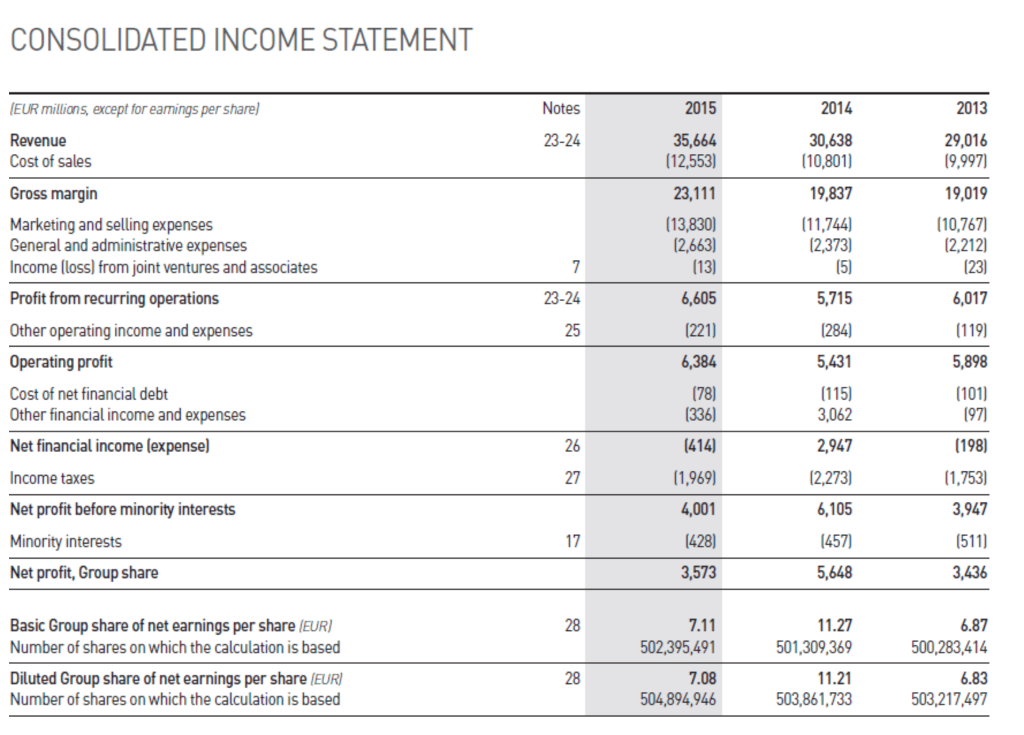

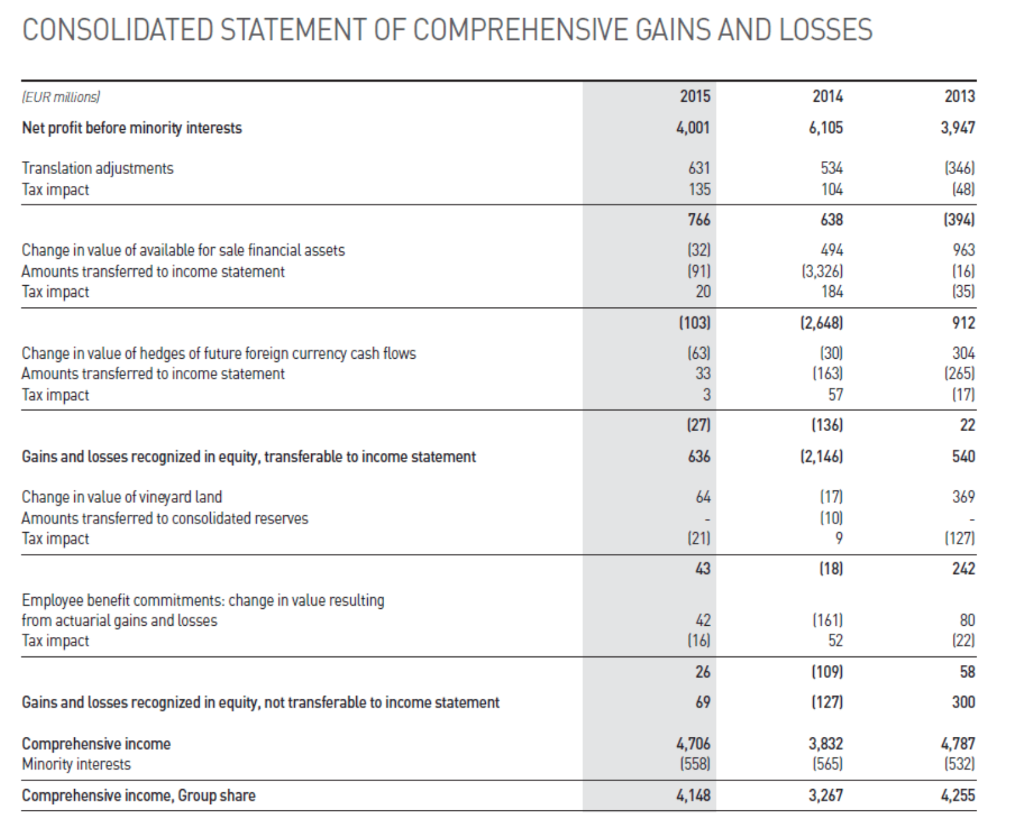

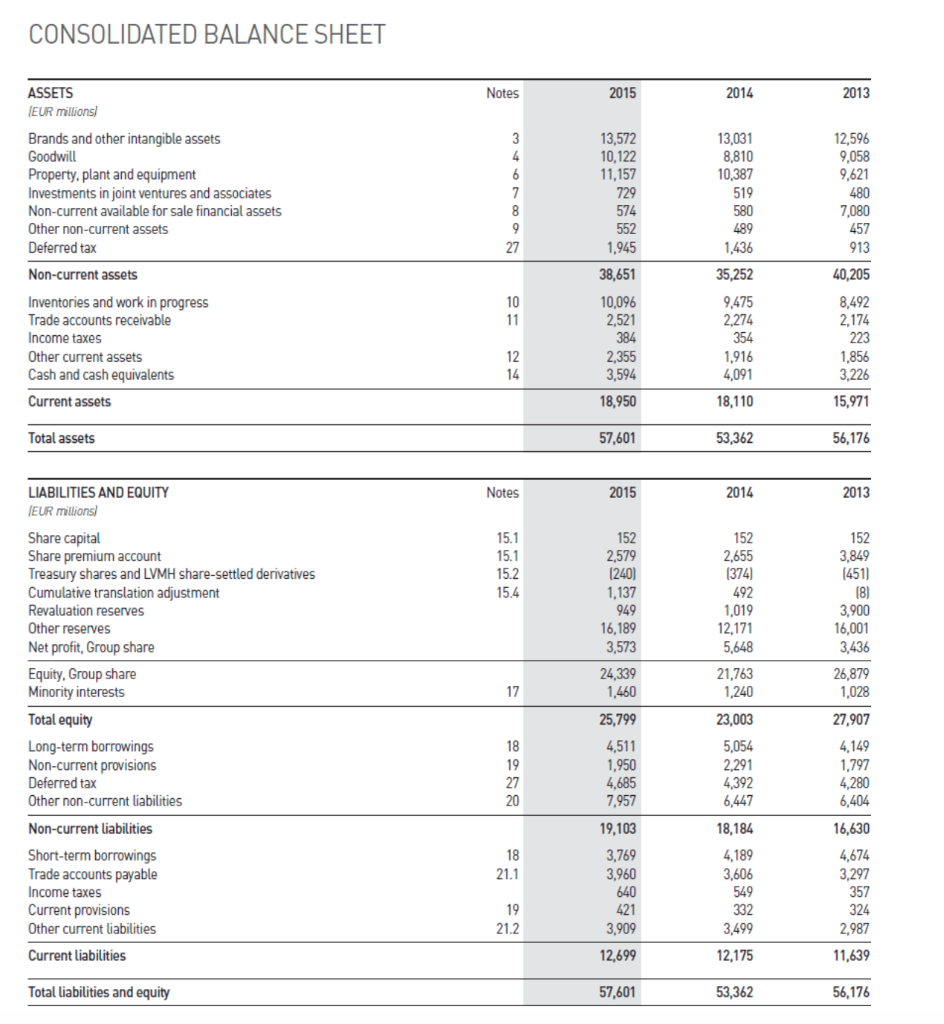

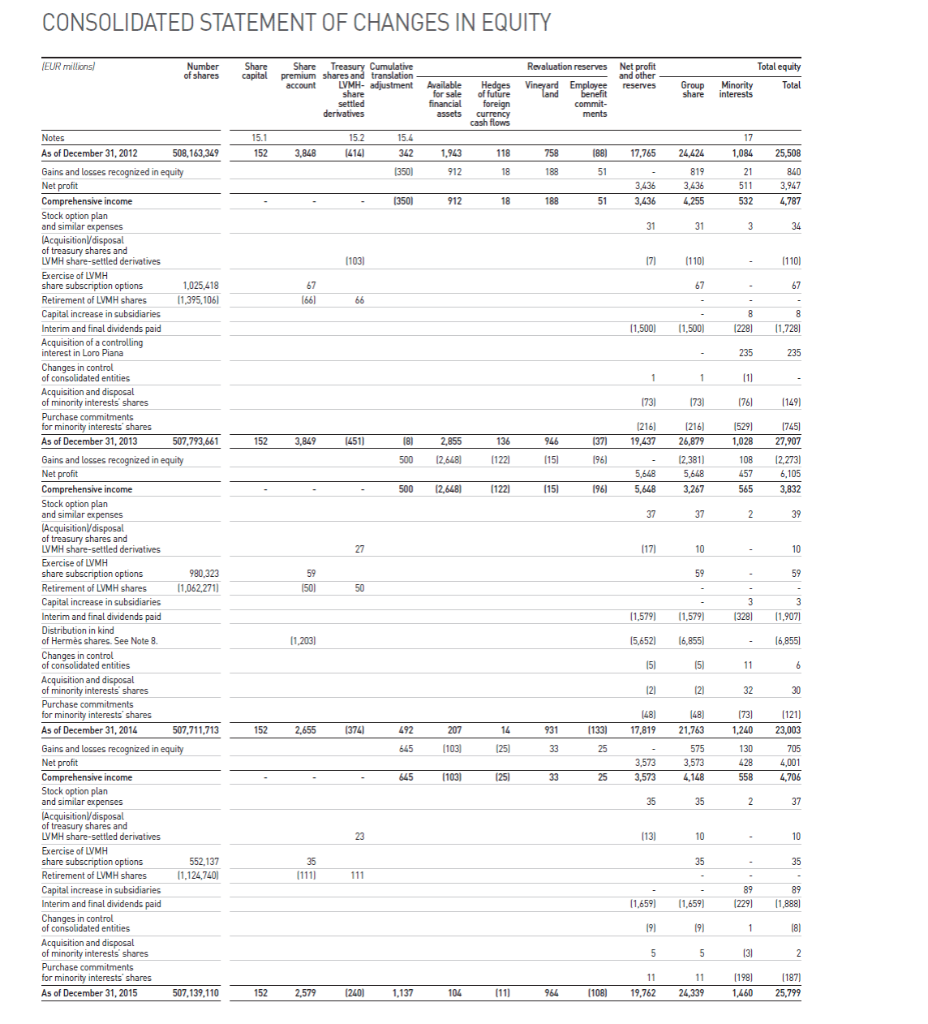

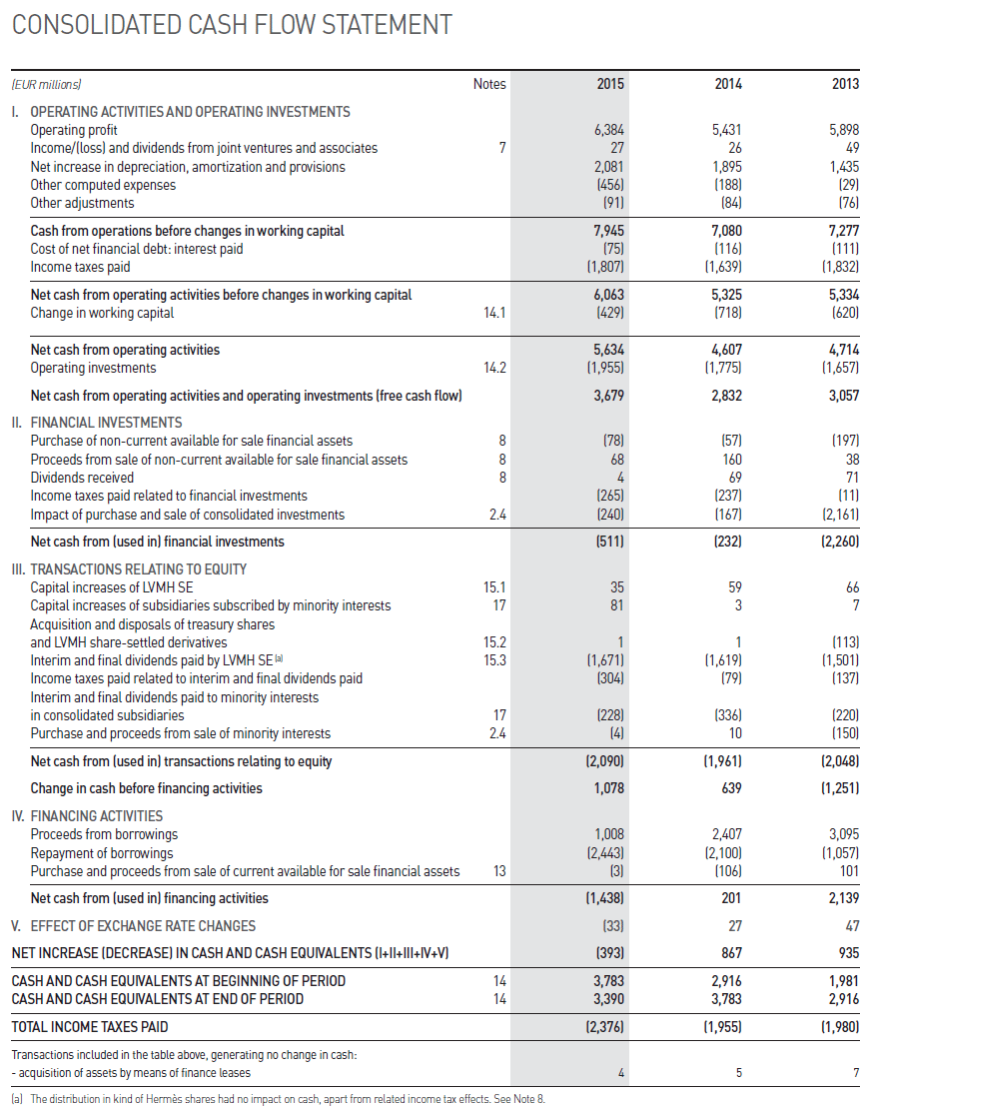

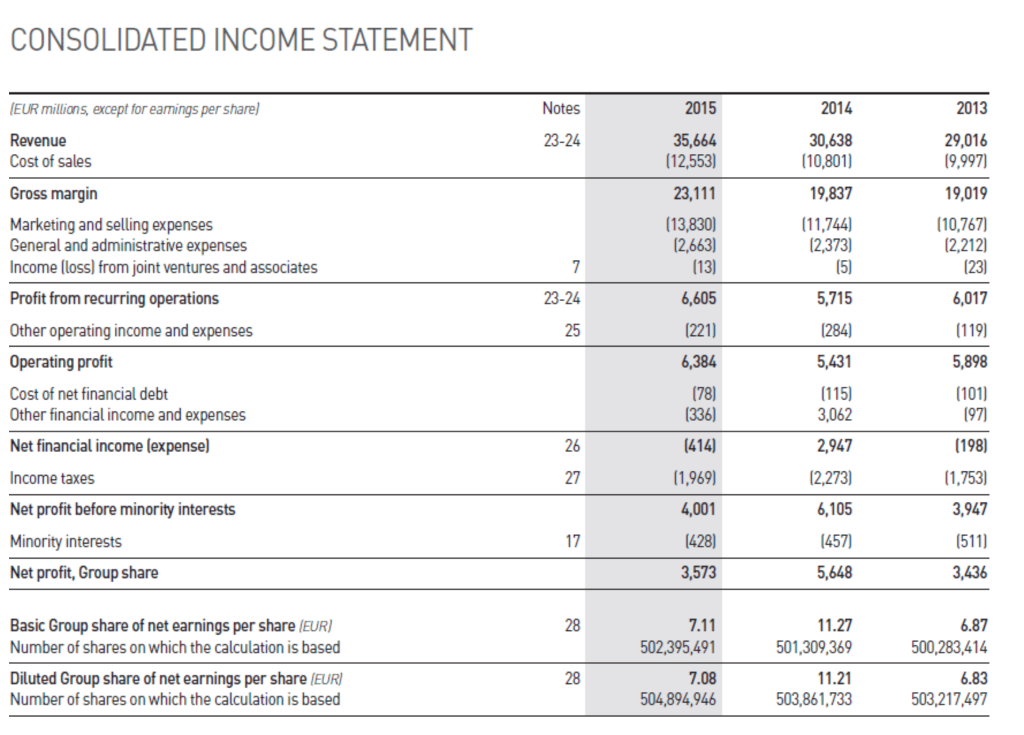

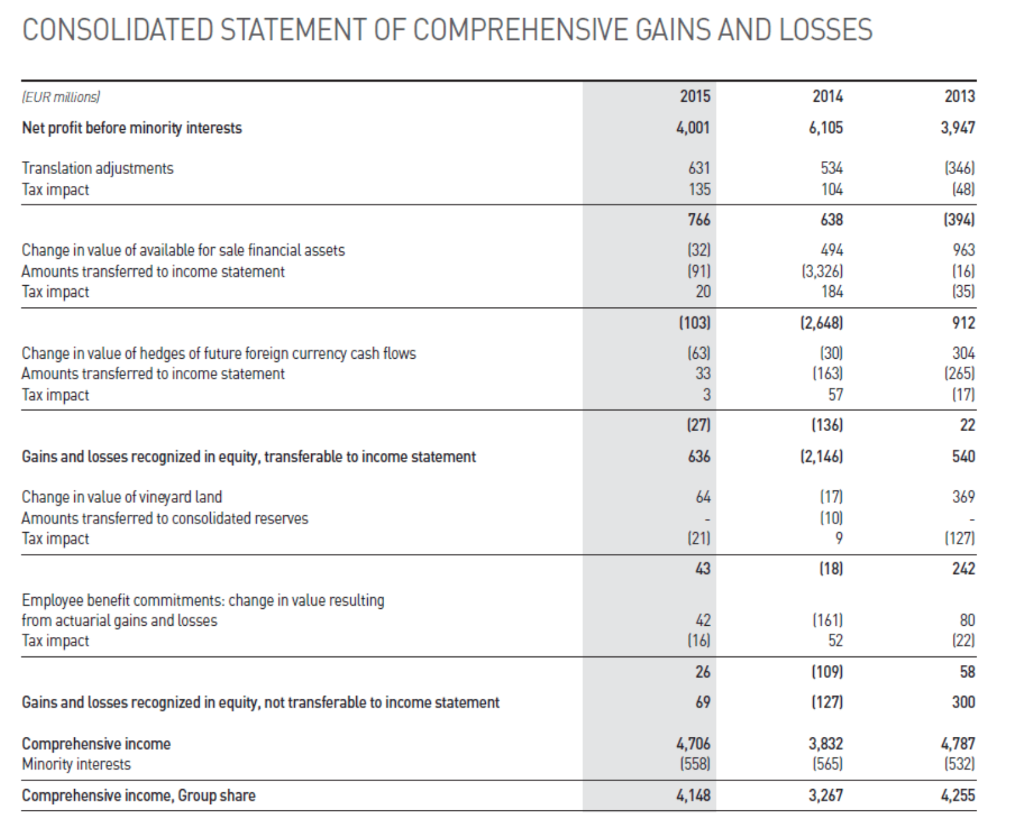

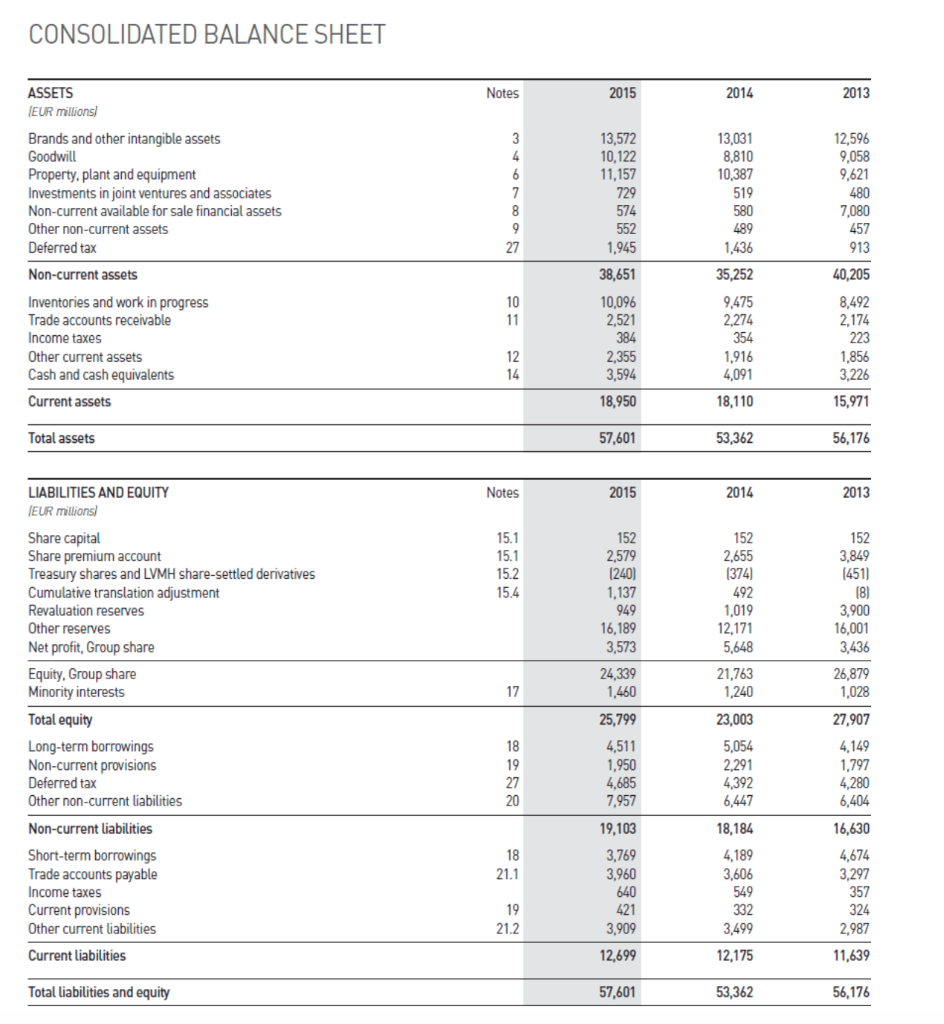

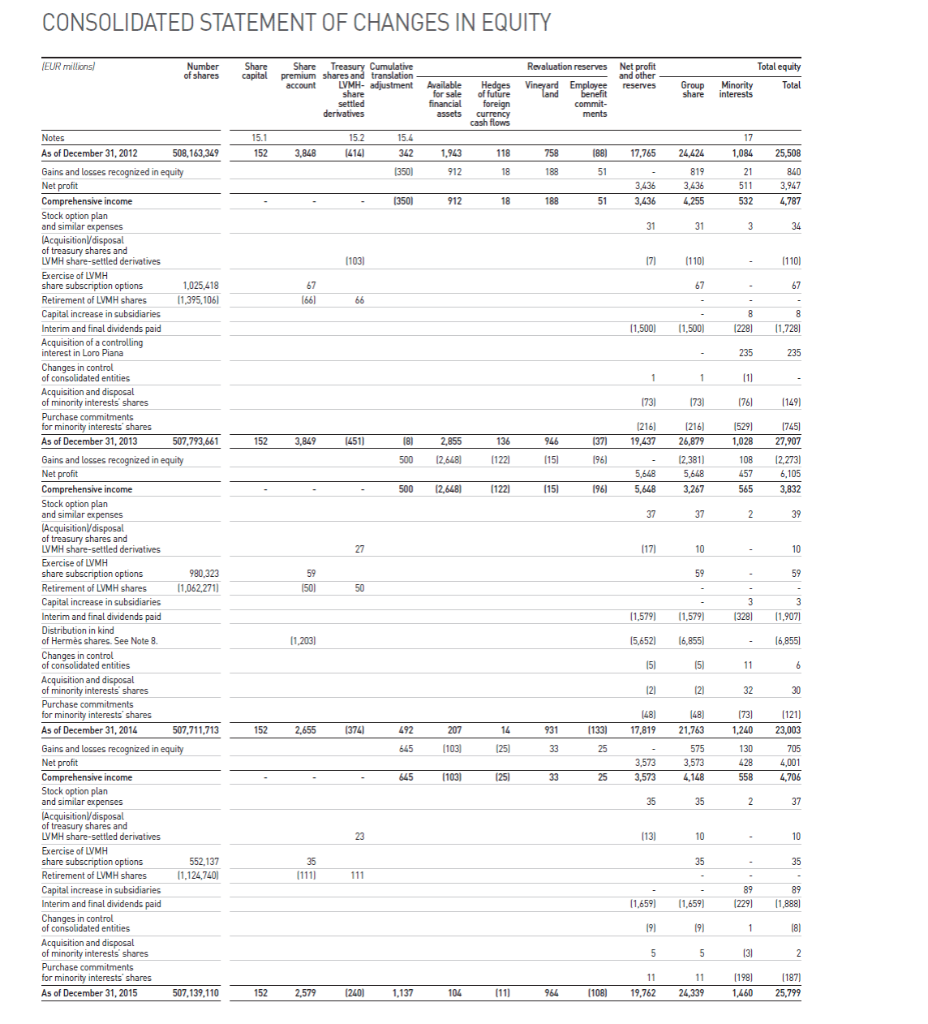

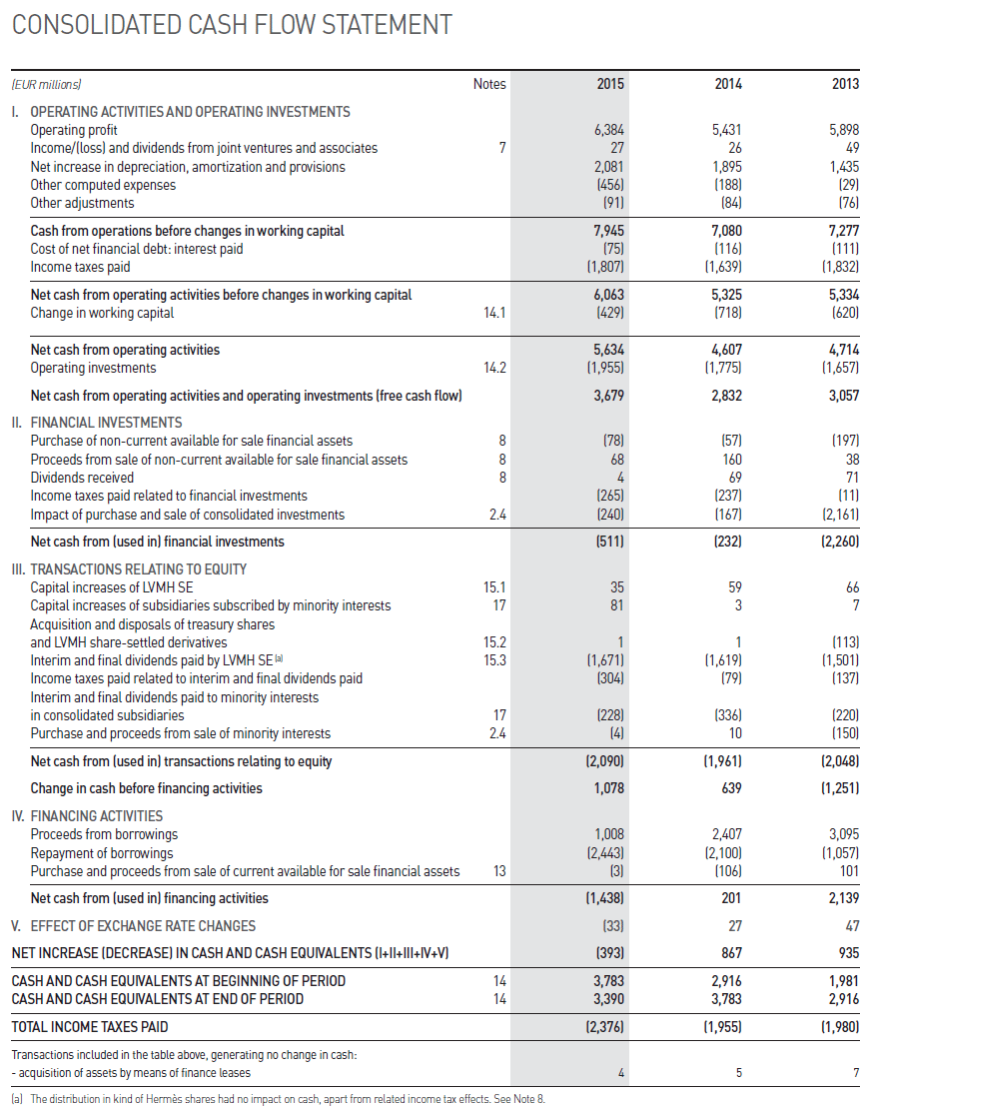

IFRS 14-01 a-c (Part Level Submission) The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix F. Use the company's annual report to answer the following questions. (a) Did the company declare and pay any dividends for the year ended December 31, 2015? The company declared dividends of and paid dividends of in 2015. Click if you would like to Show Work for this question: Open Show Work CONSOLIDATED INCOME STATEMENT (EUR millions, except for earings per share) Notes 2015 2014 23-24 Revenue Cost of sales 35,664 (12,553) 30,638 (10,801) 2013 29,016 19,997) 23,111 (13,830) 12,663) (13) 19,837 (11,744) (2,373) (5) 19,019 (10,767) (2,212) (23) 23-24 Gross margin Marketing and selling expenses General and administrative expenses Income (loss) from joint ventures and associates Profit from recurring operations Other operating income and expenses Operating profit Cost of net financial debt Other financial income and expenses Net financial income (expense) 6,605 (221) 5,715 (284) 6,017 (119) 6,384 5,898 (78) (101) (336) (97) (414) 5,431 (115) 3,062 2,947 (2,273) 6,105 (457) 5,648 Income taxes (1,969) 4,001 (428) Net profit before minority interests Minority interests Net profit, Group share (198) (1,753) 3,947 (511) 3,436 3,573 Basic Group share of net earnings per share (EUR) Number of shares on which the calculation is based Diluted Group share of net earnings per share (EUR) Number of shares on which the calculation is based 7.11 502,395,491 7.08 504,894,946 11.27 501,309,369 11.21 503,861,733 6.87 500,283,414 6.83 503,217,497 CONSOLIDATED STATEMENT OF COMPREHENSIVE GAINS AND LOSSES EUR millions 2015 4,001 2014 6,105 2013 3,947 Net profit before minority interests Translation adjustments Tax impact 631 (346) (48) 638 (394) Change in value of available for sale financial assets Amounts transferred to income statement Tax impact 494 (3,326) 184 (103) Change in value of hedges of future foreign currency cash flows Amounts transferred to income statement Tax impact (2,648) (30) (163) 57 (17) (136) (2,146) Gains and losses recognized in equity, transferable to income statement (17) Change in value of vineyard land Amounts transferred to consolidated reserves Tax impact (18) Employee benefit commitments: change in value resulting from actuarial gains and losses Tax impact (161) (109) Gains and losses recognized in equity, not transferable to income statement (127) 300 Comprehensive income Minority interests Comprehensive income, Group share 4,706 (558) 3,832 (565) 4,787 (532) 4,148 3,267 4,255 CONSOLIDATED BALANCE SHEET Notes 2015 2014 2013 13,572 ASSETS IEUR Millions) Brands and other intangible assets Goodwill Property, plant and equipment Investments in joint ventures and associates Non-current available for sale financial assets Other non-current assets Deferred tax 12,596 9,058 9,621 480 7,080 10,122 11,157 729 574 552 1,945 38,651 10,096 2,521 457 913 Non-current assets 13,031 8,810 10,387 519 580 489 1,436 35,252 9,475 2,274 354 1,916 4,091 18,110 40,205 384 Inventories and work in progress Trade accounts receivable Income taxes Other current assets Cash and cash equivalents Current assets 2,355 3,594 18,950 8,492 2.174 223 1,856 3,226 15,971 Total assets 57,601 53,362 56,176 Notes 2015 2014 2013 LIABILITIES AND EQUITY (EUR millions 152 152 3,849 15.1 15.1 15.2 154 (451) Share capital Share premium account Treasury shares and LVMH share-settled derivatives Cumulative translation adjustment Revaluation reserves Other reserves Net profit Group share Equity, Group share Minority interests Total equity Long-term borrowings Non-current provisions Deferred tax Other non-current liabilities 152 2,579 (240) 1,137 949 16,189 3,573 24,339 1,460 25,799 4,511 1,950 4,685 7,957 2,655 (374) 492 1,019 12,171 5,648 21,763 1,240 23,003 5,054 2.291 4,392 6,447 (8) 3,900 16,001 3,436 26,879 1,028 27,907 4,149 1,797 4,280 6,404 Non-current liabilities 19,103 3,769 3,960 Short-term borrowings Trade accounts payable Income taxes Current provisions Other current liabilities 18,184 4.189 3,606 549 332 3,499 12,175 16,630 4,674 3,297 357 640 421 324 3,909 12,699 2,987 11,639 Current liabilities Total liabilities and equity 57,601 53,362 56,176 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY EUR millions Number of shares Share capital Share premium account Net profit and other reserves Total equity Total Treasury Cumulative shares and translation - LVMH- adjustment share settled derivatives Group share Revaluation reserves Vinevard Employee land benefit commit- ments Available for sale Financial assets Minority interests Hedges of future foreign currency cash flows 15.1 152 3 ,848 15.2 (414) 15.6 342 1350) 1 1,943 912 18 18 758 188 1 88 51 17,765 - 3.436 3,436 31 24.424 819 3,436 4,255 31 17 1,084 21 511 532 3 25,508 840 3,947 4,787 34 . (3501 912 18 188 51 (1031 17 (110) 67 . . (110) 67 16666 1,500) 1,500 - 88 (2281 1 ,728) 235 235 173] [73] [76] (149) 152 3,849 451 216) 19,437 1 181 500 2,855 12,648 136 [122] 946 (15 137 9 6 (216) 26,879 2,381 5,648 3,267 (529) ,028 108 457 565 2 (745) 27,907 12,273) 6,105 3,832 39 - 500 (2,648) [122] [15] 5,648 ,648 196 5 117) Notes As of December 31, 2012 508, 163,349 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 1.025,418 Retirement of LVMH shares 11,395,106) Capital increase in subsidiaries Interim and final dividends paid Acquisition of a controlling interest in Loro Piana Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2013 507,793,661 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 980,323 Retirement of LVMH shares 11,062,271) Capital increase in subsidiaries Interim and final dividends paid Distribution in kind of Herms chares. See Note 8 Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2014 507,711,713 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 552.137 Retirement of LVMH shares 1.124 7401 Capital increase in subsidiaries Interim and final dividends paid Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2015 507,139,110 10 59 . 59 1501 3 (328) 11,579) (1,579 (1,907) 11,203) 15,652 16,855 - 16,855) 120 121 32 3 0 152 2,655 (3741 1 492 645 207 (103) 14 25 931 33 (133) 25 (48) 17,819 . 3,573 48 21,763 575 3,573 (73] ,240 130 428 (121) 23,003 705 4,001 . 645 (103) (25) 33 25 35 2 37 113110 11111 1 11 (229) (1,659) 191 5 (1,659) 191 5 11.8881 181 1 31 2 11 19,762 11 24,339 (198) 1,460 (187) 25,799 152 2,579 1 240 1,137 104 (11) 964 (108) CONSOLIDATED CASH FLOW STATEMENT Notes 2015 2014 2013 6,384 [EUR millions) 1. OPERATING ACTIVITIES AND OPERATING INVESTMENTS Operating profit Income/(loss) and dividends from joint ventures and associates Net increase in depreciation, amortization and provisions Other computed expenses Other adjustments 5,898 49 1,435 2,081 (456) 191) (29) 5,431 26 1,895 (188) (84) 7,080 (116) (1,639) 1761 7,945 7,277 (75) (1,807) Cash from operations before changes in working capital Cost of net financial debt: interest paid Income taxes paid Net cash from operating activities before changes in working capital Change in working capital (111) (1,832) 5,334 (620) 14.1 6,063 (429) 5,325 1718) 4,714 14.2 5,634 (1,955) 3,679 4,607 (1,775) 2,832 (1,657) 3,057 8 (78) (57) (197) 68 160 38 69 (265) (240) (511) (237) (167) (232) (11) (2,161) (2,260) 35 59 (113) Net cash from operating activities Operating investments Net cash from operating activities and operating investments (free cash flow) II. FINANCIAL INVESTMENTS Purchase of non-current available for sale financial assets Proceeds from sale of non-current available for sale financial assets Dividends received Income taxes paid related to financial investments Impact of purchase and sale of consolidated investments Net cash from (used in) financial investments III. TRANSACTIONS RELATING TO EQUITY Capital increases of LVMH SE Capital increases of subsidiaries subscribed by minority interests Acquisition and disposals of treasury shares and LVMH share-settled derivatives Interim and final dividends paid by LVMH SE! Income taxes paid related to interim and final dividends paid Interim and final dividends paid to minority interests in consolidated subsidiaries Purchase and proceeds from sale of minority interests Net cash from (used in) transactions relating to equity Change in cash before financing activities IV. FINANCING ACTIVITIES Proceeds from borrowings Repayment of borrowings Purchase and proceeds from sale of current available for sale financial assets Net cash from (used in) financing activities V. EFFECT OF EXCHANGE RATE CHANGES NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (1+11+11+1V+V) (1,671) (304) (1,619) (79) (1,501) (137) (228) (336) (4) 10 (220) (150) (2,048) (1,251) (2,090) (1,961) 1,078 639 1,008 (2,443) 2,407 (2,100) 13 (106) (1,438) (33] (393) 201 27 867 3,095 (1,057) 101 2,139 47 935 3,783 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD 2,916 3,783 (1,955) 1,981 2,916 3,390 TOTAL INCOME TAXES PAID (2,376) (1,980) Transactions included in the table above, generating no change in cash: - acquisition of assets by means of finance leases (a) The distribution in kind of Herms shares had no impact on cash, apart from related income tax effects. See Note 8 IFRS 14-01 a-c (Part Level Submission) The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix F. Use the company's annual report to answer the following questions. (a) Did the company declare and pay any dividends for the year ended December 31, 2015? The company declared dividends of and paid dividends of in 2015. Click if you would like to Show Work for this question: Open Show Work CONSOLIDATED INCOME STATEMENT (EUR millions, except for earings per share) Notes 2015 2014 23-24 Revenue Cost of sales 35,664 (12,553) 30,638 (10,801) 2013 29,016 19,997) 23,111 (13,830) 12,663) (13) 19,837 (11,744) (2,373) (5) 19,019 (10,767) (2,212) (23) 23-24 Gross margin Marketing and selling expenses General and administrative expenses Income (loss) from joint ventures and associates Profit from recurring operations Other operating income and expenses Operating profit Cost of net financial debt Other financial income and expenses Net financial income (expense) 6,605 (221) 5,715 (284) 6,017 (119) 6,384 5,898 (78) (101) (336) (97) (414) 5,431 (115) 3,062 2,947 (2,273) 6,105 (457) 5,648 Income taxes (1,969) 4,001 (428) Net profit before minority interests Minority interests Net profit, Group share (198) (1,753) 3,947 (511) 3,436 3,573 Basic Group share of net earnings per share (EUR) Number of shares on which the calculation is based Diluted Group share of net earnings per share (EUR) Number of shares on which the calculation is based 7.11 502,395,491 7.08 504,894,946 11.27 501,309,369 11.21 503,861,733 6.87 500,283,414 6.83 503,217,497 CONSOLIDATED STATEMENT OF COMPREHENSIVE GAINS AND LOSSES EUR millions 2015 4,001 2014 6,105 2013 3,947 Net profit before minority interests Translation adjustments Tax impact 631 (346) (48) 638 (394) Change in value of available for sale financial assets Amounts transferred to income statement Tax impact 494 (3,326) 184 (103) Change in value of hedges of future foreign currency cash flows Amounts transferred to income statement Tax impact (2,648) (30) (163) 57 (17) (136) (2,146) Gains and losses recognized in equity, transferable to income statement (17) Change in value of vineyard land Amounts transferred to consolidated reserves Tax impact (18) Employee benefit commitments: change in value resulting from actuarial gains and losses Tax impact (161) (109) Gains and losses recognized in equity, not transferable to income statement (127) 300 Comprehensive income Minority interests Comprehensive income, Group share 4,706 (558) 3,832 (565) 4,787 (532) 4,148 3,267 4,255 CONSOLIDATED BALANCE SHEET Notes 2015 2014 2013 13,572 ASSETS IEUR Millions) Brands and other intangible assets Goodwill Property, plant and equipment Investments in joint ventures and associates Non-current available for sale financial assets Other non-current assets Deferred tax 12,596 9,058 9,621 480 7,080 10,122 11,157 729 574 552 1,945 38,651 10,096 2,521 457 913 Non-current assets 13,031 8,810 10,387 519 580 489 1,436 35,252 9,475 2,274 354 1,916 4,091 18,110 40,205 384 Inventories and work in progress Trade accounts receivable Income taxes Other current assets Cash and cash equivalents Current assets 2,355 3,594 18,950 8,492 2.174 223 1,856 3,226 15,971 Total assets 57,601 53,362 56,176 Notes 2015 2014 2013 LIABILITIES AND EQUITY (EUR millions 152 152 3,849 15.1 15.1 15.2 154 (451) Share capital Share premium account Treasury shares and LVMH share-settled derivatives Cumulative translation adjustment Revaluation reserves Other reserves Net profit Group share Equity, Group share Minority interests Total equity Long-term borrowings Non-current provisions Deferred tax Other non-current liabilities 152 2,579 (240) 1,137 949 16,189 3,573 24,339 1,460 25,799 4,511 1,950 4,685 7,957 2,655 (374) 492 1,019 12,171 5,648 21,763 1,240 23,003 5,054 2.291 4,392 6,447 (8) 3,900 16,001 3,436 26,879 1,028 27,907 4,149 1,797 4,280 6,404 Non-current liabilities 19,103 3,769 3,960 Short-term borrowings Trade accounts payable Income taxes Current provisions Other current liabilities 18,184 4.189 3,606 549 332 3,499 12,175 16,630 4,674 3,297 357 640 421 324 3,909 12,699 2,987 11,639 Current liabilities Total liabilities and equity 57,601 53,362 56,176 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY EUR millions Number of shares Share capital Share premium account Net profit and other reserves Total equity Total Treasury Cumulative shares and translation - LVMH- adjustment share settled derivatives Group share Revaluation reserves Vinevard Employee land benefit commit- ments Available for sale Financial assets Minority interests Hedges of future foreign currency cash flows 15.1 152 3 ,848 15.2 (414) 15.6 342 1350) 1 1,943 912 18 18 758 188 1 88 51 17,765 - 3.436 3,436 31 24.424 819 3,436 4,255 31 17 1,084 21 511 532 3 25,508 840 3,947 4,787 34 . (3501 912 18 188 51 (1031 17 (110) 67 . . (110) 67 16666 1,500) 1,500 - 88 (2281 1 ,728) 235 235 173] [73] [76] (149) 152 3,849 451 216) 19,437 1 181 500 2,855 12,648 136 [122] 946 (15 137 9 6 (216) 26,879 2,381 5,648 3,267 (529) ,028 108 457 565 2 (745) 27,907 12,273) 6,105 3,832 39 - 500 (2,648) [122] [15] 5,648 ,648 196 5 117) Notes As of December 31, 2012 508, 163,349 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 1.025,418 Retirement of LVMH shares 11,395,106) Capital increase in subsidiaries Interim and final dividends paid Acquisition of a controlling interest in Loro Piana Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2013 507,793,661 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 980,323 Retirement of LVMH shares 11,062,271) Capital increase in subsidiaries Interim and final dividends paid Distribution in kind of Herms chares. See Note 8 Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2014 507,711,713 Gains and losses recognized in equity Net profit Comprehensive income Stock option plan and similar expenses (Acquisition disposal of treasury shares and LVMH share-settled derivatives Exercise of LVMH share subscription options 552.137 Retirement of LVMH shares 1.124 7401 Capital increase in subsidiaries Interim and final dividends paid Changes in control of consolidated entities Acquisition and disposal of minority interests shares Purchase commitments for minority interests shares As of December 31, 2015 507,139,110 10 59 . 59 1501 3 (328) 11,579) (1,579 (1,907) 11,203) 15,652 16,855 - 16,855) 120 121 32 3 0 152 2,655 (3741 1 492 645 207 (103) 14 25 931 33 (133) 25 (48) 17,819 . 3,573 48 21,763 575 3,573 (73] ,240 130 428 (121) 23,003 705 4,001 . 645 (103) (25) 33 25 35 2 37 113110 11111 1 11 (229) (1,659) 191 5 (1,659) 191 5 11.8881 181 1 31 2 11 19,762 11 24,339 (198) 1,460 (187) 25,799 152 2,579 1 240 1,137 104 (11) 964 (108) CONSOLIDATED CASH FLOW STATEMENT Notes 2015 2014 2013 6,384 [EUR millions) 1. OPERATING ACTIVITIES AND OPERATING INVESTMENTS Operating profit Income/(loss) and dividends from joint ventures and associates Net increase in depreciation, amortization and provisions Other computed expenses Other adjustments 5,898 49 1,435 2,081 (456) 191) (29) 5,431 26 1,895 (188) (84) 7,080 (116) (1,639) 1761 7,945 7,277 (75) (1,807) Cash from operations before changes in working capital Cost of net financial debt: interest paid Income taxes paid Net cash from operating activities before changes in working capital Change in working capital (111) (1,832) 5,334 (620) 14.1 6,063 (429) 5,325 1718) 4,714 14.2 5,634 (1,955) 3,679 4,607 (1,775) 2,832 (1,657) 3,057 8 (78) (57) (197) 68 160 38 69 (265) (240) (511) (237) (167) (232) (11) (2,161) (2,260) 35 59 (113) Net cash from operating activities Operating investments Net cash from operating activities and operating investments (free cash flow) II. FINANCIAL INVESTMENTS Purchase of non-current available for sale financial assets Proceeds from sale of non-current available for sale financial assets Dividends received Income taxes paid related to financial investments Impact of purchase and sale of consolidated investments Net cash from (used in) financial investments III. TRANSACTIONS RELATING TO EQUITY Capital increases of LVMH SE Capital increases of subsidiaries subscribed by minority interests Acquisition and disposals of treasury shares and LVMH share-settled derivatives Interim and final dividends paid by LVMH SE! Income taxes paid related to interim and final dividends paid Interim and final dividends paid to minority interests in consolidated subsidiaries Purchase and proceeds from sale of minority interests Net cash from (used in) transactions relating to equity Change in cash before financing activities IV. FINANCING ACTIVITIES Proceeds from borrowings Repayment of borrowings Purchase and proceeds from sale of current available for sale financial assets Net cash from (used in) financing activities V. EFFECT OF EXCHANGE RATE CHANGES NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (1+11+11+1V+V) (1,671) (304) (1,619) (79) (1,501) (137) (228) (336) (4) 10 (220) (150) (2,048) (1,251) (2,090) (1,961) 1,078 639 1,008 (2,443) 2,407 (2,100) 13 (106) (1,438) (33] (393) 201 27 867 3,095 (1,057) 101 2,139 47 935 3,783 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD 2,916 3,783 (1,955) 1,981 2,916 3,390 TOTAL INCOME TAXES PAID (2,376) (1,980) Transactions included in the table above, generating no change in cash: - acquisition of assets by means of finance leases (a) The distribution in kind of Herms shares had no impact on cash, apart from related income tax effects. See Note 8