Answered step by step

Verified Expert Solution

Question

1 Approved Answer

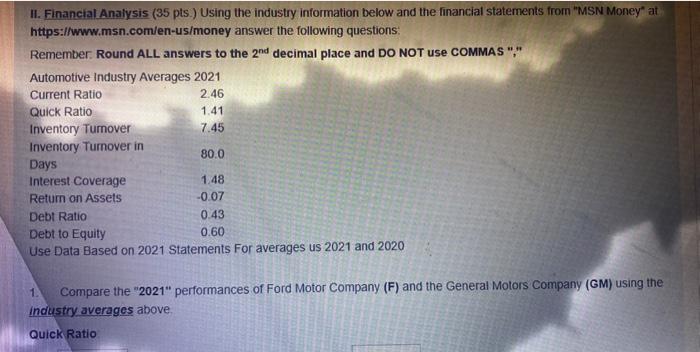

II. Financial Analysis (35 pts.) Using the industry information below and the financial statements from MSN Money at answer the following questions: https://www.msn.com/en-us/money Remember:

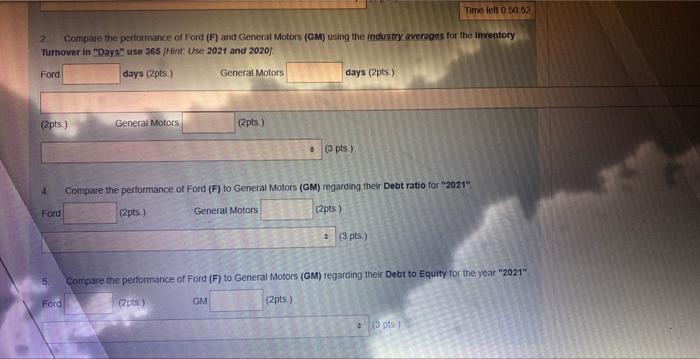

II. Financial Analysis (35 pts.) Using the industry information below and the financial statements from "MSN Money" at answer the following questions: https://www.msn.com/en-us/money Remember: Round ALL answers to the 2nd decimal place and DO NOT use COMMAS"," Automotive Industry Averages 2021 Current Ratio 2.46 Quick Ratio 1.41 Inventory Turnover 7.45 Inventory Turnover in 80.0 1.48 -0.07 Days Interest Coverage Return on Assets 0.43 0.60 Debt Ratio Debt to Equity Use Data Based on 2021 Statements For averages us 2021 and 2020 1. Compare the "2021" performances of Ford Motor Company (F) and the General Motors Company (GM) using the industry averages above. Quick Ratio 2 Compare the performance of Ford (F) and General Motors (GM) using the industry averages for the inventory Turnover in "Days" use 365 (Hint: Use 2021 and 2020) Ford days (2pts.) General Motors (2pts.) 5 General Motors Ford (2pts.) (2pts.) 4. Compare the performance of Ford (F) to General Motors (GM) regarding their Debt ratio for "2021" Ford General Motors (2pts) days (2pts) (2pts) (3 pts) Time left 0:50:52 (3 pts) Compare the performance of Ford (F) to General Motors (GM) regarding their Debt to Equity for the year "2021" GM (2pts) (3 pts)

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Financial Analysis of Ford F and General Motors GM in 2021 compared to Industry Averages Metric Ford F General Motors GM Industry Average 2021 Analysi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started