Answered step by step

Verified Expert Solution

Question

1 Approved Answer

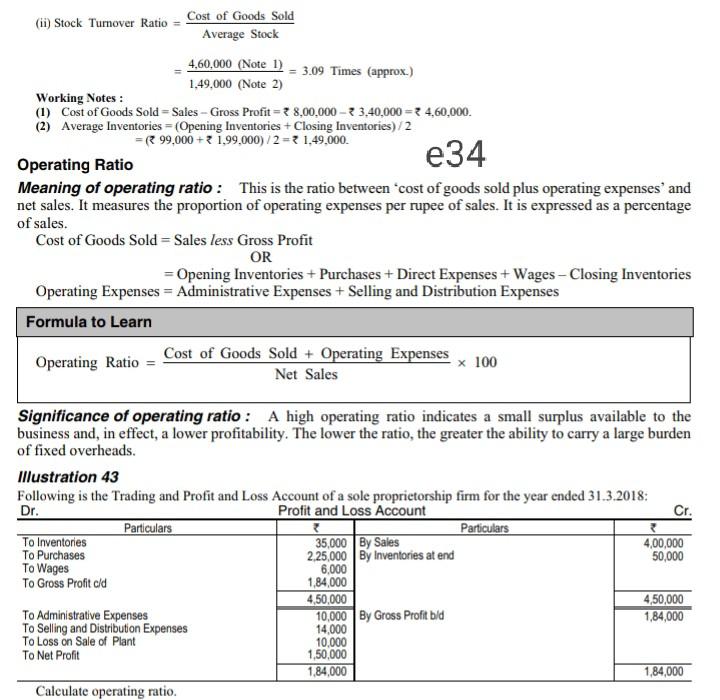

(ii) Stock Tumover Ratio - Cost of Goods Sold Average Stock 4,60,000 (Note 1) 3.09 Times (approx.) 1,49,000 (Note 2) Working Notes: (1) Cost of

(ii) Stock Tumover Ratio - Cost of Goods Sold Average Stock 4,60,000 (Note 1) 3.09 Times (approx.) 1,49,000 (Note 2) Working Notes: (1) Cost of Goods Sold Sales - Gross Profit=38,00.000 - 33,40,000 = 4,60,000. (2) Average Inventories = (Opening Inventories + Closing Inventories)/2 R99.000 +3 1,99.000)/2=3 1,49,000 Operating Ratio e34 Meaning of operating ratio : This is the ratio between cost of goods sold plus operating expenses' and net sales. It measures the proportion of operating expenses per rupee of sales. It is expressed as a percentage of sales. Cost of Goods Sold = Sales less Gross Profit OR = Opening Inventories + Purchases + Direct Expenses + Wages - Closing Inventories Operating Expenses = Administrative Expenses + Selling and Distribution Expenses Formula to Learn Operating Ratio - Cost of Goods Sold + Operating Expenses x 100 Net Sales Significance of operating ratio : A high operating ratio indicates a small surplus available to the business and, in effect, a lower profitability. The lower the ratio, the greater the ability to carry a large burden of fixed overheads. Illustration 43 Following is the Trading and Profit and Loss Account of a sole proprietorship firm for the year ended 31.3.2018: Dr. Profit and Loss Account Cr. Particulars Particulars To Inventories 35,000 By Sales 4,00,000 To Purchases 2.25,000 By Inventories at end 50,000 To Wages To Gross Profit old 1.84,000 4,50,000 4,50,000 To Administrative Expenses 10,000 By Gross Profit bld 1,84,000 To Selling and Distribution Expenses 14,000 To Loss on Sale of Plant 10,000 To Net Profit 1,50,000 1.84,000 1,84,000 Calculate operating ratio. 6,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started