alone. Thanks!!!!!!!!!!!! 37-38-39 & 42

2020 final - Saved Search ut References Mailings Review View Help 37. If a firm wants to issue debt to buy back stock what may happen: a. EPS will go down and the WACC may rise as more debt is issued b. EPS will go up and the WACC may rise as more debt is issued C. EPS will remain the same and the WACC will stay the same 38. T/E A firm should pay out a dividend if they cannot earn a better rate of return than the stockholder can achieve by receiving the dividend. 39. What is the yield to maturity of a 6% semiannual coupon bond that matures in 8 years if he pays 930? a. 6% b. 3.58% c. 7.16% d. Cannot be determined Show in Excel and highlight the answer in excel so it can be easily seen for 40 and 41 40. What is the IRR of the following cash flows: CFO-600k CF 1-3 = 150k CF 4-7 = 40k What is the NPV of the above CF's if the WACC is 5% and the salvage value in yr 7 is 15k in addition to the 40k 42. What is the payback period of a 450k machine that has CF's of 175k per year? List one problem with the payback method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started