IFRS THe solution supplement is on the left. Please explain the steps in your answer.

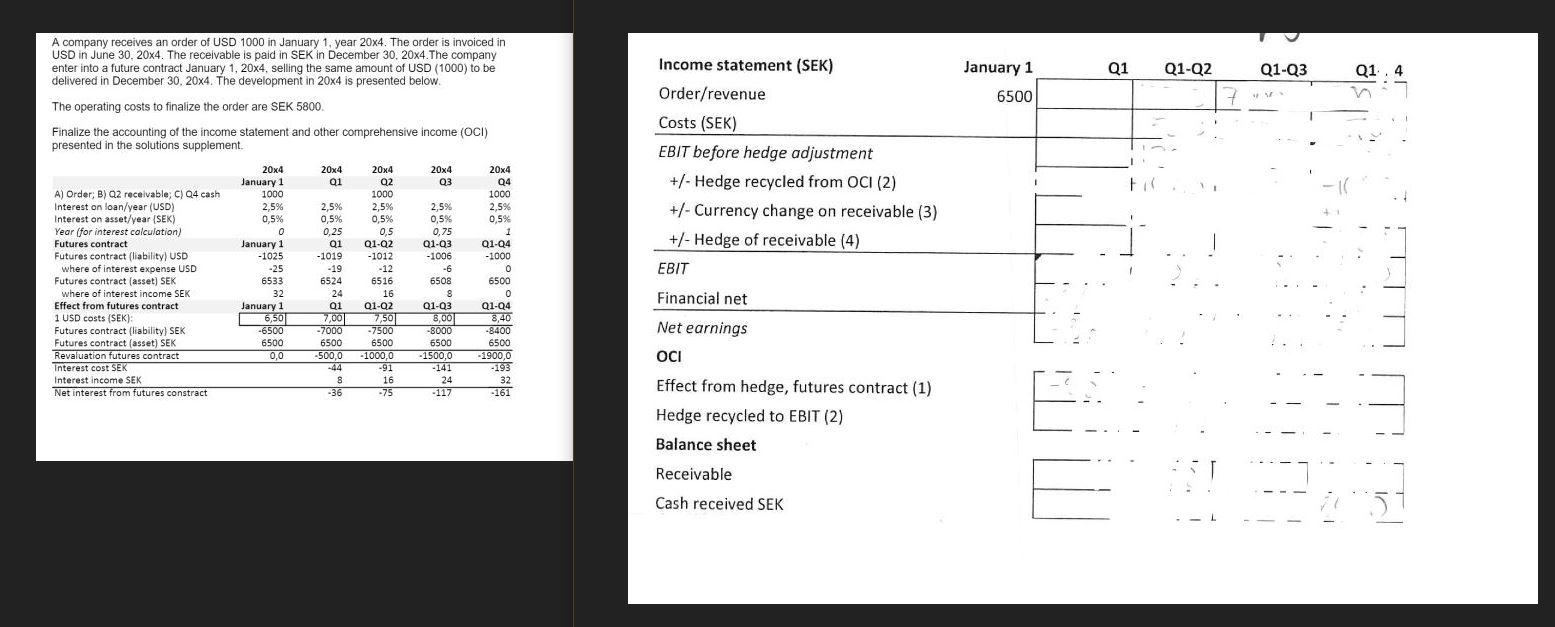

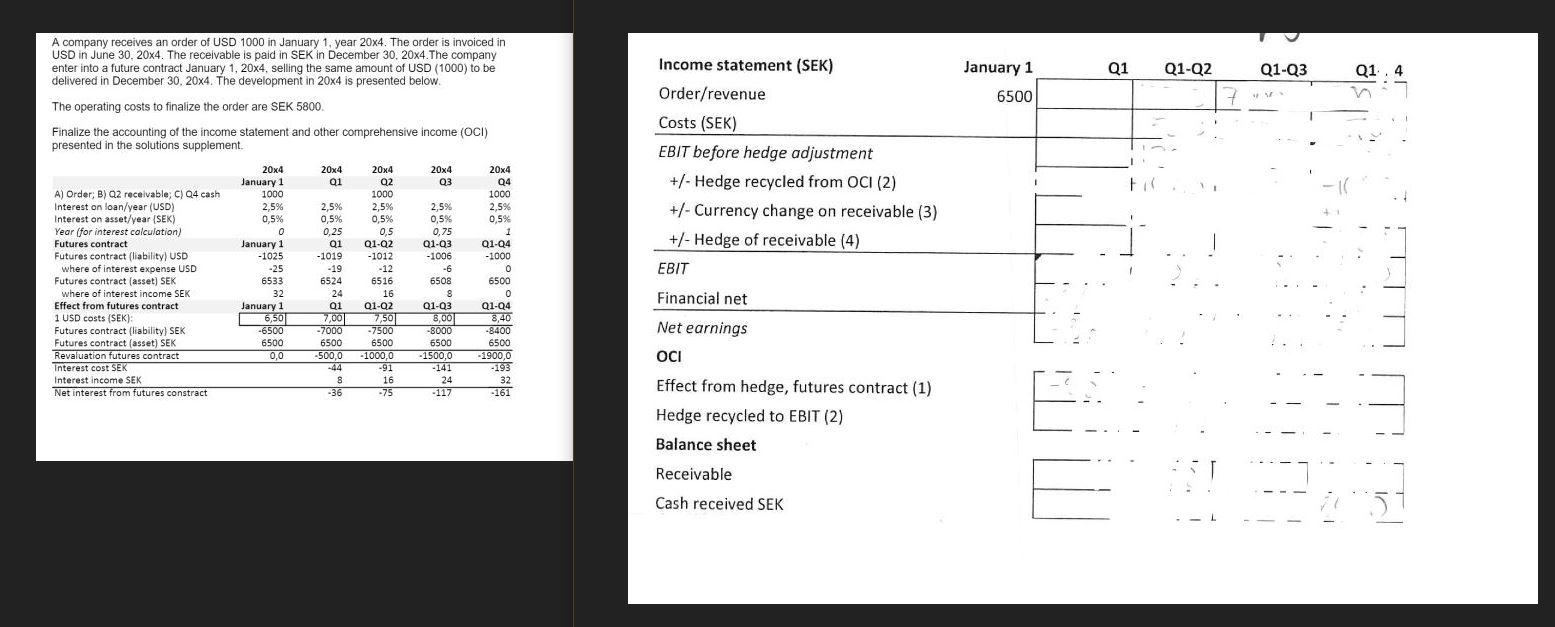

A company receives an order of USD 1000 in January 1, year 20x4. The order is invoiced in USD in June 30, 20x4. The receivable is paid in SEK in December 30, 20x4. The company enter into a future contract January 1, 20x4, selling the same amount of USD (1000) to be delivered in December 30, 20x4. The development in 20x4 is presented below Q1 Q1-Q2 Q1-Q3 Q1.4 January 1 6500 7 The operating costs to finalize the order are SEK 5800 Income statement (SEK) Order/revenue Costs (SEK) EBIT before hedge adjustment +/- Hedge recycled from OCI (2) +/- Currency change on receivable (3) +/- Hedge of receivable (4) EBIT Finalize the accounting of the income statement and other comprehensive income (OCI) presented in the solutions supplement. 20x4 20x4 20x4 20x4 20x4 January 1 01 Q2 03 Q4 A) Order; B) Q2 receivable, C) Q4 cash 1000 1000 1000 Interest on loan/year (USD) 2,5% 2,5% 2,5% 2,5% 2,5% Interest on asset/year (SEK) 0,5% 0,5% 0,5% 0,5% 0,5% Year (for interest calculation) 0 0 0,25 0,5 0,75 1 Futures contract January 1 Q1 01-02 Q1-Q3 Q1-Q4 Futures contract liability) USD -1025 -1019 -1012 -1006 -1000 where of interest expense USD -25 -19 -12 -6 0 Futures contract (asset) SEK 6533 6524 6516 6508 6500 where of interest income SEK 32 24 16 8 0 Effect from futures contract January 1 Q1 01-02 Q1-Q3 Q1-Q4 1 USD costs (SEK): 6,50 7,001 7,50 8,00 8,40 Futures contract liability) SEK -6500 -7000 -7500 -8000 -8400 Futures contract (asset) SEK 6500 6500 6500 6500 6500 Revaluation futures contract 0,0 -500,0 -1000,0 - 1500,0 -1900,0 Interest cost SEK -44 -91 -141 -193 Interest income SEK 8 16 24 32 Net interest from futures constract -36 -75 -117 -161 10 Financial net Net earnings OCI Effect from hedge, futures contract (1) Hedge recycled to EBIT (2) Balance sheet Receivable E T Cash received SEK A company receives an order of USD 1000 in January 1, year 20x4. The order is invoiced in USD in June 30, 20x4. The receivable is paid in SEK in December 30, 20x4. The company enter into a future contract January 1, 20x4, selling the same amount of USD (1000) to be delivered in December 30, 20x4. The development in 20x4 is presented below Q1 Q1-Q2 Q1-Q3 Q1.4 January 1 6500 7 The operating costs to finalize the order are SEK 5800 Income statement (SEK) Order/revenue Costs (SEK) EBIT before hedge adjustment +/- Hedge recycled from OCI (2) +/- Currency change on receivable (3) +/- Hedge of receivable (4) EBIT Finalize the accounting of the income statement and other comprehensive income (OCI) presented in the solutions supplement. 20x4 20x4 20x4 20x4 20x4 January 1 01 Q2 03 Q4 A) Order; B) Q2 receivable, C) Q4 cash 1000 1000 1000 Interest on loan/year (USD) 2,5% 2,5% 2,5% 2,5% 2,5% Interest on asset/year (SEK) 0,5% 0,5% 0,5% 0,5% 0,5% Year (for interest calculation) 0 0 0,25 0,5 0,75 1 Futures contract January 1 Q1 01-02 Q1-Q3 Q1-Q4 Futures contract liability) USD -1025 -1019 -1012 -1006 -1000 where of interest expense USD -25 -19 -12 -6 0 Futures contract (asset) SEK 6533 6524 6516 6508 6500 where of interest income SEK 32 24 16 8 0 Effect from futures contract January 1 Q1 01-02 Q1-Q3 Q1-Q4 1 USD costs (SEK): 6,50 7,001 7,50 8,00 8,40 Futures contract liability) SEK -6500 -7000 -7500 -8000 -8400 Futures contract (asset) SEK 6500 6500 6500 6500 6500 Revaluation futures contract 0,0 -500,0 -1000,0 - 1500,0 -1900,0 Interest cost SEK -44 -91 -141 -193 Interest income SEK 8 16 24 32 Net interest from futures constract -36 -75 -117 -161 10 Financial net Net earnings OCI Effect from hedge, futures contract (1) Hedge recycled to EBIT (2) Balance sheet Receivable E T Cash received SEK