Answered step by step

Verified Expert Solution

Question

1 Approved Answer

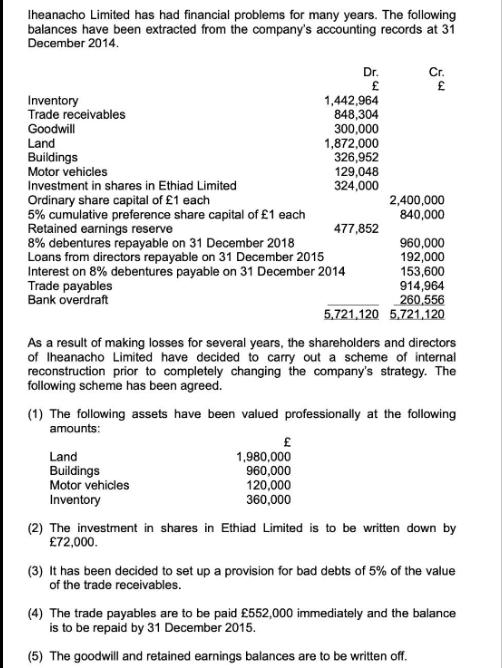

Iheanacho Limited has had financial problems for many years. The following balances have been extracted from the company's accounting records at 31 December 2014.

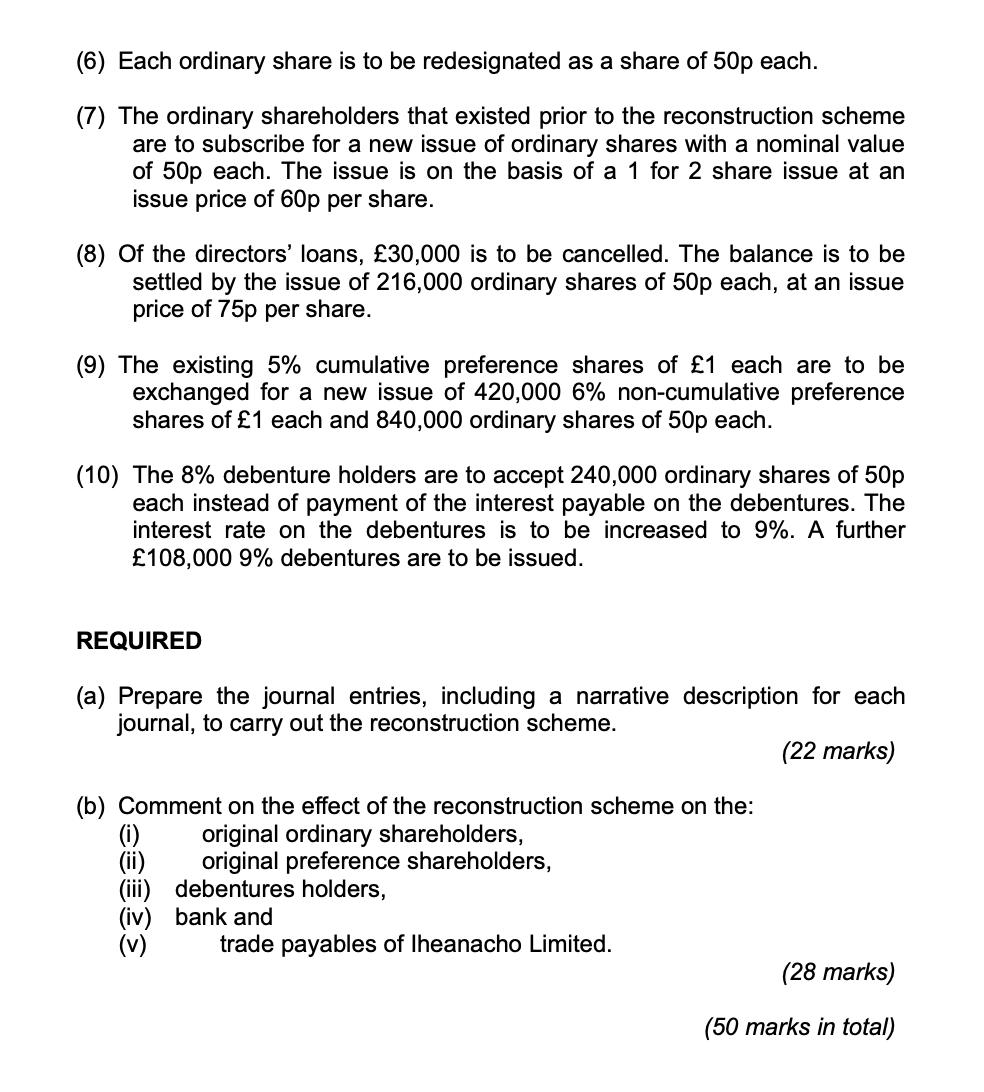

Iheanacho Limited has had financial problems for many years. The following balances have been extracted from the company's accounting records at 31 December 2014. Inventory Trade receivables Goodwill Land Buildings Motor vehicles Investment in shares in Ethiad Limited Ordinary share capital of 1 each 5% cumulative preference share capital of 1 each Retained earnings reserve 8% debentures repayable on 31 December 2018 Loans from directors repayable on 31 December 2015 Interest on 8% debentures payable on 31 December 2014 Trade payables Bank overdraft Dr. 1,442,964 848,304 300,000 1,872,000 326,952 129,048 324,000 Land Buildings Motor vehicles Inventory 477,852 1,980,000 960,000 120,000 360,000 Cr. 2,400,000 840,000 As a result of making losses for several years, the shareholders and directors of Iheanacho Limited have decided to carry out a scheme of internal reconstruction prior to completely changing the company's strategy. The following scheme has been agreed. 960,000 192,000 153,600 914,964 260,556 5,721,120 5,721,120 (1) The following assets have been valued professionally at the following amounts: (2) The investment in shares in Ethiad Limited is to be written down by 72,000. (3) It has been decided to set up a provision for bad debts of 5% of the value of the trade receivables. (4) The trade payables are to be paid 552,000 immediately and the balance is to be repaid by 31 December 2015. (5) The goodwill and retained earnings balances are to be written off. (6) Each ordinary share is to be redesignated as a share of 50p each. (7) The ordinary shareholders that existed prior to the reconstruction scheme are to subscribe for a new issue of ordinary shares with a nominal value of 50p each. The issue is on the basis of a 1 for 2 share issue at an issue price of 60p per share. (8) Of the directors' loans, 30,000 is to be cancelled. The balance is to be settled by the issue of 216,000 ordinary shares of 50p each, at an issue price of 75p per share. (9) The existing 5% cumulative preference shares of 1 each are to be exchanged for a new issue of 420,000 6% non-cumulative preference shares of 1 each and 840,000 ordinary shares of 50p each. (10) The 8% debenture holders are to accept 240,000 ordinary shares of 50p each instead of payment of the interest payable on the debentures. The interest rate on the debentures is to be increased to 9%. A further 108,000 9% debentures are to be issued. REQUIRED (a) Prepare the journal entries, including a narrative description for each journal, to carry out the reconstruction scheme. (22 marks) (b) Comment on the effect of the reconstruction scheme on the: original ordinary shareholders, (ii) original preference shareholders, (iii) debentures holders, (iv) bank and trade payables of Iheanacho Limited. (28 marks) (50 marks in total)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

JOURNAL ENTRIES Journal Entry Debit Credit Narrative Description 1 Valuation of Assets Land 1872000 Buildings 326952 Motor Vehicles 129048 Inventory 1442964 Accumulated DepreciationProvisions Professi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started