Answered step by step

Verified Expert Solution

Question

1 Approved Answer

II. Two Sole Proprietorships Converted to a Partnership On January 1, 20YY, Michael and Rafael agreed to combine their existing businesses to form a partnership.

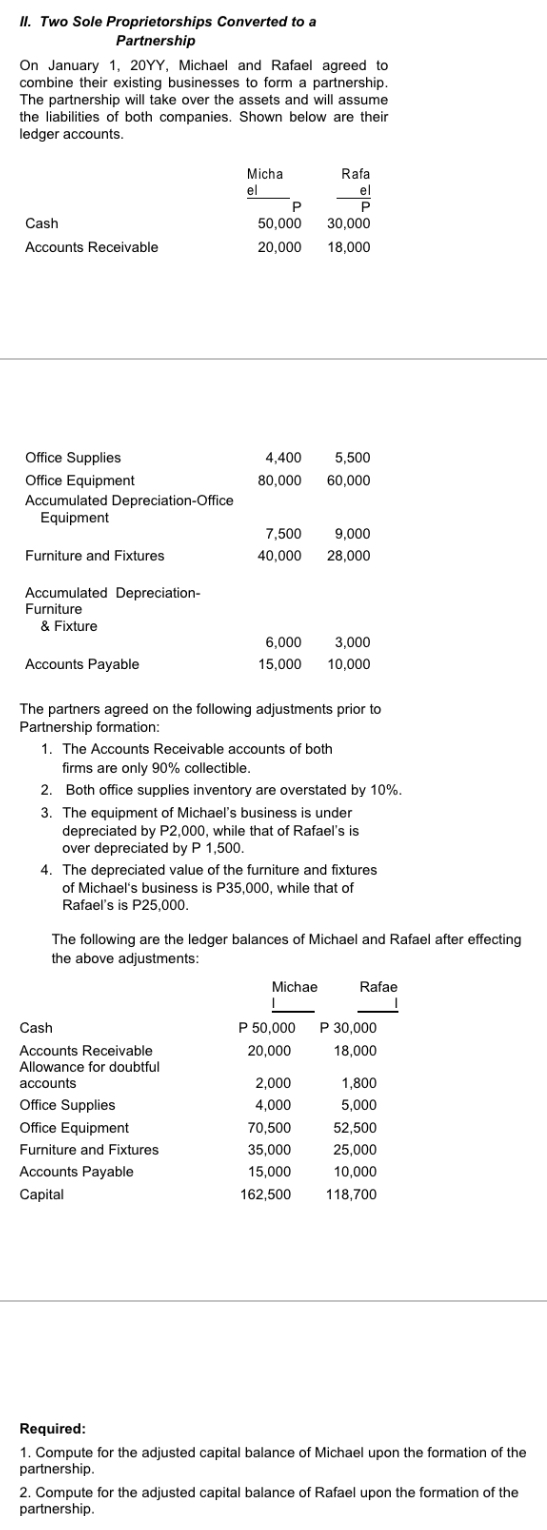

II. Two Sole Proprietorships Converted to a Partnership On January 1, 20YY, Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets and will assume the liabilities of both companies. Shown below are their ledger accounts. The partners agreed on the following adjustments prior to Partnership formation: 1. The Accounts Receivable accounts of both firms are only 90% collectible. 2. Both office supplies inventory are overstated by 10%. 3. The equipment of Michael's business is under depreciated by P2,000, while that of Rafael's is over depreciated by P1,500. 4. The depreciated value of the furniture and fixtures of Michael's business is P 35,000 , while that of Rafael's is P25,000. The following are the ledger balances of Michael and Rafael after effecting the above adjustments: Required: 1. Compute for the adjusted capital balance of Michael upon the formation of the partnership. 2. Compute for the adjusted capital balance of Rafael upon the formation of the partnership

II. Two Sole Proprietorships Converted to a Partnership On January 1, 20YY, Michael and Rafael agreed to combine their existing businesses to form a partnership. The partnership will take over the assets and will assume the liabilities of both companies. Shown below are their ledger accounts. The partners agreed on the following adjustments prior to Partnership formation: 1. The Accounts Receivable accounts of both firms are only 90% collectible. 2. Both office supplies inventory are overstated by 10%. 3. The equipment of Michael's business is under depreciated by P2,000, while that of Rafael's is over depreciated by P1,500. 4. The depreciated value of the furniture and fixtures of Michael's business is P 35,000 , while that of Rafael's is P25,000. The following are the ledger balances of Michael and Rafael after effecting the above adjustments: Required: 1. Compute for the adjusted capital balance of Michael upon the formation of the partnership. 2. Compute for the adjusted capital balance of Rafael upon the formation of the partnership Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started