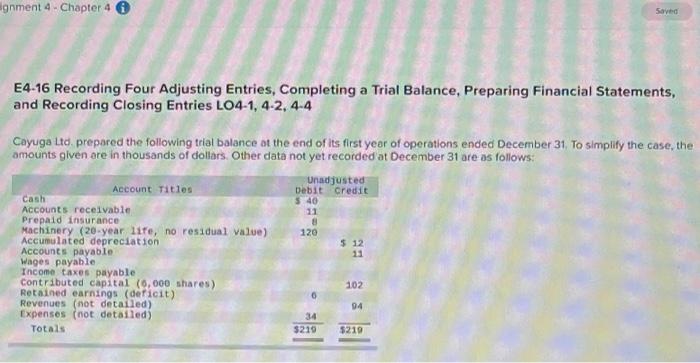

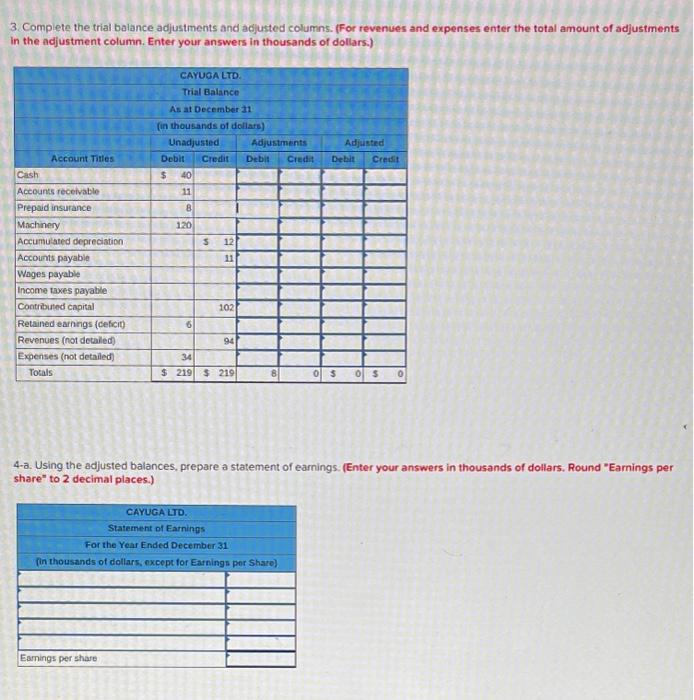

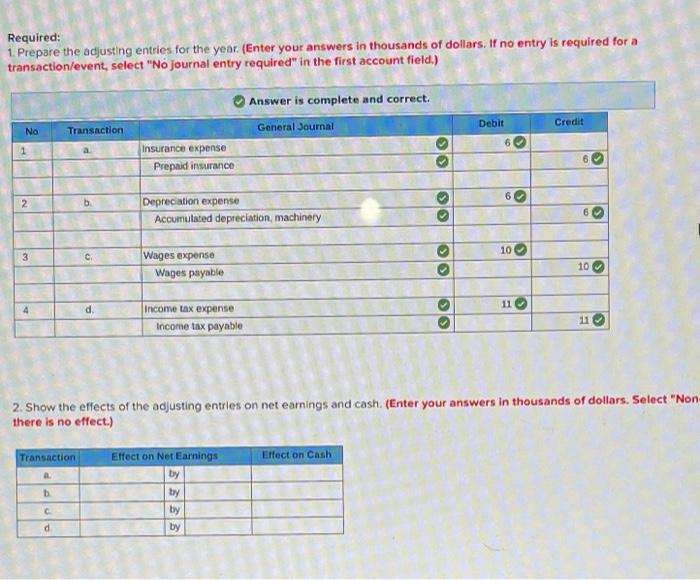

Ignment 4 - Chapter 4 Saved E4-16 Recording Four Adjusting Entries, Completing a Trial Balance, Preparing Financial Statements, and Recording Closing Entries L04-1, 4-2,44 Cayuga Ltd, prepared the following trial balance at the end of its first year of operations ended December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not yet recorded at December 31 are as follows: Uradjusted Account Titles Debit Credit Cash 5.40 Accounts receivable 11 Prepaid insurance Machinery (20-year lite, no residual value) 120 Accumulated depreciation $ 12 Accounts payable Wages payable Income taxes payable Contributed capital (0,000 shares) 102 Retained earnings (deficit) Revenues not detailed) 94 Expenses (not detailed) Totals $219 5219 13 34 3. Complete the trial balance adjustments and adjusted columns. (For revenues and expenses enter the total amount of adjustments in the adjustment column. Enter your answers in thousands of dollars.) CAYUGA LTD. Trial Balance As at December 11 (in thousands of dollars) Unadjusted Adjustments Debit Credit Debit Credit $ 40 Adjusted Debit Credit Account Titles Cash 11 8 120 5 12 B Accounts receivable Prepaid insurance Machinery Accumulated depreciation Accounts payable Wages payable Income taxes payable Contributed capital Retained earnings (deficit) Revenues (not detailed Expenses (not detailed) Totals 102 94 34 $ 219 $ 219 8 0 $ 0 4-a. Using the adjusted balances, prepare a statement of earnings. (Enter your answers in thousands of dollars. Round "Earnings per share" to 2 decimal places.) CAYUGA LTD. Statement of Earnings For the Year Ended December 31 [in thousands of dollars, except for Earnings per Share) Eamings per share Required: 1. Prepare the adjusting entries for the year. (Enter your answers in thousands of dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. General Journal Debit Credit No Transaction 6 1 Insurance expense Prepaid insurance 6 2 2 b Depreciation expense Accumulated depreciation, machinery 10 3 c Wages expense Wages payable e 10 > O 11 d. Income tax expense Income tax payable 11 2. Show the effects of the adjusting entries on net earnings and cash. (Enter your answers in thousands of dollars. Select "Non there is no effect.) Transaction Effect on Cash b Effect on Net Earnings by by by by d