Question

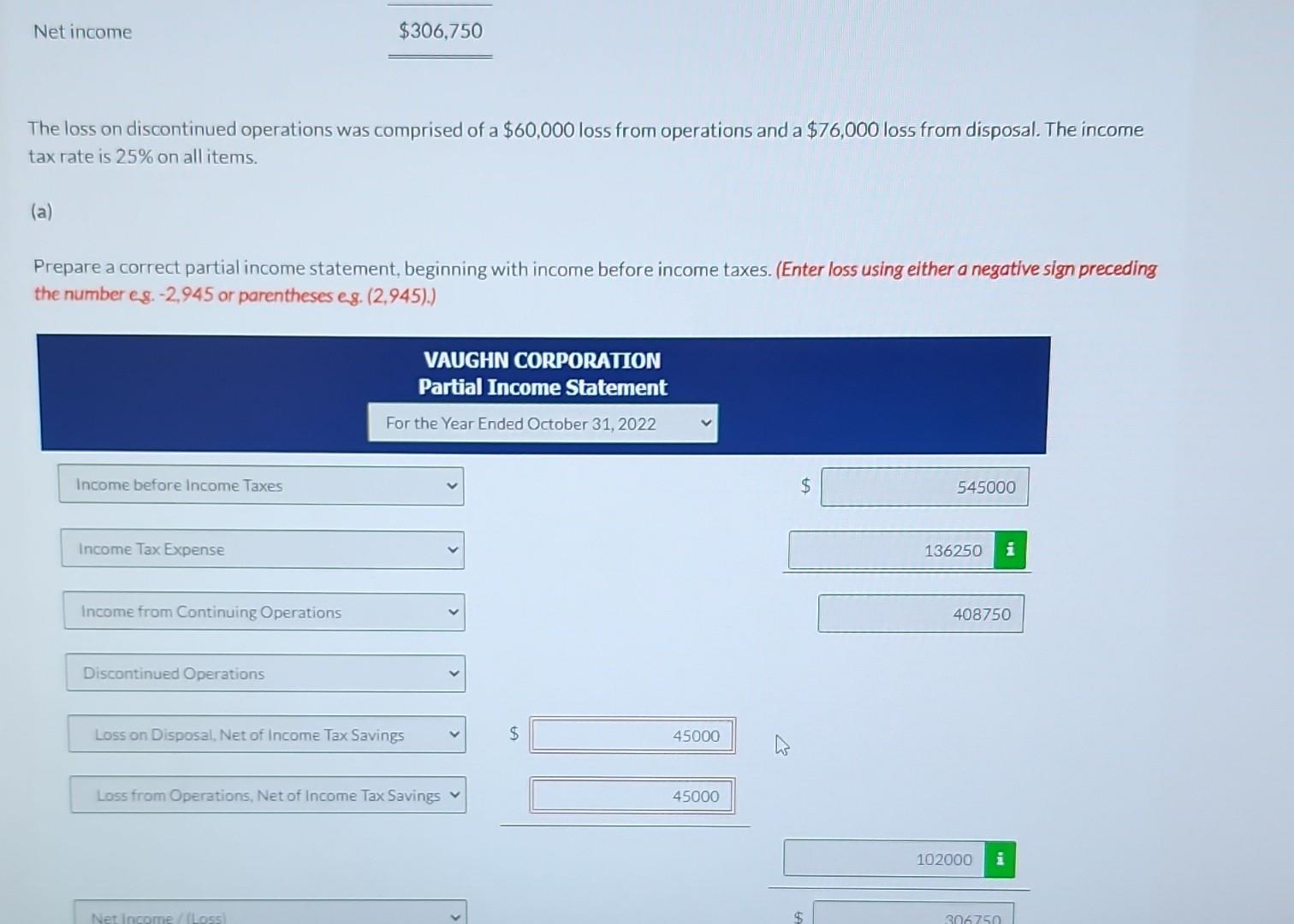

ii The loss on discontinued operations was comprised of a $60,000 loss from operations and a $76,000 loss from disposal. The income tax rate is

ii The loss on discontinued operations was comprised of a $60,000 loss from operations and a $76,000 loss from disposal. The income tax rate is 25% on all items. (a) Prepare a correct partial income statement, beginning with income before income taxes. (Enter loss using either a negative sign preceding the number eg. -2,945 or parentheses eg. (2,945).) Income before Income Taxes Income Tax Expense Income from Continuing Operations Discontinued Operations Loss on Disposal, Net of Income Tax Savings VAUGHN CORPORATION Partial Income Statement For the Year Ended October 31, 2022 Loss from Operations, Net of Income Tax Savings Net Income /(Loss) UP Sau Cash acco 45000 45000 Justin 95-eSite dubriona 01- Skyline $ $ 545000 136250 i 408750 102000 i 306750 Desktop 73F Cloudy Second Sight 5524 not

The loss on discontinued operations was comprised of a $60,000 loss from operations and a $76,000 loss from disposal. The income tax rate is 25% on all items. (a) Prepare a correct partial income statement, beginning with income before income taxes. (Enter loss using either a negative sign preceding the number es. 2,945 or parentheses eg. (2,945).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started