Answered step by step

Verified Expert Solution

Question

1 Approved Answer

II . SOLVE. Problems About Adjusting Entries Accrued Revenues: A company provides consulting services in December but will not receive payment until January. The service

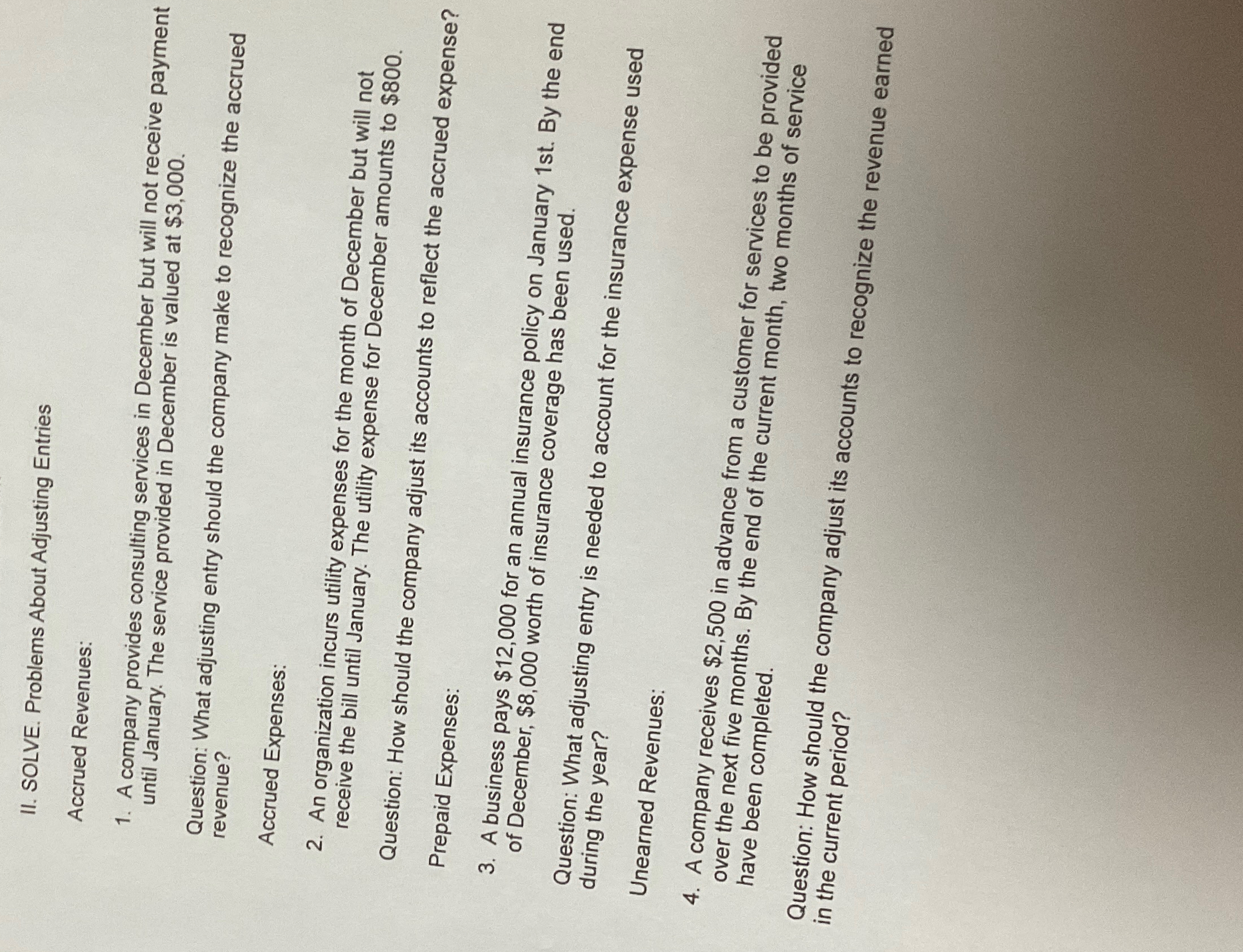

II SOLVE. Problems About Adjusting Entries

Accrued Revenues:

A company provides consulting services in December but will not receive payment until January. The service provided in December is valued at $

Question: What adjusting entry should the company make to recognize the accrued revenue?

Accrued Expenses:

An organization incurs utility expenses for the month of December but will not receive the bill until January. The utility expense for December amounts to $

Question: How should the company adjust its accounts to reflect the accrued expense?

Prepaid Expenses:

A business pays $ for an annual insurance policy on January st By the end of December, $ worth of insurance coverage has been used.

Question: What adjusting entry is needed to account for the insurance expense used during the year?

Unearned Revenues:

A company receives $ in advance from a customer for services to be provided over the next five months. By the end of the current month, two months of service have been completed.

Question: How should the company adjust its accounts to recognize the revenue earned in the current period?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started