Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(ii) The original default rate on the sample of 135,000 cardholders was extremely high at approximately 8.0%. What impact would setting the cut-off at 85

(ii) The original default rate on the sample of 135,000 cardholders was extremely high at approximately 8.0%. What impact would setting the cut-off at 85 have on the default rate? Show calculations.

(iii) Based on the credit evaluation process. Do you suggest the revised cutoff to 85 be adopted? Why?

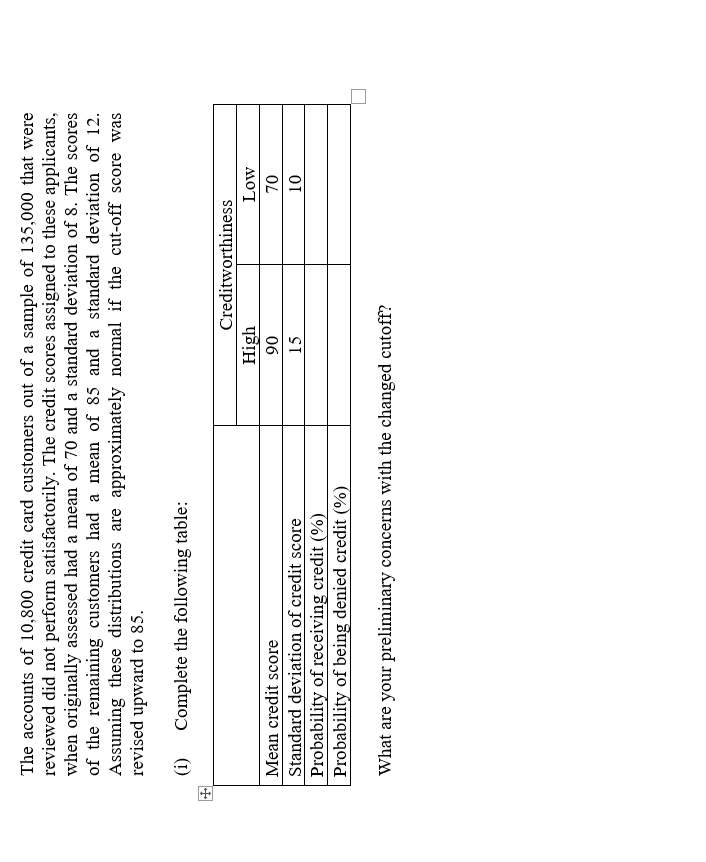

The accounts of 10,800 credit card customers out of a sample of 135,000 that were reviewed did not perform satisfactorily. The credit scores assigned to these applicants, when originally assessed had a mean of 70 and a standard deviation of 8 . The scores of the remaining customers had a mean of 85 and a standard deviation of 12 . Assuming these distributions are approximately normal if the cut-off score was revised upward to 85 . (i) Complete the following table: What are your preliminary concerns with the changed cutoffStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started