Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ignore the spreadsheet, just the answer please you with the following Income Statement information for the year ended December 31, 3019 (credit iterns are in

Ignore the spreadsheet, just the answer please

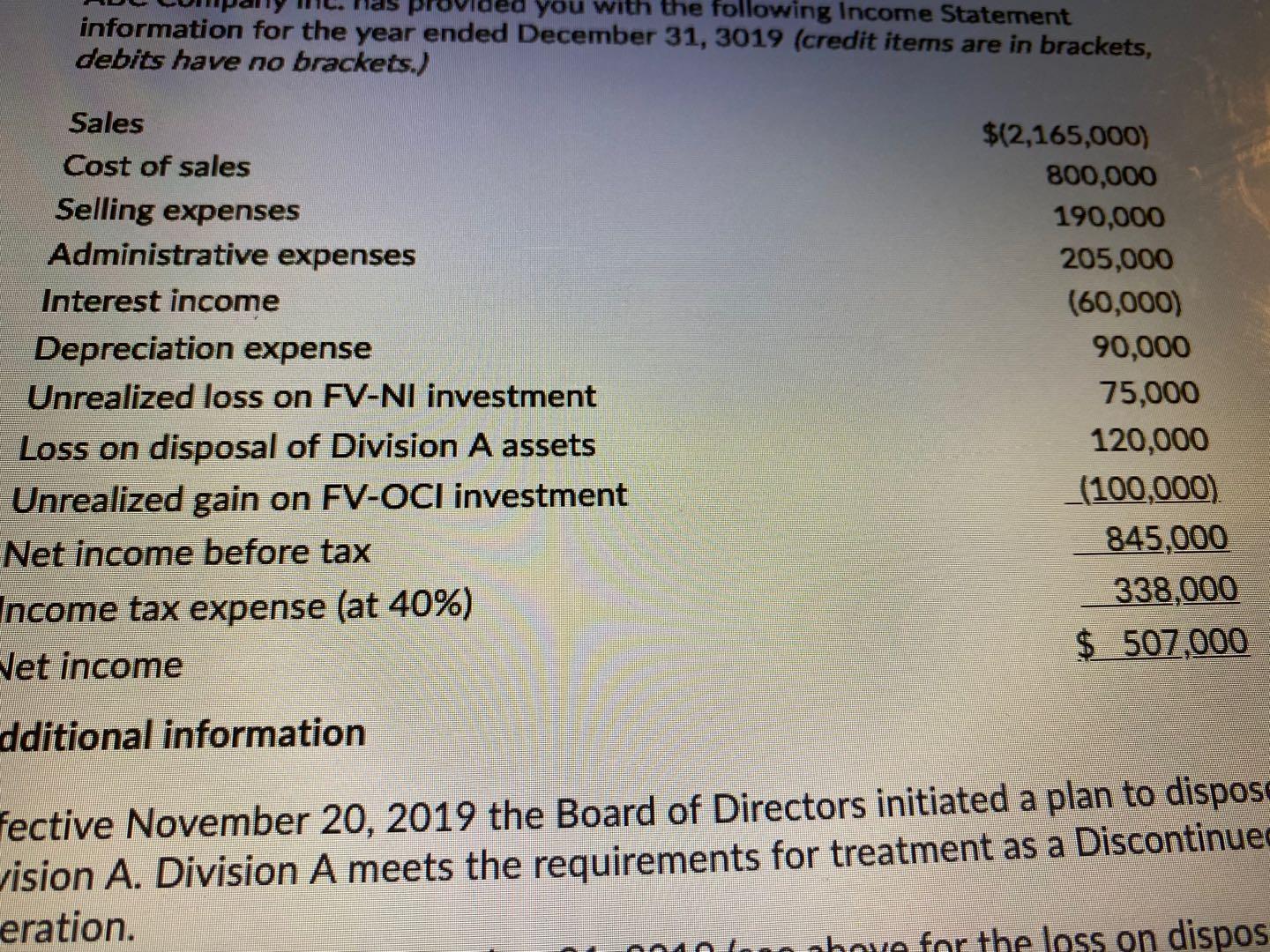

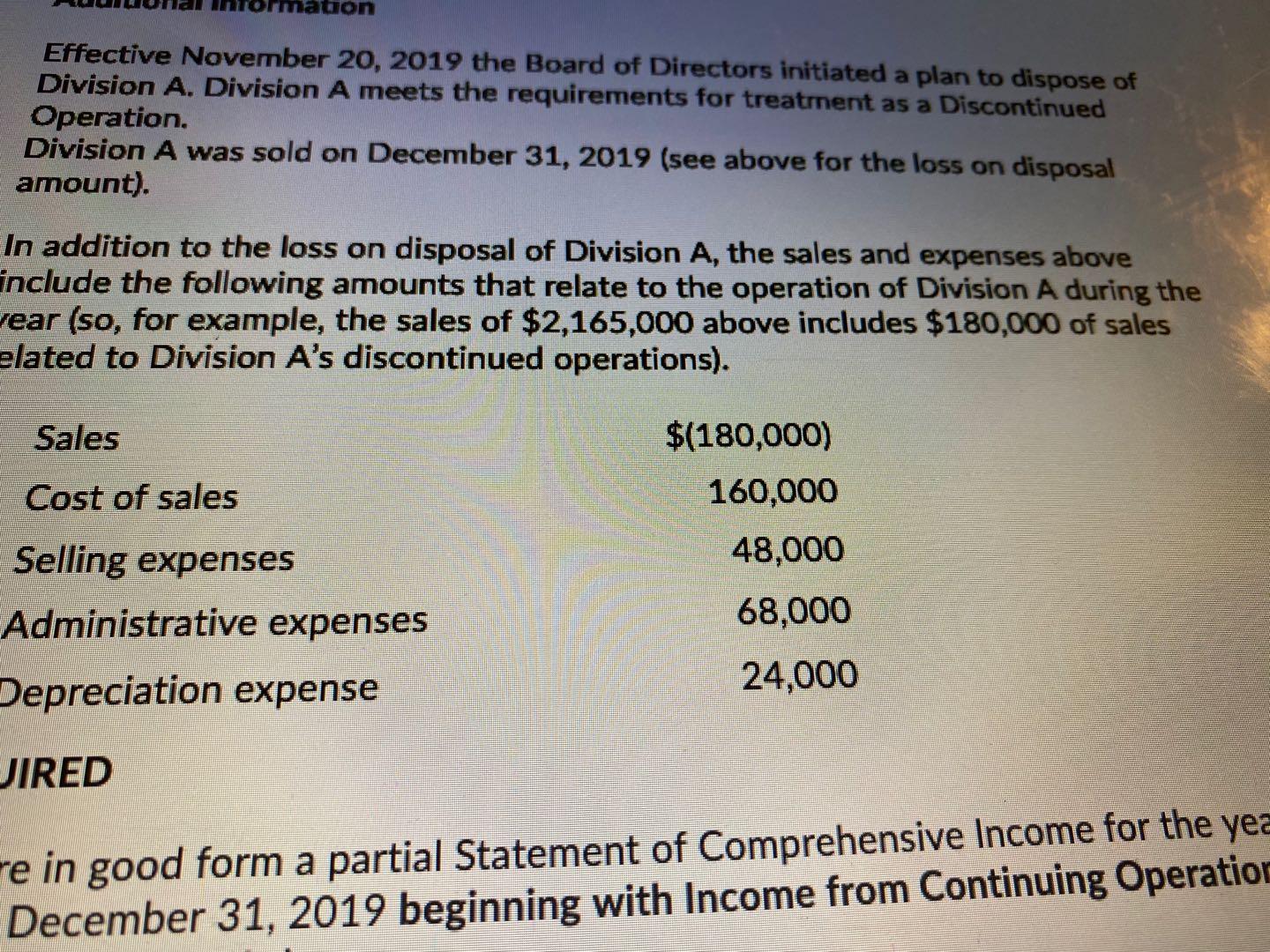

you with the following Income Statement information for the year ended December 31, 3019 (credit iterns are in brackets, debits have no brackets.) Sales Cost of sales Selling expenses Administrative expenses Interest income Depreciation expense Unrealized loss on FV-NI investment Loss on disposal of Division A assets Unrealized gain on FV-OCI investment Net income before tax Income tax expense (at 40%) Vet income $(2,165,000) 800,000 190,000 205,000 (60,000) 90,000 75,000 120,000 (100,000) 845,000 338,000 $ 507,000 dditional information fective November 20, 2019 the Board of Directors initiated a plan to dispose vision A. Division A meets the requirements for treatment as a Discontinue eration. above for the loss on dispos maton Effective November 20, 2019 the Board of Directors initiated a plan to dispose of Division A. Division A meets the requirements for treatment as a Discontinued Operation. Division A was sold on December 31, 2019 (see above for the loss on disposal amount). In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales elated to Division A's discontinued operations). Sales Cost of sales $(180,000) 160,000 48,000 68,000 Selling expenses Administrative expenses Depreciation expense 24,000 JIRED re in good form a partial Statement of Comprehensive Income for the yea December 31, 2019 beginning with Income from Continuing Operation you with the following Income Statement information for the year ended December 31, 3019 (credit iterns are in brackets, debits have no brackets.) Sales Cost of sales Selling expenses Administrative expenses Interest income Depreciation expense Unrealized loss on FV-NI investment Loss on disposal of Division A assets Unrealized gain on FV-OCI investment Net income before tax Income tax expense (at 40%) Vet income $(2,165,000) 800,000 190,000 205,000 (60,000) 90,000 75,000 120,000 (100,000) 845,000 338,000 $ 507,000 dditional information fective November 20, 2019 the Board of Directors initiated a plan to dispose vision A. Division A meets the requirements for treatment as a Discontinue eration. above for the loss on dispos maton Effective November 20, 2019 the Board of Directors initiated a plan to dispose of Division A. Division A meets the requirements for treatment as a Discontinued Operation. Division A was sold on December 31, 2019 (see above for the loss on disposal amount). In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales elated to Division A's discontinued operations). Sales Cost of sales $(180,000) 160,000 48,000 68,000 Selling expenses Administrative expenses Depreciation expense 24,000 JIRED re in good form a partial Statement of Comprehensive Income for the yea December 31, 2019 beginning with Income from Continuing OperationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started