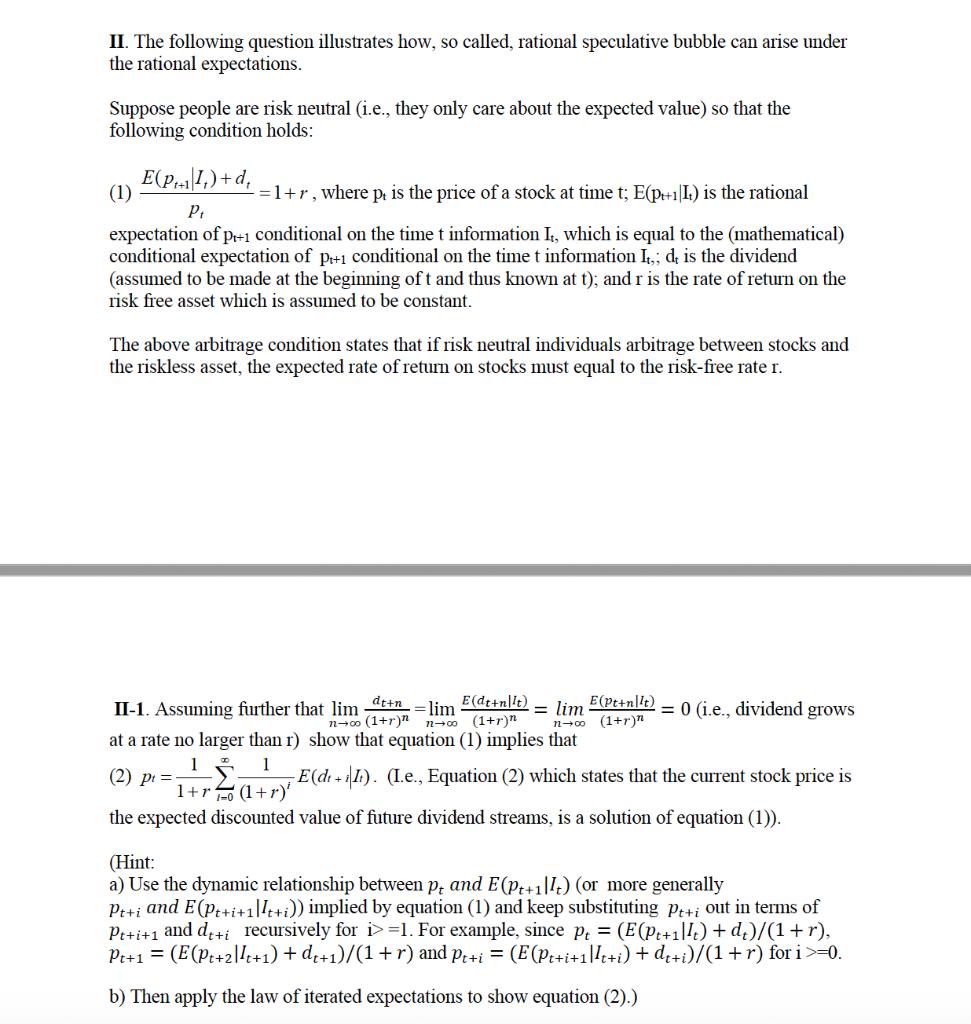

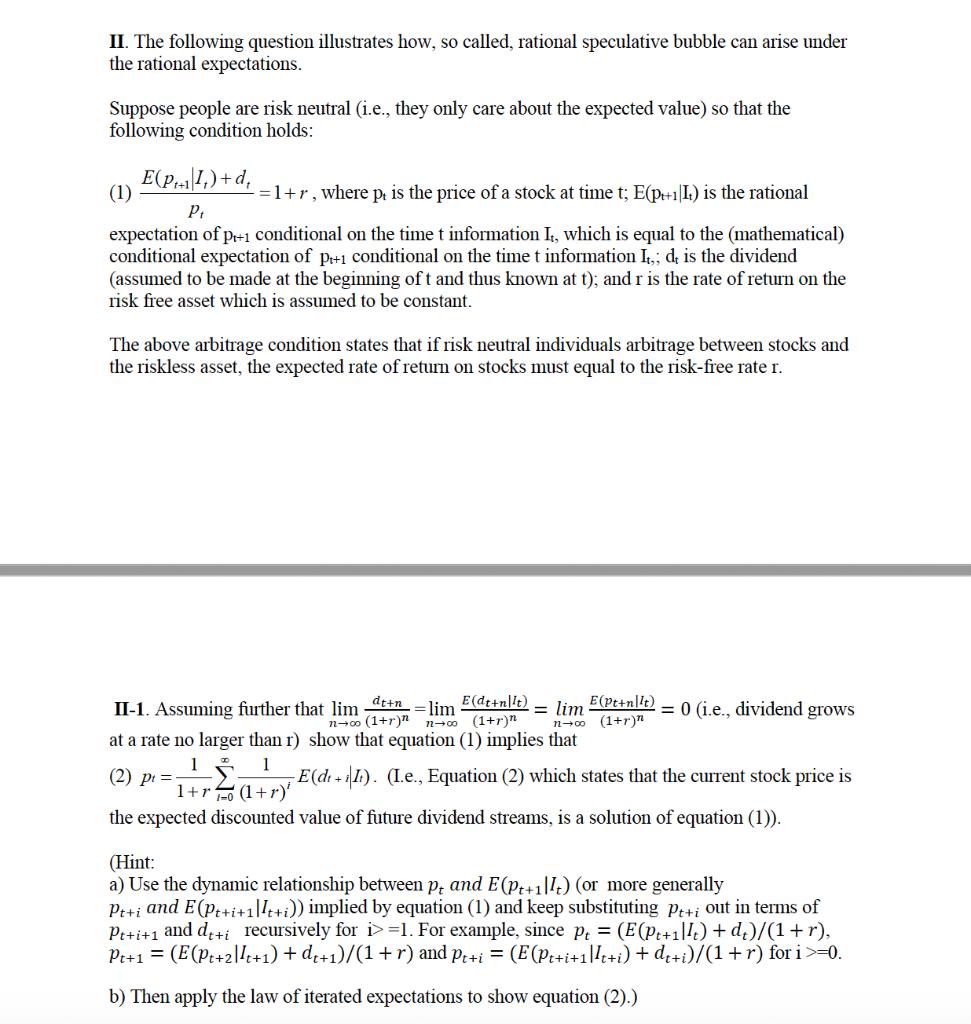

II. The following question illustrates how, so called, rational speculative bubble can arise under the rational expectations. Suppose people are risk neutral (i.e., they only care about the expected value) so that the following condition holds: E(Pr+1\4,)+d, (1) =1+r, where p is the price of a stock at time t; E(P=+1 It) is the rational P expectation of pr+1 conditional on the time t information Is, which is equal to the (mathematical) conditional expectation of pr+1 conditional on the time t information Ic; de is the dividend (assumed to be made at the beginning oft and thus known at t); and r is the rate of return on the risk free asset which is assumed to be constant. The above arbitrage condition states that if risk neutral individuals arbitrage between stocks and the riskless asset, the expected rate of return on stocks must equal to the risk-free rate r. dtun II-1. Assuming further that lim Edt+n1t) E(Pt+n\'t) =lim = lim = 0 (i.e., dividend grows n-(1+r)" n-6 (1+r)" n+00 (1+r)" at a rate no larger than r) show that equation (1) implies that 1 1 (2) p = E(de + i]It). (I.e., Equation (2) which states that the current stock price is 1+r (1+r)' the expected discounted value of future dividend streams, is a solution of equation (1)). (Hint: a) Use the dynamic relationship between pt and E(Pt+1/7) (or more generally Pt+i and E(Pt+i+1.7++i)) implied by equation (1) and keep substituting Pt+i out in terms of Pe+i+1 and deti recursively for i>=1. For example, since pz = (E(Pt+111.) +d)/(1+r), Pe+1 = (E(Pt+2|1e+1) +de+1)/(1+r) and Peti = (E(Pe+i+1|1t+i) +de+i)/(1+r) for i >=0. b) Then apply the law of iterated expectations to show equation (2).) II. The following question illustrates how, so called, rational speculative bubble can arise under the rational expectations. Suppose people are risk neutral (i.e., they only care about the expected value) so that the following condition holds: E(Pr+1\4,)+d, (1) =1+r, where p is the price of a stock at time t; E(P=+1 It) is the rational P expectation of pr+1 conditional on the time t information Is, which is equal to the (mathematical) conditional expectation of pr+1 conditional on the time t information Ic; de is the dividend (assumed to be made at the beginning oft and thus known at t); and r is the rate of return on the risk free asset which is assumed to be constant. The above arbitrage condition states that if risk neutral individuals arbitrage between stocks and the riskless asset, the expected rate of return on stocks must equal to the risk-free rate r. dtun II-1. Assuming further that lim Edt+n1t) E(Pt+n\'t) =lim = lim = 0 (i.e., dividend grows n-(1+r)" n-6 (1+r)" n+00 (1+r)" at a rate no larger than r) show that equation (1) implies that 1 1 (2) p = E(de + i]It). (I.e., Equation (2) which states that the current stock price is 1+r (1+r)' the expected discounted value of future dividend streams, is a solution of equation (1)). (Hint: a) Use the dynamic relationship between pt and E(Pt+1/7) (or more generally Pt+i and E(Pt+i+1.7++i)) implied by equation (1) and keep substituting Pt+i out in terms of Pe+i+1 and deti recursively for i>=1. For example, since pz = (E(Pt+111.) +d)/(1+r), Pe+1 = (E(Pt+2|1e+1) +de+1)/(1+r) and Peti = (E(Pe+i+1|1t+i) +de+i)/(1+r) for i >=0. b) Then apply the law of iterated expectations to show equation (2).)