Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IIf it's incomplete, I do not know. It's all I have as the questions. It is not a question, on the PHASE 1 there is

IIf it's incomplete, I do not know. It's all I have as the questions.

IIf it's incomplete, I do not know. It's all I have as the questions.

It is not a question, on the PHASE 1 there is what I have to do, and then is in that order.

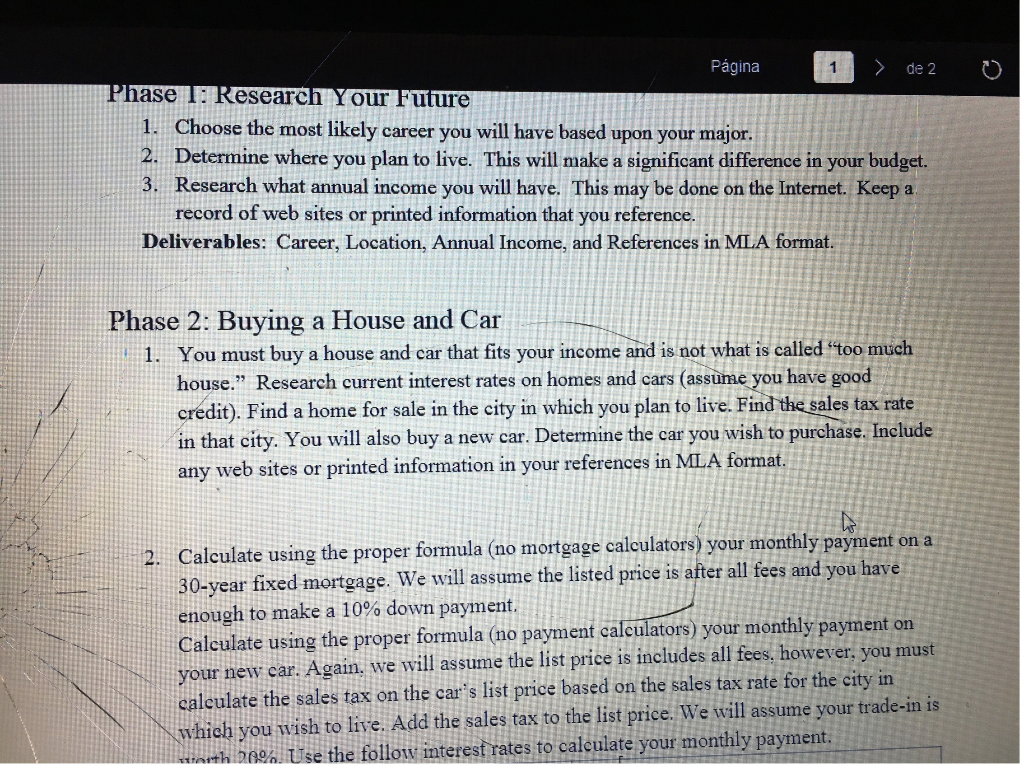

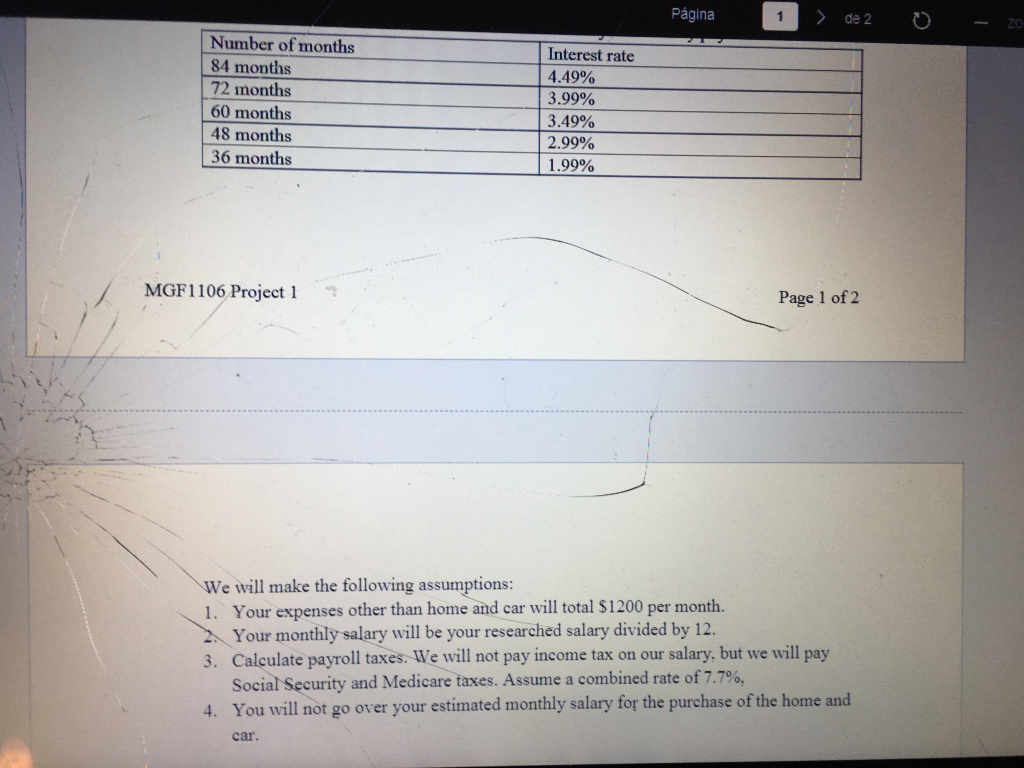

Pgina 1 > de 2 Phase Research Your Future 1. Choose the most likely career you will have based upon your major. 2. Determine where you plan to live. This will make a significant difference in your budget. 3. Research what annual income you will have. This may be done on the Internet. Keep a record of web sites or printed information that you reference. Deliverables: Career, Location, Annual Income, and References in MLA format. Phase 2: Buying a House and Car You must buy a house and car that fits your income and is not what is called too much house. Research current interest rates on homes and cars (assume you have good credit). Find a home for sale in the city in which you plan to live. Find the sales tax rate in that city. You will also buy a new car. Determine the car you wish to purchase. Include any web sites or printed information in your references in MLA format. Calculate using the proper formula (no mortgage calculators) your monthly payment on a 30-year fixed mortgage. We will assume the listed price is after all fees and you have enough to make a 10% down payment. Calculate using the proper formula (no payment calculators) your monthly payment on your new car. Again, we will assume the list price is includes all fees, however, you must calculate the sales tax on the car's list price based on the sales tax rate for the city in which you wish to live. Add the sales tax to the list price. We will assume your trade-in is tarth 50%. Use the follow interest rates to calculate your monthly payment. Pgina 1 >_de 2 0 - 2 Number of months 84 months 72 inonths 60 months 48 months 36 months Interest rate 4.49% 3.99% 3.49% 2.99% 1.99% MGF1106 Project 1 Page 1 of 2 We will make the following assumptions: 1. Your expenses other than home and car will total $1200 per month. Your monthly salary will be your researched salary divided by 12. 3. Calculate payroll taxes. We will not pay income tax on our salary, but we will pay Social Security and Medicare taxes. Assume a combined rate of 7.7%. 4. You will not go over your estimated monthly salary for the purchase of the home and car. Pgina 1 > de 2 Phase Research Your Future 1. Choose the most likely career you will have based upon your major. 2. Determine where you plan to live. This will make a significant difference in your budget. 3. Research what annual income you will have. This may be done on the Internet. Keep a record of web sites or printed information that you reference. Deliverables: Career, Location, Annual Income, and References in MLA format. Phase 2: Buying a House and Car You must buy a house and car that fits your income and is not what is called too much house. Research current interest rates on homes and cars (assume you have good credit). Find a home for sale in the city in which you plan to live. Find the sales tax rate in that city. You will also buy a new car. Determine the car you wish to purchase. Include any web sites or printed information in your references in MLA format. Calculate using the proper formula (no mortgage calculators) your monthly payment on a 30-year fixed mortgage. We will assume the listed price is after all fees and you have enough to make a 10% down payment. Calculate using the proper formula (no payment calculators) your monthly payment on your new car. Again, we will assume the list price is includes all fees, however, you must calculate the sales tax on the car's list price based on the sales tax rate for the city in which you wish to live. Add the sales tax to the list price. We will assume your trade-in is tarth 50%. Use the follow interest rates to calculate your monthly payment. Pgina 1 >_de 2 0 - 2 Number of months 84 months 72 inonths 60 months 48 months 36 months Interest rate 4.49% 3.99% 3.49% 2.99% 1.99% MGF1106 Project 1 Page 1 of 2 We will make the following assumptions: 1. Your expenses other than home and car will total $1200 per month. Your monthly salary will be your researched salary divided by 12. 3. Calculate payroll taxes. We will not pay income tax on our salary, but we will pay Social Security and Medicare taxes. Assume a combined rate of 7.7%. 4. You will not go over your estimated monthly salary for the purchase of the home and carStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started