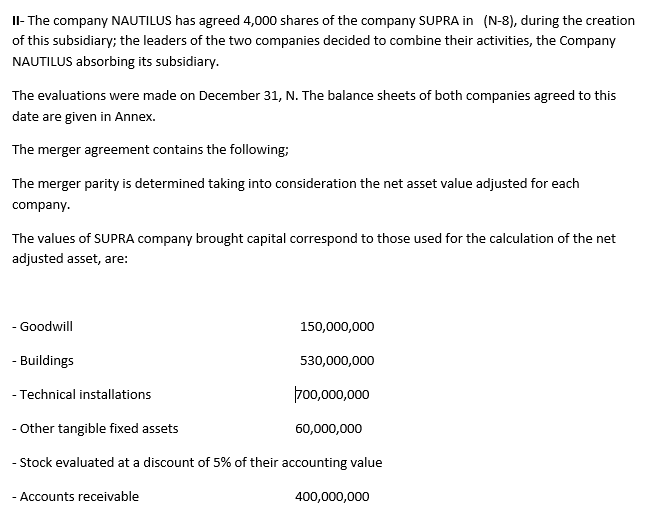

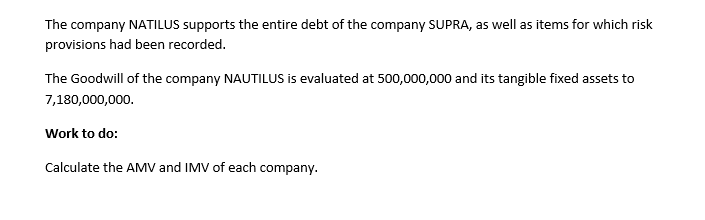

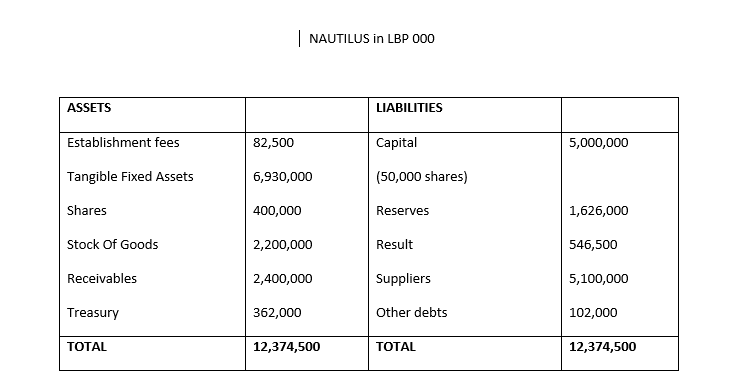

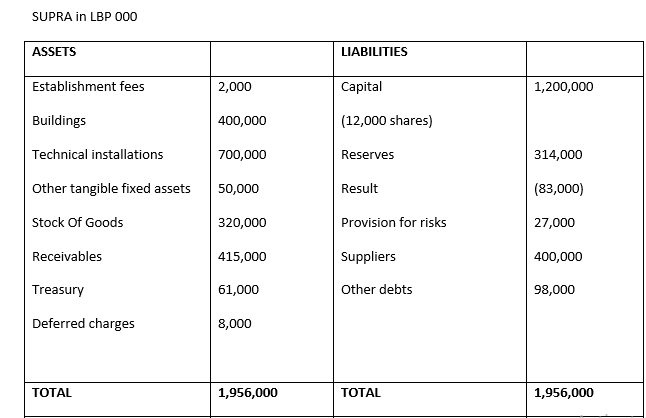

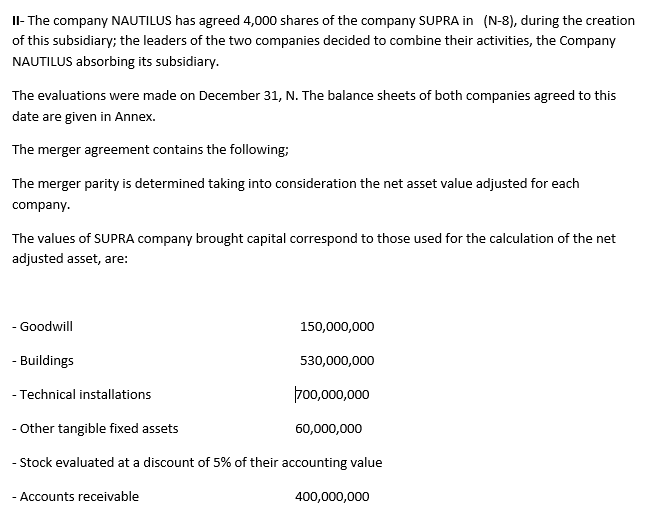

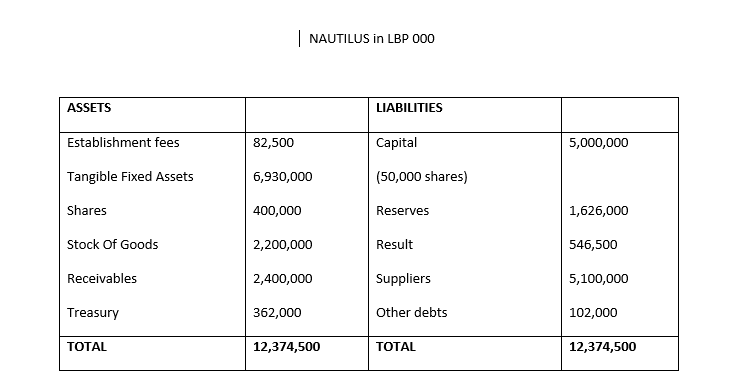

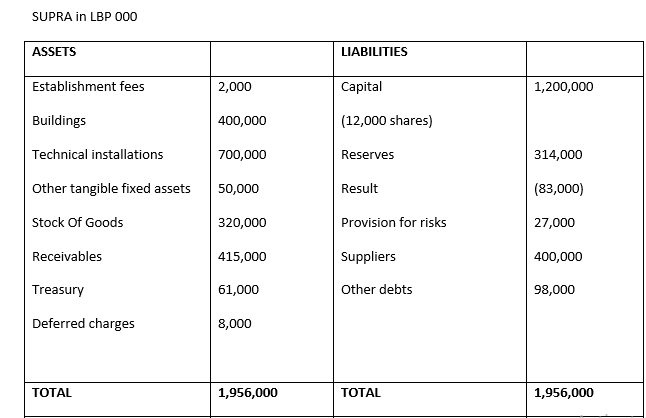

II- The company NAUTILUS has agreed 4,000 shares of the company SUPRA in (N-8), during the creation of this subsidiary; the leaders of the two companies decided to combine their activities, the Company NAUTILUS absorbing its subsidiary. The evaluations were made on December 31, N. The balance sheets of both companies agreed to this date are given in Annex. The merger agreement contains the following: The merger parity is determined taking into consideration the net asset value adjusted for each company. The values of SUPRA company brought capital correspond to those used for the calculation of the net adjusted asset, are: Goodwill 150,000,000 - Buildings 530,000,000 - Technical installations 700,000,000 - Other tangible fixed assets 60,000,000 - Stock evaluated at a discount of 5% of their accounting value - Accounts receivable 400,000,000 The company NATILUS supports the entire debt of the company SUPRA, as well as items for which risk provisions had been recorded. The Goodwill of the company NAUTILUS is evaluated at 500,000,000 and its tangible fixed assets to 7,180,000,000 Work to do: Calculate the AMV and IMV of each company. | NAUTILUS in LBP 000 ASSETS LIABILITIES Establishment fees 82,500 Capital 5,000,000 Tangible Fixed Assets 6,930,000 (50,000 shares) Shares 400,000 Reserves 1,626,000 Stock Of Goods 2,200,000 Result 546,500 Receivables 2,400,000 Suppliers 5,100,000 Treasury 362,000 Other debts 102,000 TOTAL 12,374,500 TOTAL 12,374,500 SUPRA in LBP 000 ASSETS LIABILITIES Establishment fees 2,000 Capital 1,200,000 Buildings 400,000 (12,000 shares) Technical installations 700,000 Reserves 314,000 Other tangible fixed assets 50,000 Result (83,000) Stock Of Goods 320,000 Provision for risks 27,000 Receivables 415,000 Suppliers 400,000 Treasury 61,000 Other debts 98,000 Deferred charges 8,000 TOTAL 1,956,000 TOTAL 1,956,000 II- The company NAUTILUS has agreed 4,000 shares of the company SUPRA in (N-8), during the creation of this subsidiary; the leaders of the two companies decided to combine their activities, the Company NAUTILUS absorbing its subsidiary. The evaluations were made on December 31, N. The balance sheets of both companies agreed to this date are given in Annex. The merger agreement contains the following: The merger parity is determined taking into consideration the net asset value adjusted for each company. The values of SUPRA company brought capital correspond to those used for the calculation of the net adjusted asset, are: Goodwill 150,000,000 - Buildings 530,000,000 - Technical installations 700,000,000 - Other tangible fixed assets 60,000,000 - Stock evaluated at a discount of 5% of their accounting value - Accounts receivable 400,000,000 The company NATILUS supports the entire debt of the company SUPRA, as well as items for which risk provisions had been recorded. The Goodwill of the company NAUTILUS is evaluated at 500,000,000 and its tangible fixed assets to 7,180,000,000 Work to do: Calculate the AMV and IMV of each company. | NAUTILUS in LBP 000 ASSETS LIABILITIES Establishment fees 82,500 Capital 5,000,000 Tangible Fixed Assets 6,930,000 (50,000 shares) Shares 400,000 Reserves 1,626,000 Stock Of Goods 2,200,000 Result 546,500 Receivables 2,400,000 Suppliers 5,100,000 Treasury 362,000 Other debts 102,000 TOTAL 12,374,500 TOTAL 12,374,500 SUPRA in LBP 000 ASSETS LIABILITIES Establishment fees 2,000 Capital 1,200,000 Buildings 400,000 (12,000 shares) Technical installations 700,000 Reserves 314,000 Other tangible fixed assets 50,000 Result (83,000) Stock Of Goods 320,000 Provision for risks 27,000 Receivables 415,000 Suppliers 400,000 Treasury 61,000 Other debts 98,000 Deferred charges 8,000 TOTAL 1,956,000 TOTAL 1,956,000