Question

ii. Calculate the one month financial and the physical results if the market price of copper, instead, has fallen to $4.50 per pound. Calculate only

ii. Calculate the one month financial and the physical results if the market price of copper, instead, has fallen to $4.50 per pound. Calculate only the financial impact of copper transactions and disregard the loss of revenue due to business loss. Find the financial result.

B. Now assume the firm has just received a new client's business and must purchase 850,000 pounds of copper.

i. Calculate the one month financial and the physical results if the market price of copper has risen to $6.50 per pound. Calculate only the financial impact of copper transactions and disregard the loss of revenue due to business loss. Find the financial result.

ii. Calculate the one month financial and the physical results if the market price of copper, instead, has fallen to $4.50 per pound. Calculate only the financial impact of copper transactions and disregard the loss of revenue due to business loss. Find the financial result.

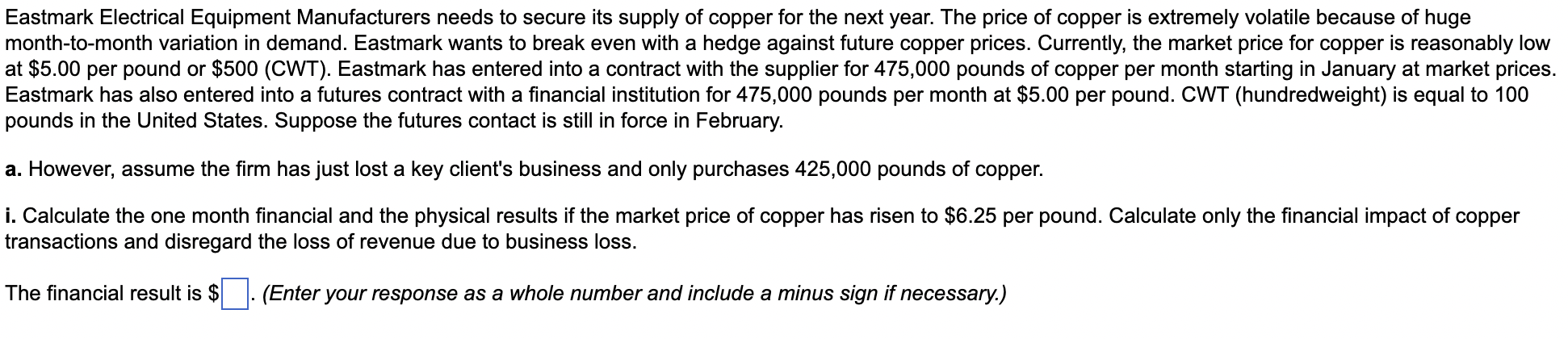

Eastmark Electrical Equipment Manufacturers needs to secure its supply of copper for the next year. The price of copper is extremely volatile because of huge month-to-month variation in demand. Eastmark wants to break even with a hedge against future copper prices. Currently, the market price for copper is reasonably low at $5.00 per pound or $500 (CWT). Eastmark has entered into a contract with the supplier for 475,000 pounds of copper per month starting in January at market prices. Eastmark has also entered into a futures contract with a financial institution for 475,000 pounds per month at $5.00 per pound. CWT (hundredweight) is equal to 100 pounds in the United States. Suppose the futures contact is still in force in February. a. However, assume the firm has just lost a key client's business and only purchases 425,000 pounds of copper i. Calculate the one month financial and the physical results if the market price of copper has risen to $6.25 per pound. Calculate only the financial impact of copper transactions and disregard the loss of revenue due to business loss. The financial result is $. (Enter your response as a whole number and include a minus sign if necessary.) Eastmark Electrical Equipment Manufacturers needs to secure its supply of copper for the next year. The price of copper is extremely volatile because of huge month-to-month variation in demand. Eastmark wants to break even with a hedge against future copper prices. Currently, the market price for copper is reasonably low at $5.00 per pound or $500 (CWT). Eastmark has entered into a contract with the supplier for 475,000 pounds of copper per month starting in January at market prices. Eastmark has also entered into a futures contract with a financial institution for 475,000 pounds per month at $5.00 per pound. CWT (hundredweight) is equal to 100 pounds in the United States. Suppose the futures contact is still in force in February. a. However, assume the firm has just lost a key client's business and only purchases 425,000 pounds of copper i. Calculate the one month financial and the physical results if the market price of copper has risen to $6.25 per pound. Calculate only the financial impact of copper transactions and disregard the loss of revenue due to business loss. The financial result is $. (Enter your response as a whole number and include a minus sign if necessary.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started