Answered step by step

Verified Expert Solution

Question

1 Approved Answer

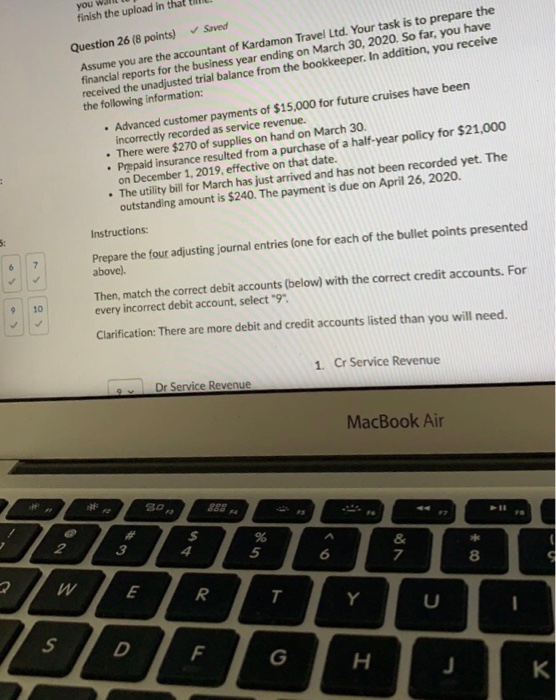

ignore the unadjusted trial balance part you will finish the upload in that time. Question 26 (8 points) Surved Assume you are the accountant of

ignore the unadjusted trial balance part

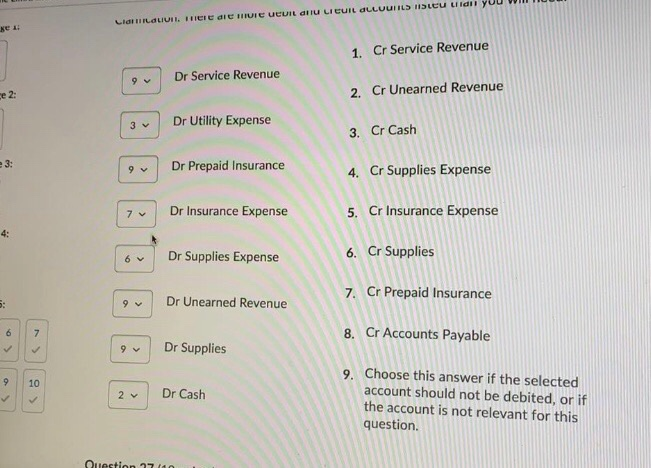

you will finish the upload in that time. Question 26 (8 points) Surved Assume you are the accountant of Kardamon Travel Ltd. Your task is to prepare the financial reports for the business year ending on March 30, 2020. So far, you have received the unadjusted trial balance from the bookkeeper. In addition, you receive the following information: Advanced customer payments of $15,000 for future cruises have been incorrectly recorded as service revenue. . There were $270 of supplies on hand on March 30. Prepaid insurance resulted from a purchase of a half-year policy for $21,000 on December 1, 2019, effective on that date. . The utility bill for March has just arrived and has not been recorded yet. The outstanding amount is $240. The payment is due on April 26, 2020. Instructions: Prepare the four adjusting journal entries (one for each of the bullet points presented above). Then, match the correct debit accounts (below) with the correct credit accounts. For every incorrect debit account, select "9". Clarification: There are more debit and credit accounts listed than you will need. 1. Cr Service Revenue Le Dr Service Revenue MacBook Air LI EUIL DULUUILD CU Lidl you will HIFLOLIUI. CE di TITUIE UCU ge Cr Service Revenue Dr Service Revenue ce 2: Cr Unearned Revenue Dr Utility Expense 3. Cr Cash 9 Dr Prepaid Insurance Cr Supplies Expense 7 Dr Insurance Expense Cr Insurance Expense ov Dr Supplies Expense Cr Supplies Dr Unearned Revenue Cr Prepaid Insurance 10 8. Cr Accounts Payable Dr Supplies 2v Dr Cash Choose this answer if the selected account should not be debited, or if the account is not relevant for this question. Question 2710 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started