IFRS

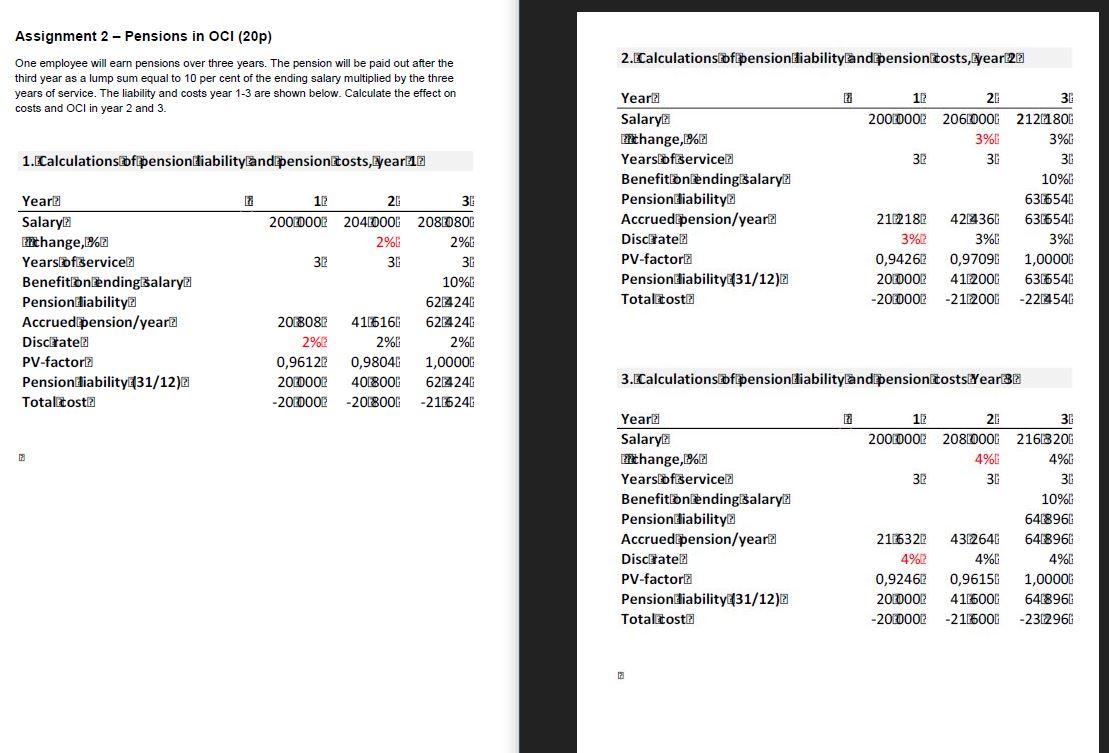

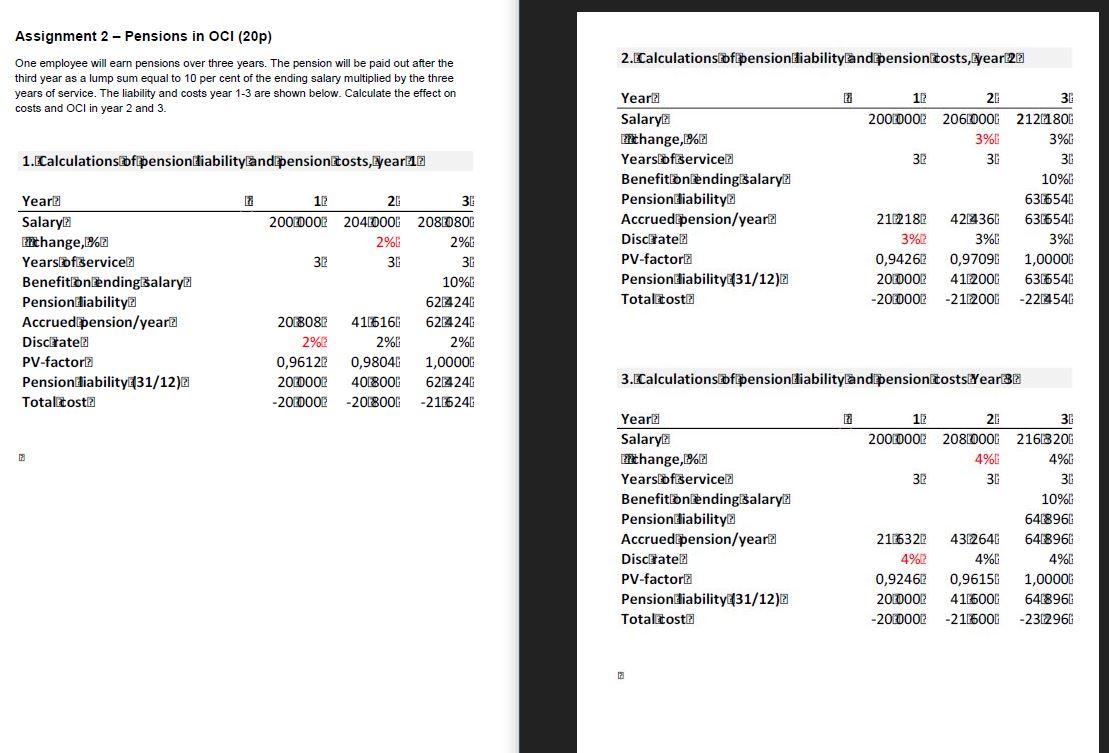

One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to 10 per cent of the ending salary multiplied by the three years of service. The liability and costs year 1-3 are shown below. Calculate the effect on costs and OCI in year 2 and 3.

2.Calculations bfipension Liability and pension tosts, year 22 Assignment 2 - Pensions in OCI (20p) One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to 10 per cent of the ending salary multiplied by the three years of service. The liability and costs year 1-3 are shown below. Calculate the effect on costs and OCI in year 2 and 3. 1.Calculationshftpensioniliability andipensionitosts, year:17 Yeart: Salary2 change,1% Years of service BenefitnlendingBalary? Pension diability Accrued pension/year Disciate? PV-factor: Pension fiability (31/12)2 Totalttost? 12 26 2000002 204000L 208080G 2% 2%! 37 36 36 10% 622 246 2018083 4116166 6224246 2% 2% 2% 0,9612 0,98046 1,00006 200002 401800L 6214240 -2010002 -2018001 -216240 Yeard Salary change,%2 Yearsbfservice Benefitlnlendingialary Pensioniliability Accrued bension/year? Disclate? PV-factor? Pension diability(31/12)2 Totaltosta 11 20 3. 200 DOOR 206100OG 21241 80C 3% 3% 32 36 30 10% 636540 2172182 422 361 636548 3% 3%L 3% 0,94262 0,97096 1,0000L 200002 411200G 6316546 -20000L -2112000 -22124546 3.Calculationsbfpensionfiability and pensionit ostsiYear33 Year Salary: change,1% Years of service BenefitblendingBalary? Pension liability Accrued pension/year Disclate? PV-factor: Pension liability (31/12) Totalitosti 11 20 200 DOOZ 2080OOL 2161820L 4% 4% 32 36 36 10% 648966 216322 4312646 648966 4% 4%C 4% 0,924617 0,96156 1,00000 2010002 416000 648966 -2000OOZ -216006-232966 2.Calculations bfipension Liability and pension tosts, year 22 Assignment 2 - Pensions in OCI (20p) One employee will earn pensions over three years. The pension will be paid out after the third year as a lump sum equal to 10 per cent of the ending salary multiplied by the three years of service. The liability and costs year 1-3 are shown below. Calculate the effect on costs and OCI in year 2 and 3. 1.Calculationshftpensioniliability andipensionitosts, year:17 Yeart: Salary2 change,1% Years of service BenefitnlendingBalary? Pension diability Accrued pension/year Disciate? PV-factor: Pension fiability (31/12)2 Totalttost? 12 26 2000002 204000L 208080G 2% 2%! 37 36 36 10% 622 246 2018083 4116166 6224246 2% 2% 2% 0,9612 0,98046 1,00006 200002 401800L 6214240 -2010002 -2018001 -216240 Yeard Salary change,%2 Yearsbfservice Benefitlnlendingialary Pensioniliability Accrued bension/year? Disclate? PV-factor? Pension diability(31/12)2 Totaltosta 11 20 3. 200 DOOR 206100OG 21241 80C 3% 3% 32 36 30 10% 636540 2172182 422 361 636548 3% 3%L 3% 0,94262 0,97096 1,0000L 200002 411200G 6316546 -20000L -2112000 -22124546 3.Calculationsbfpensionfiability and pensionit ostsiYear33 Year Salary: change,1% Years of service BenefitblendingBalary? Pension liability Accrued pension/year Disclate? PV-factor: Pension liability (31/12) Totalitosti 11 20 200 DOOZ 2080OOL 2161820L 4% 4% 32 36 36 10% 648966 216322 4312646 648966 4% 4%C 4% 0,924617 0,96156 1,00000 2010002 416000 648966 -2000OOZ -216006-232966