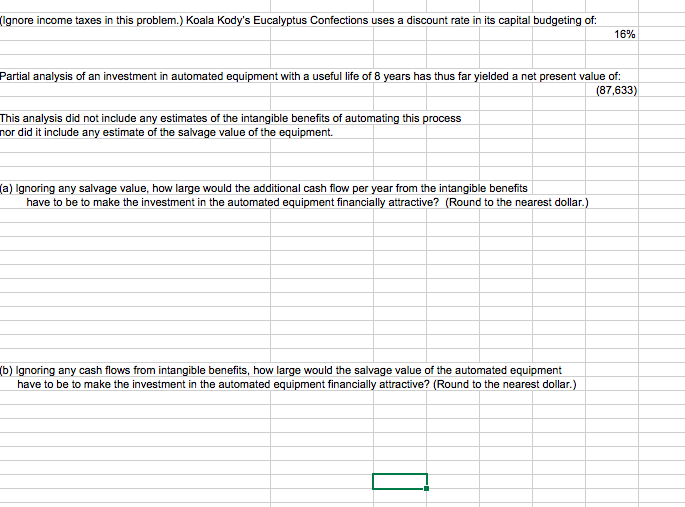

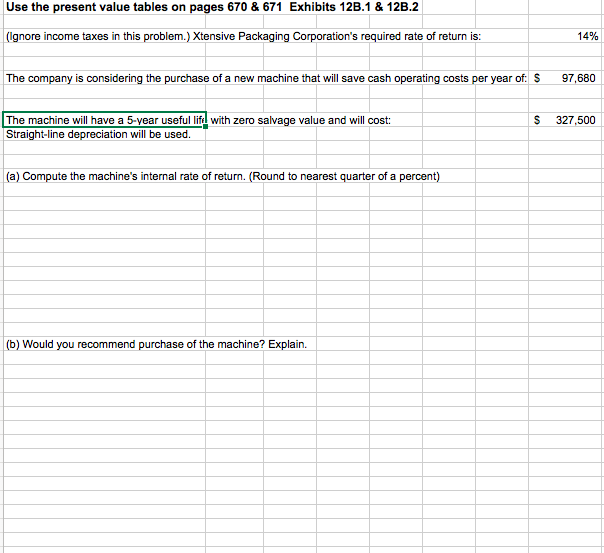

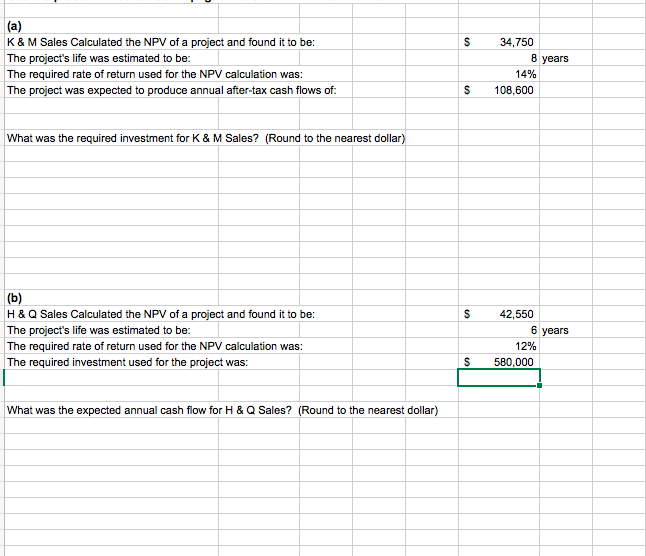

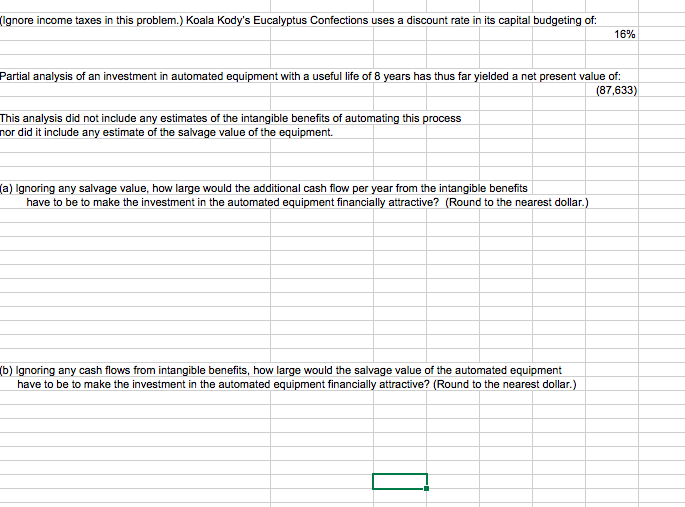

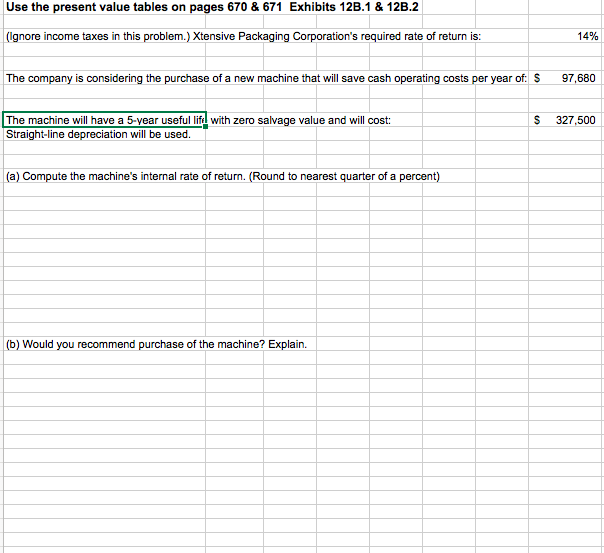

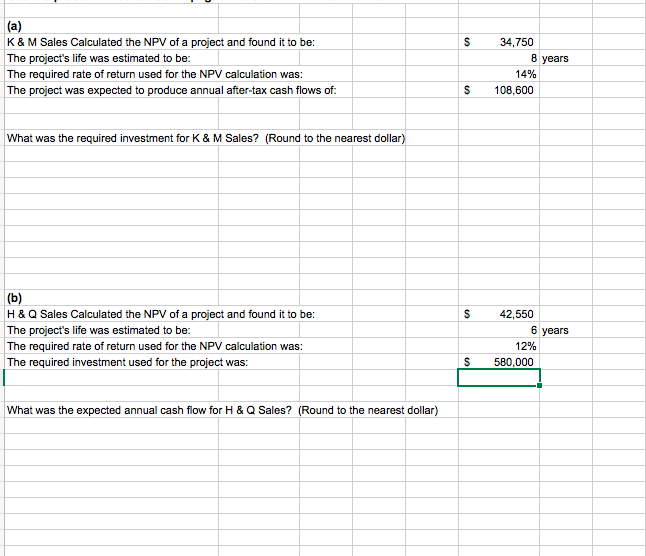

Ignore income taxes in this problem.) Koala Kody's Eucalyptus Confections uses a discount rate in its capital budgeting of: 16% Partial analysis of an investment in automated equipment with a useful life of 8 years has thus far yielded a net present value of: (87,633) This analysis did not include any estimates of the intangible benefits of automating this process nor did it include any estimate of the salvage value of the equipment. a) Ignoring any salvage value, how large would the additional cash flow per year from the intangible benefits have to be to make the investment in the automated equipment financially attractive? (Round to the nearest dollar.) (b) Ignoring any cash flows from intangible benefits, how large would the salvage value of the automated equipment have to be to make the investment in the automated equipment financially attractive? (Round to the nearest dollar.) Use the present value tables on pages 670 & 671 Exhibits 120.1 & 128.2 (Ignore income taxes in this problem.) Xtensive Packaging Corporation's required rate of return is: 14% The company is considering the purchase of a new machine that will save cash operating costs per year of: S 97,680 The machine will have a 5-year useful life with zero salvage value and will cost: Straight-line depreciation will be used. S 327,500 (a) Compute the machine's internal rate of return. (Round to nearest quarter of a percent) (b) Would you recommend purchase of the machine? Explain. $ K & M Sales Calculated the NPV of a project and found it to be: The project's life was estimated to be: The required rate of return used for the NPV calculation was: The project was expected to produce annual after-tax cash flows of: 34,750 8 years 14% 108,600 $ What was the required investment for K & M Sales? (Round to the nearest dollar) S (b) H&Q Sales Calculated the NPV of a project and found it to be: The project's life was estimated to be: The required rate of return used for the NPV calculation was: The required investment used for the project was: 42,550 6 years 12% 580,000 $ What was the expected annual cash flow for H&Q Sales? (Round to the nearest dollar)