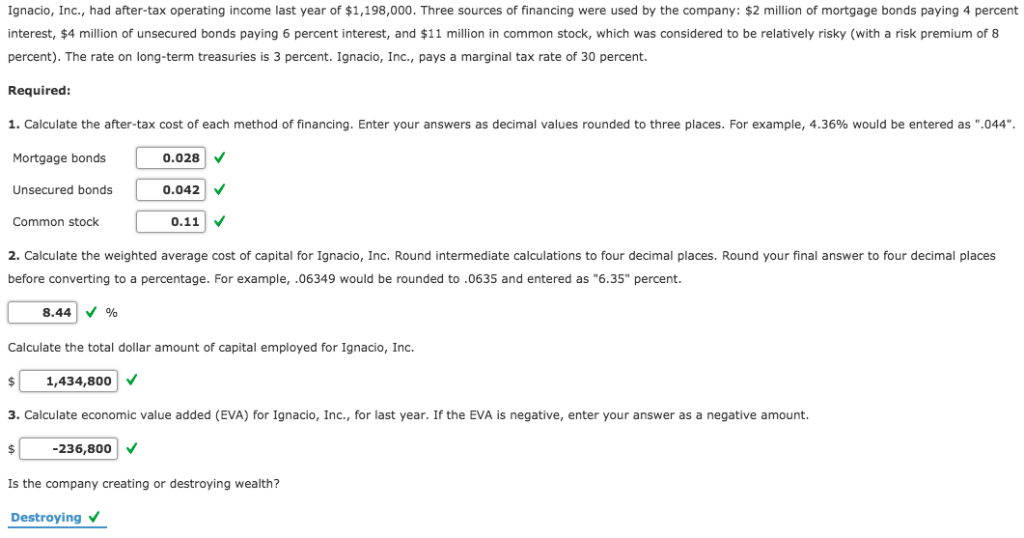

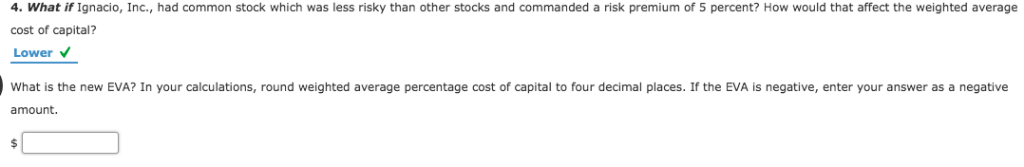

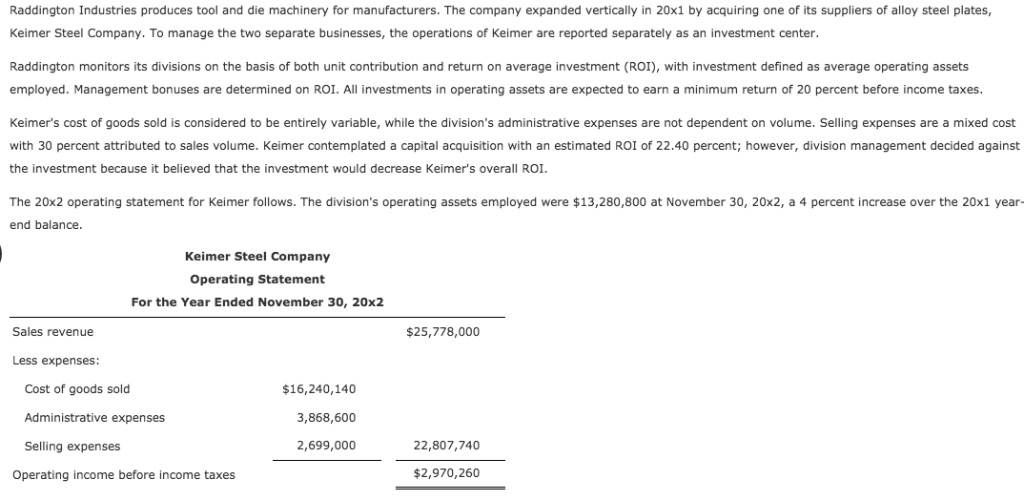

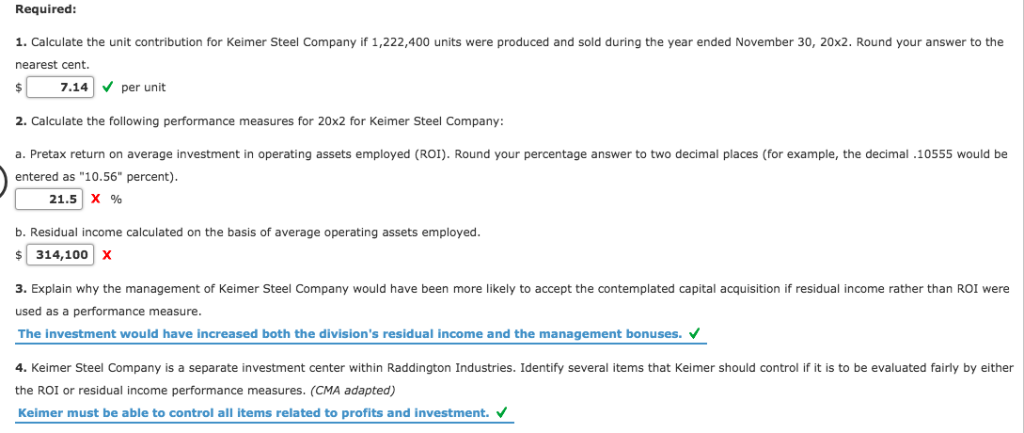

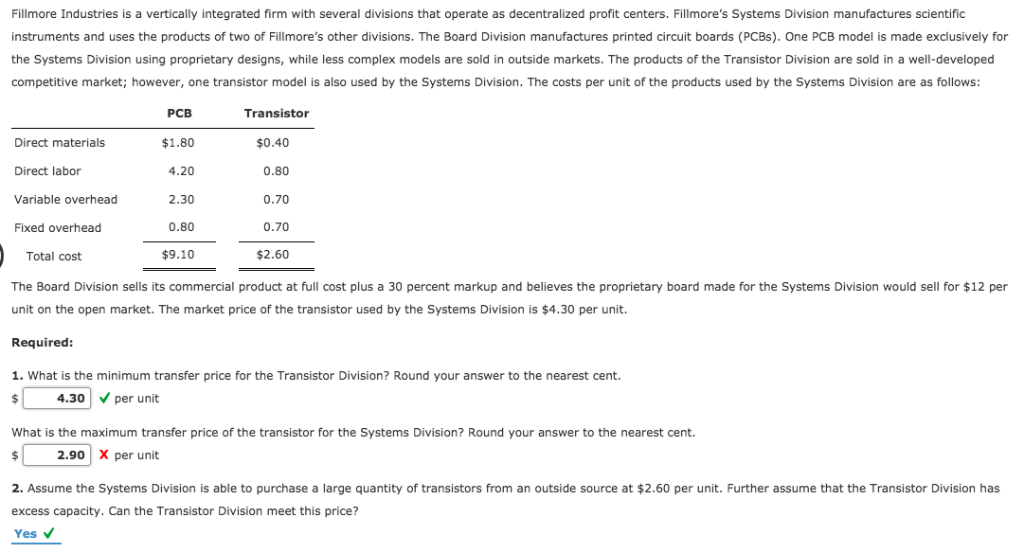

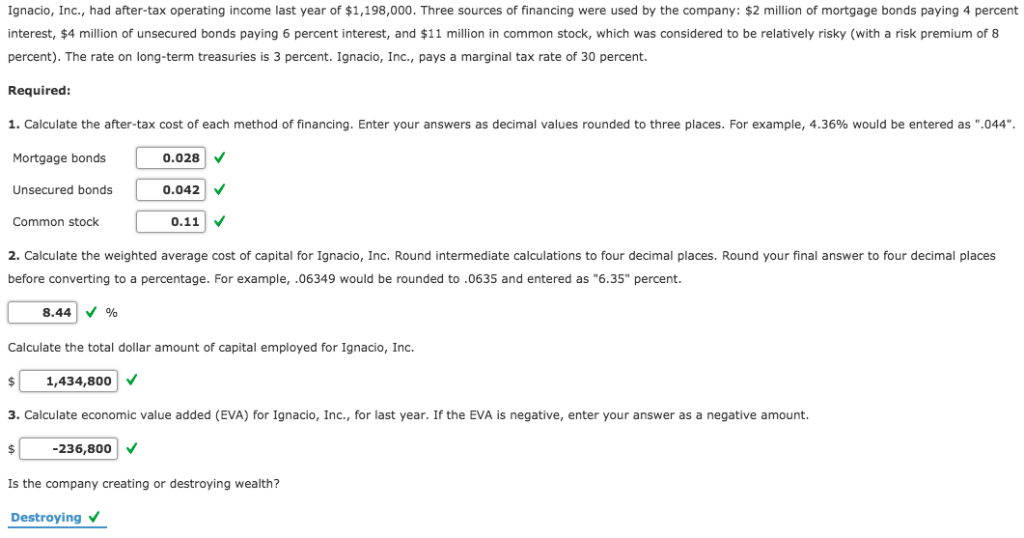

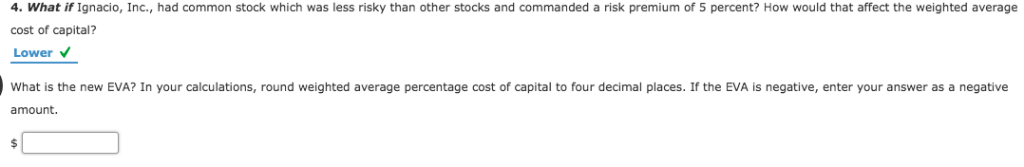

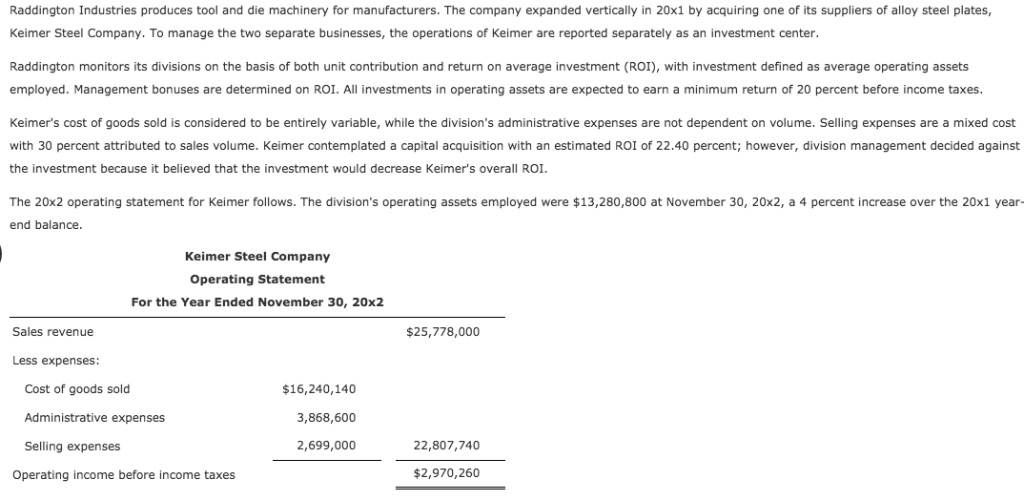

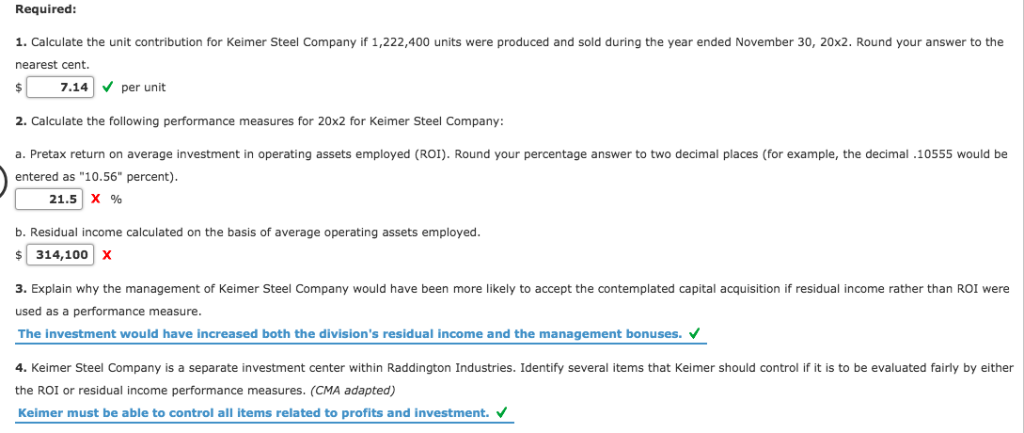

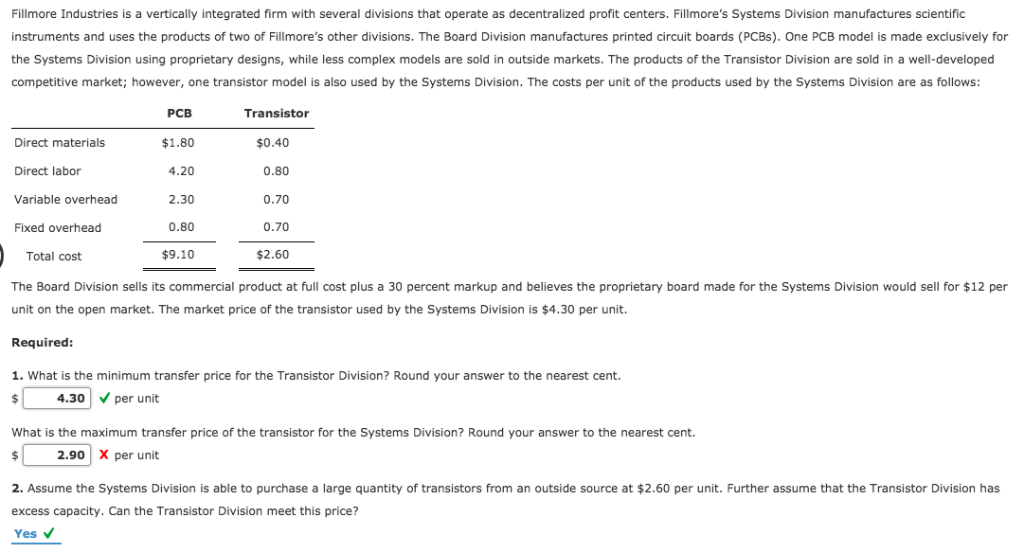

Ignacio, Inc., had after-tax operating income last year of $1,198,000. Three sources of financing were used by the company: $2 million of mortgage bonds paying 4 percent interest, $4 million of unsecured bonds paying 6 percent interest, and $11 million in common stock, which was considered to be relatively risky (with a risk premium of 8 percent). The rate on long-term treasuries is 3 percent. Ignacio, Inc., pays a marginal tax rate of 30 percent. Required: 1. Calculate the after-tax cost of each method of financing. Enter your answers as decimal values rounded to three places. For example, 4.36% would be entered as .044. Mortgage bonds Unsecured bonds Common stock 0.028 0.042 0.11 2. Calculate the weighted average cost of capital for Ignacio, Inc. Round intermediate calculations to four decimal places. Round your final answer to four decimal places before converting to a percentage. For example, .06349 would be rounded to.0635 and entered as "6.35" percent 8.44 % Calculate the total dollar amount of capital employed for Ignacio, Inc. 1,434,800 3. Calculate economic value added (EVA) for Ignacio, Inc., for last year. If the EVA is negative, enter your answer as a negative amount. -236,800 V Is the company creating or destroying wealth? Destroying Raddington Industries produces tool and die machinery for manufacturers. The company expanded vertically in 20x1 by acquiring one of its suppliers of alloy steel plates, Keimer Steel Company. To manage the two separate businesses, the operations of Keimer are reported separately as an investment center Raddington monitors its divisions on the basis of both unit contribution and return on average investment (ROI), with investment defined as average operating assets employed. Management bonuses are determined on ROI. All investments in operating assets are expected to earn a minimum return of 20 percent before income taxes Keimer's cost of goods sold is considered to be entirely variable, while the division's administrative expenses are not dependent on volume. Selling expenses are a mixed cost with 30 percent attributed to sales volume. Keimer contemplated a capital acquisition with an estimated R 0 2 4 percent; however di son management decide aga n the investment because it believed that the investment would decrease Keimer's overall ROI. The 20x2 operating statement for Keimer follows. The division's operating assets employed were $13,280,800 at November 30, 20x2, a 4 percent increase over the 20x1 year- end balance Keimer Steel Company Operating Statement For the Year Ended November 30, 20x2 Sales revenue $25,778,000 Less expenses: Cost of goods sold Administrative expenses Selling expenses $16,240,140 3,868,600 2,699,000 22,807,740 Operating income before income taxes $2,970,260 Required: 1. Calculate the unit contribution for Keimer Steel Company if 1,222,400 units were produced and sold during the year ended November 30, 20x2. Round your answer to the nearest cent. 7.14 per unit 2. Calculate the following performance measures for 20x2 for Keimer Steel Company a. Pretax return on average investment in operating assets employed (ROI). Round your percentage answer to two decimal places (for example, the decimal .10555 would be entered as "10.56" percent). 21.5| X % b. Residual income calculated on the basis of average operating assets employed $314,100 3. Explain why the management of Keimer Steel Company would have been more likely to accept the contemplated capital acquisition if residual income rather than ROI were used as a performance measure. The investment would have increased both the division's residual income and the management bonuses. 4. Keimer Steel Company is a separate investment center within Raddington Industries dentify severa tems that ke er should control f t sto be evaluated irtby either the ROI or residual income performance measures. (CMA adapted) Keimer must be able to control all items related to profits and investment. Fillmore Industries is a vertically integrated firm with several divisions that operate as decentralized profit centers. Fillmore's Systems Division manufactures scientific instruments and uses the products of two of Fillmore's other divisions. The Board Division manufactures printed circuit boards (PCBs). One PCB model is made exclusively for the Systems Division using proprietary designs, while less complex models are sold in outside markets. The products of the Transistor Division are sold in a well-developed competitive market; however, one transistor model is also used by the Systems Division. The costs per unit of the products used by the Systems Division are as follows Transistor Direct materials Direct labor Variable overhead Fixed overhead PCB $1.80 4.20 2.30 0.80 $9.10 $0.40 0.80 0.70 0.70 $2.60 Total cost The Board Division sells its commercial product at full cost plus a 30 percent markup and believes the proprietary board made for the Systems Division would sell for $12 per unit on the open market. The market price of the transistor used by the Systems Division is $4.30 per unit. Required: 1. What is the minimum transfer price for the Transistor Division? Round your answer to the nearest cent. 4.30 per unit What is the maximum transfer price of the transistor for the Systems Division? Round your answer to the nearest cent. 2.90 X per unit 2. Assume the Systems Division is able to purchase a large quantity of transistors from an outside source at $2.60 per unit. Further assume that the Transistor Division has excess capacity. Can the Transistor Division meet this price? Yes