Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(iii) calculate the project's terminal cash flows. (4 marks) (iv) calculate the project's Net Present Value (NPV). (3 marks) (v) should the company proceed with

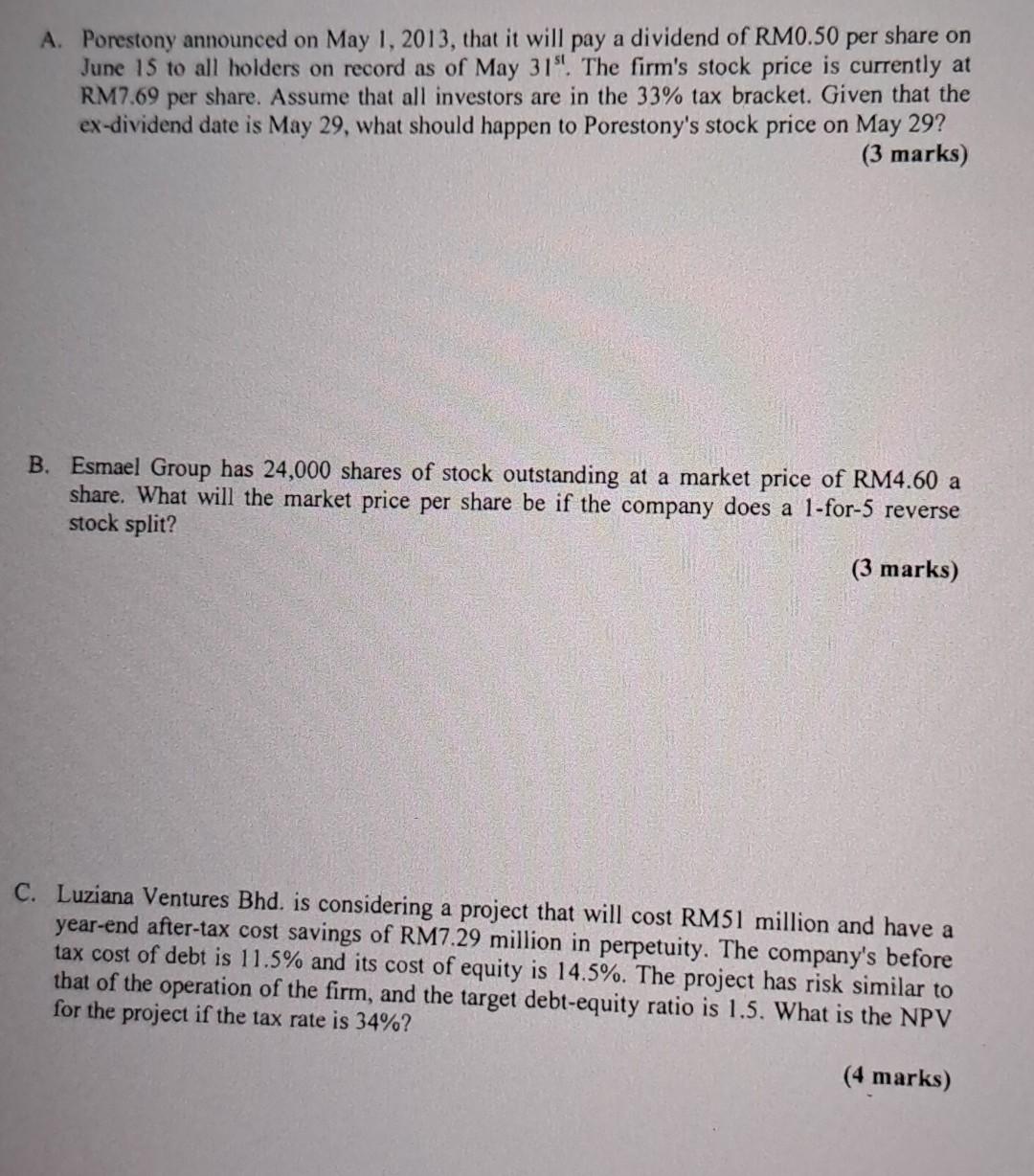

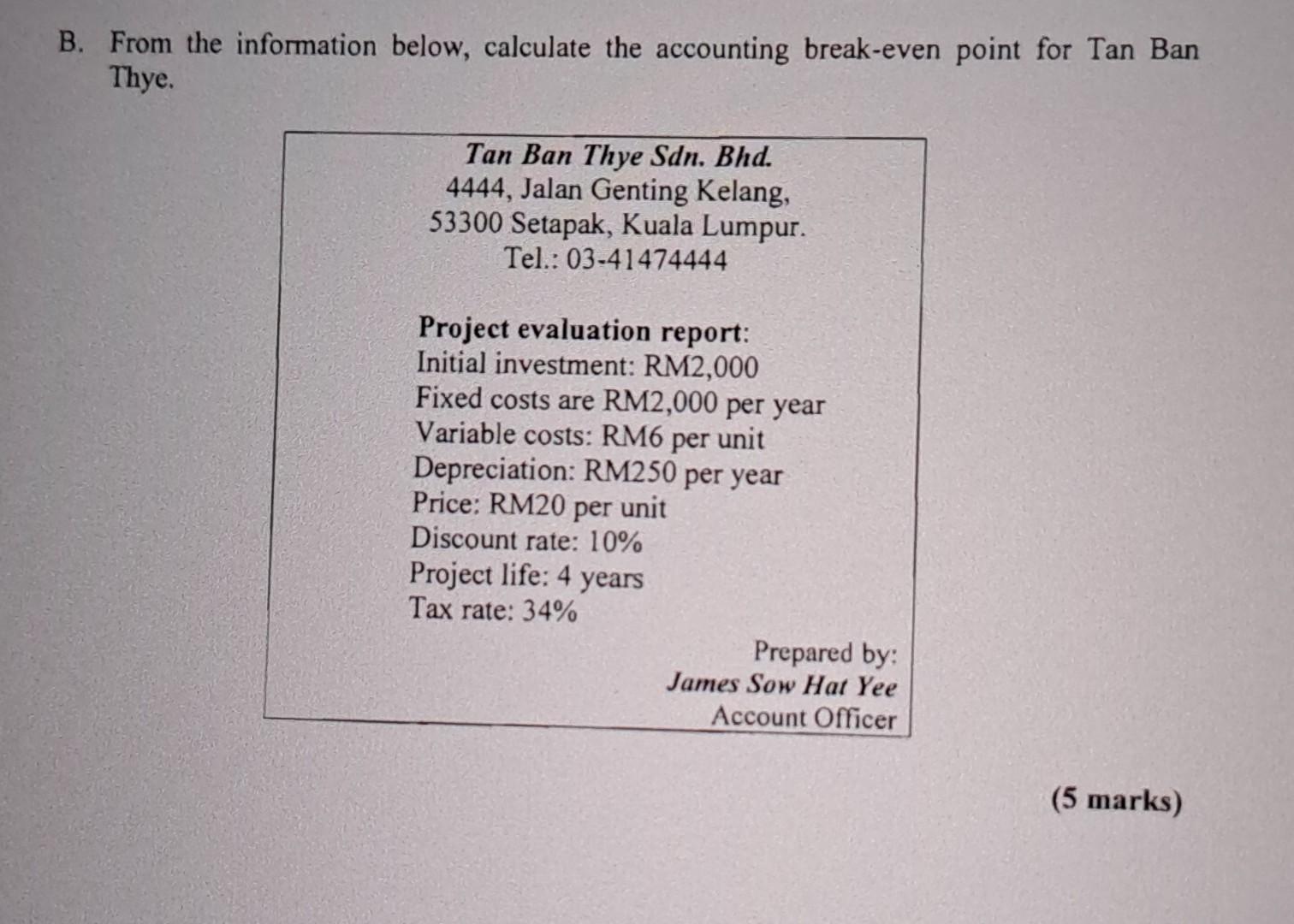

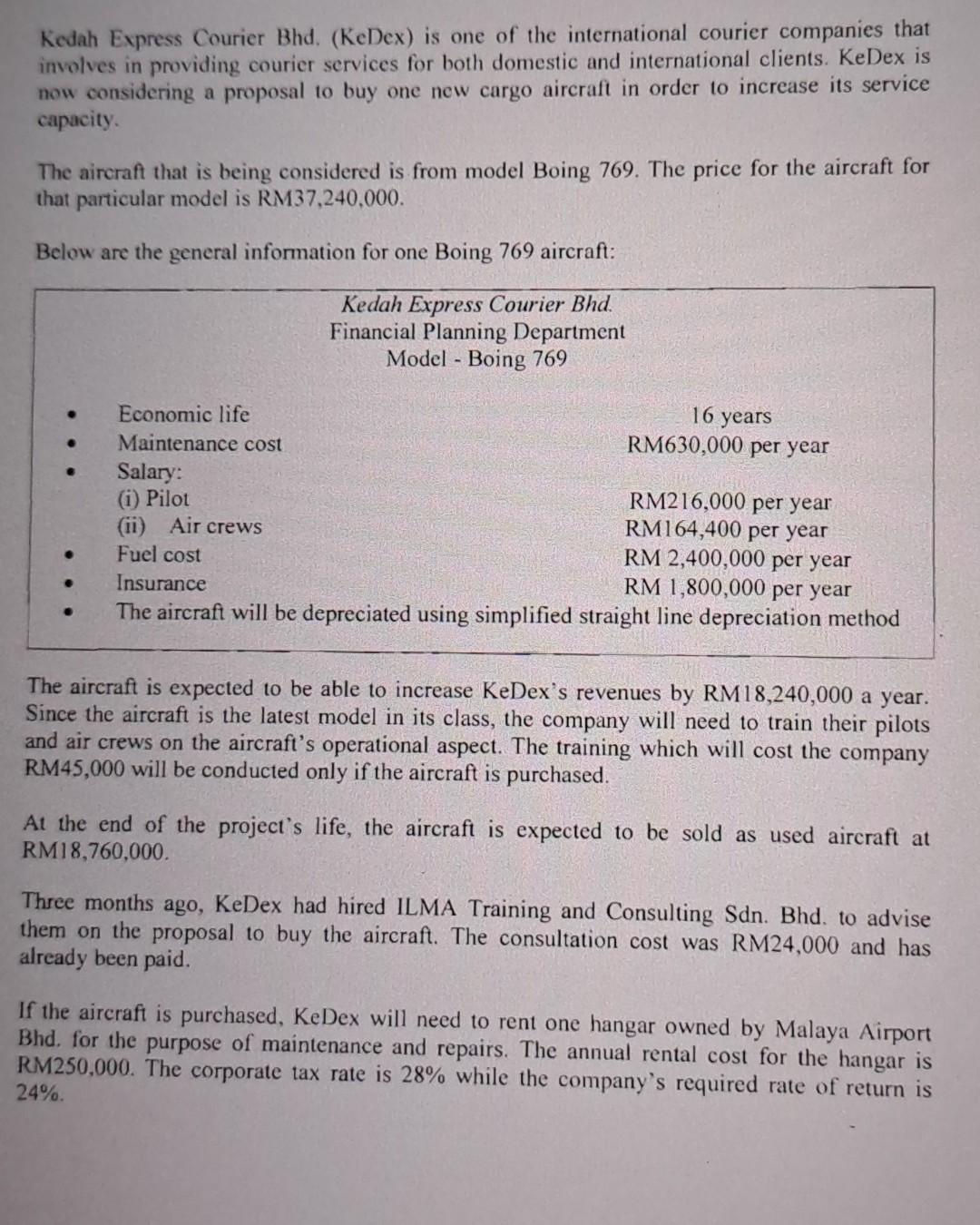

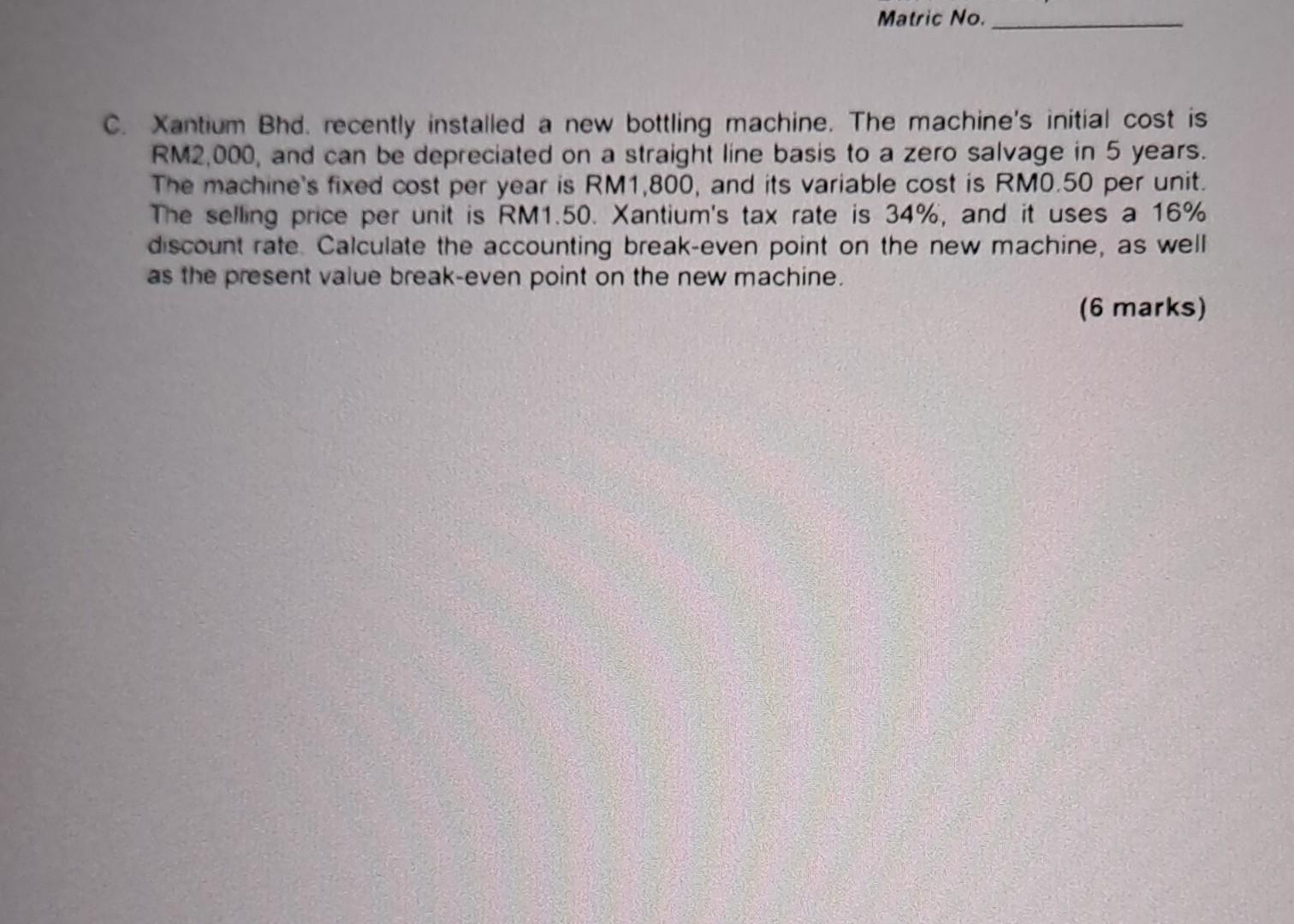

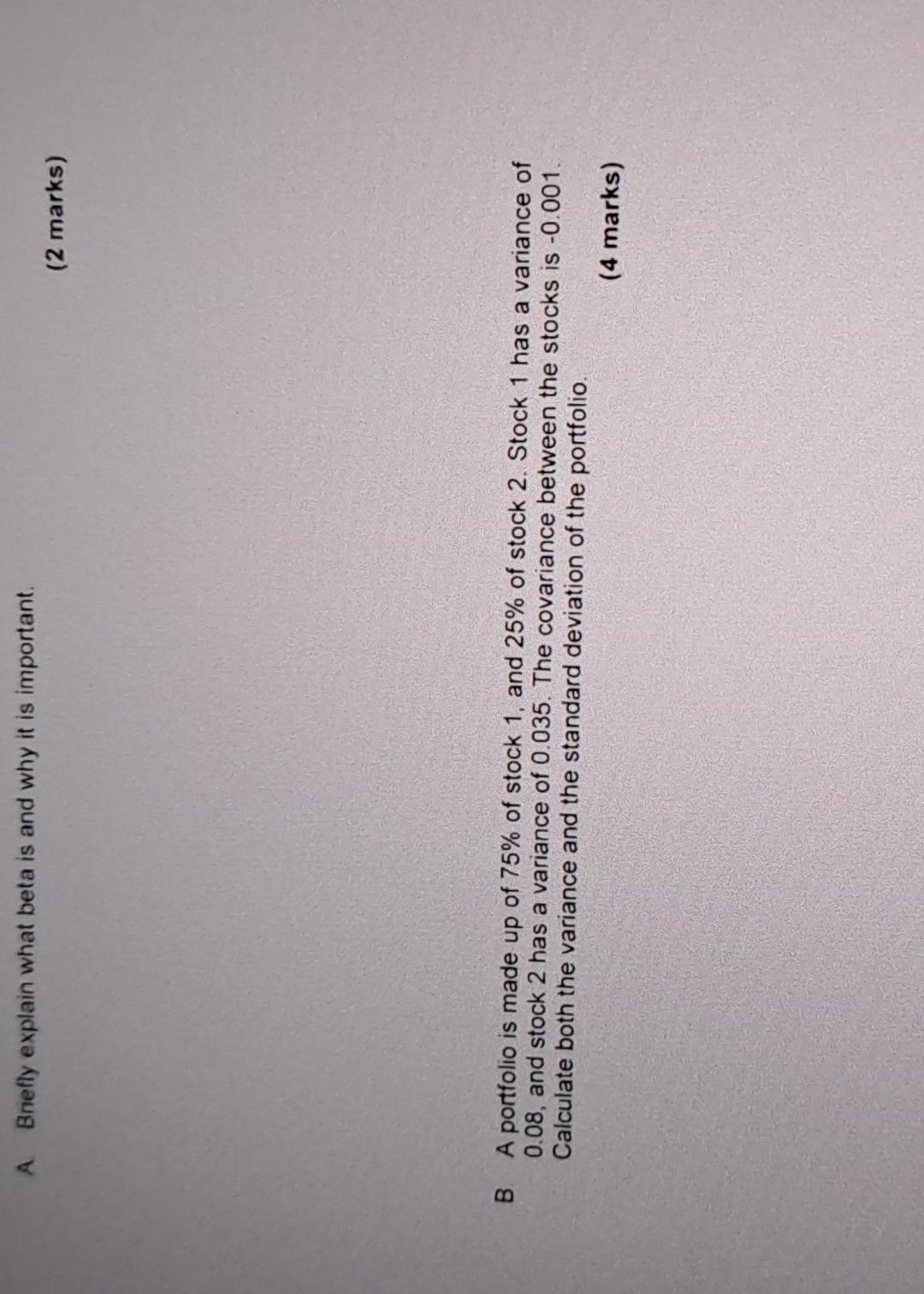

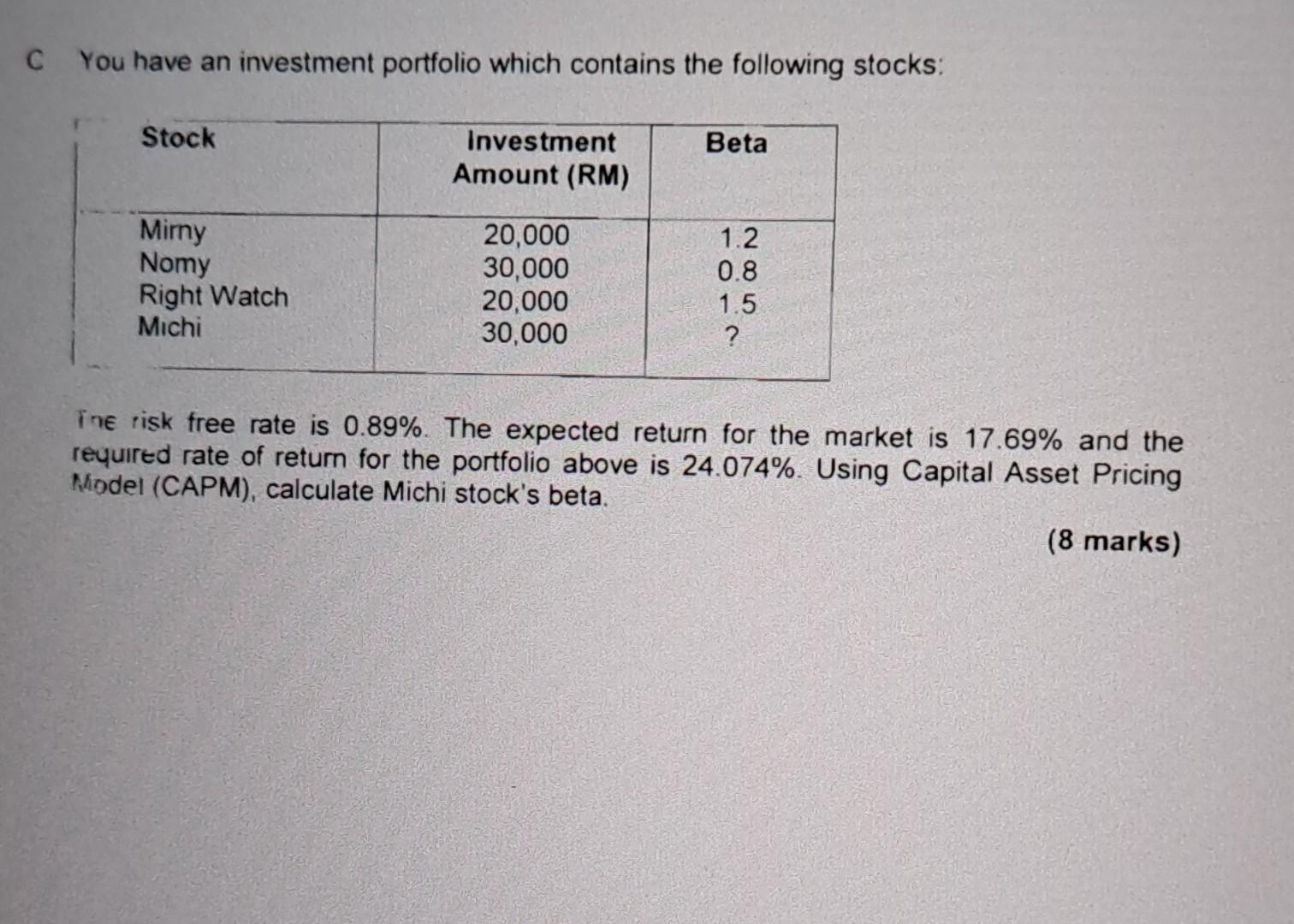

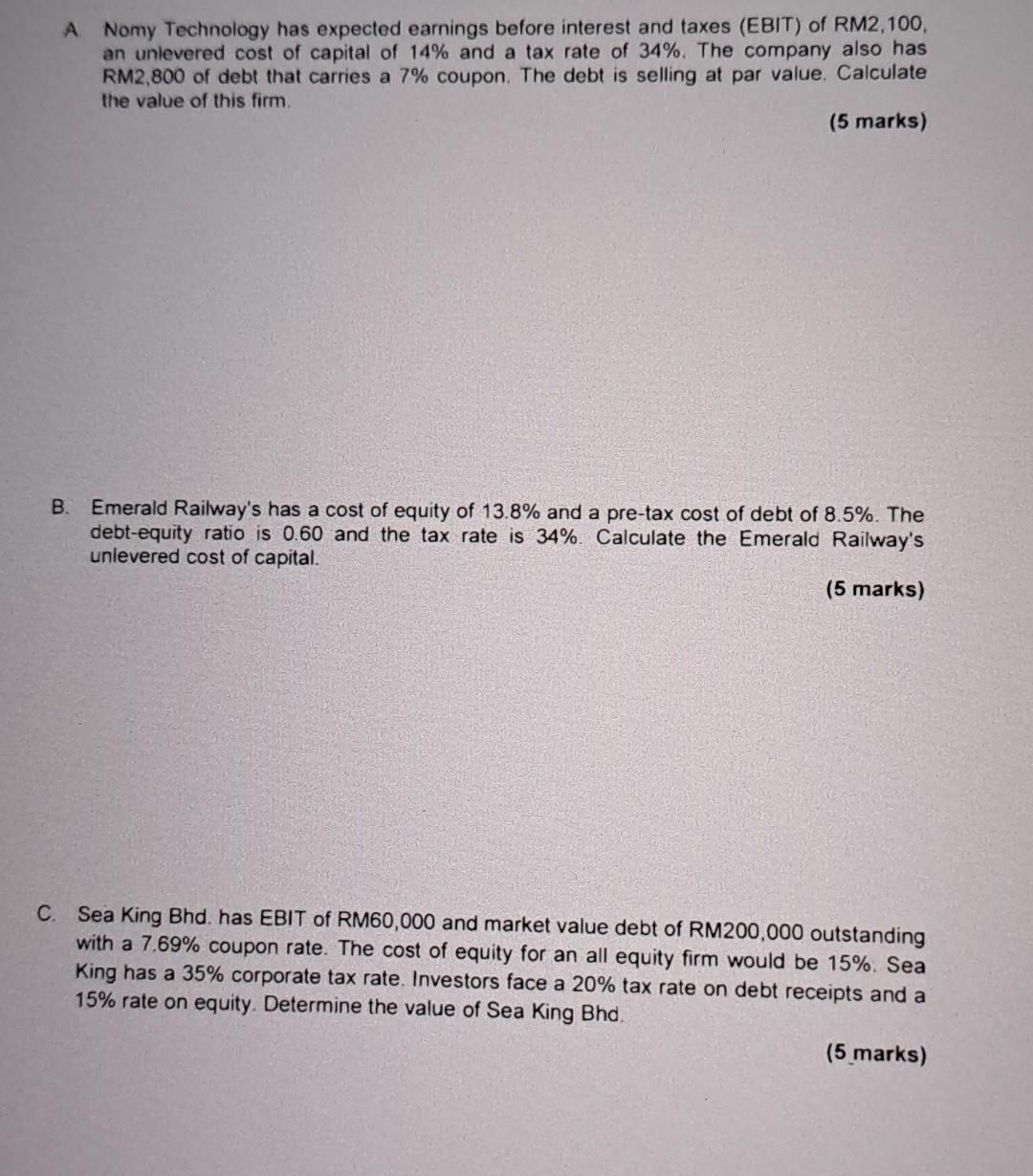

(iii) calculate the project's terminal cash flows. (4 marks) (iv) calculate the project's Net Present Value (NPV). (3 marks) (v) should the company proceed with the project? Explain your answer. A Sensitivity analysis is a method which allows for evaluation of the Net Present Value (NPV) given a series of changes to the underlying assumptions. Discuss why and how scenario analysis is used in addition to sensitivity analysis. (4 marks) B. Briefly discuss two shortcomings in the standard decision tree analysis that a financial manager should be familiar of. (2 marks) Kedah Express Courier Bhd, (KeDex) is one of the international courier companies that involves in providing courier services for both domestic and international clients. KeDex is now considering a proposal to buy one new cargo aircraft in order to increase its service capacity. The aircraft that is being considered is from model Boing 769. The price for the aircraft for that particular model is RM37,240,000. Below are the general information for one Boing 769 aircraft: The aircraft is expected to be able to increase KeDex's revenues by RM18,240,000 a year. Since the aircraft is the latest model in its class, the company will need to train their pilots and air crews on the aircraft's operational aspect. The training which will cost the company RM45,000 will be conducted only if the aircraft is purchased. At the end of the project's life, the aircraft is expected to be sold as used aircraft at RM18,760,000. Three months ago, KeDex had hired ILMA Training and Consulting Sdn. Bhd. to advise them on the proposal to buy the aircraft. The consultation cost was RM24,000 and has already been paid. If the aircraft is purchased, KeDex will need to rent one hangar owned by Malaya Airport Bhd. for the purpose of maintenance and repairs. The annual rental cost for the hangar is RM250,000. The corporate tax rate is 28% while the company's required rate of return is 24%. A. According to the Capital Asset Pricing Model (CAPM), the expected return on a risky asset depends on THREE (3) components. Describe each component, and explain its role in determining expected return. (6 marks) 3. Suppose that we have identified three important systematic risk factors given by exports, inflation, and industrial production. In the beginning of the year, growth in these three factors is estimated at 2.5%,3.5%, and 4.5% respectively. However, actual growth in these factors turns out to be 1.5%,2.4%, and 6%. The factor betas are given by EXPORT =1.6,INFLATION=0.6, and INDPRODUCTION=1.0. (i) If the expected return on the stock is 8%, and no unexpected news concerning the stock surfaces, calculate the stock's total return. (6 marks) (vii) If the company wait one year to start the project, the initial cost will rise by 10% and the annual project's cash flows will increase by 20% a year throughout the project's life. What is the value of the option to wait? (4 marks) (ii) Calculate the stock's total return if the company announces that an important patent filing has been granted sooner than expected and will earn the company 7% more in retum. (2 marks) (iii) Calculate the stock's total return if the company announces that they had an industrial accident and the operating facilities will close down for some time thus resulting in a loss by the company of 7% in return. (3 marks) (iv) What would the stock's total return be if the actual growth in each of the factors was equal to growth expected? Assume no unexpected news on the patent. (1 mark) A Bnefly explain what beta is and why it is important. (2 marks) B A portfolio is made up of 75% of stock 1 , and 25% of stock 2 . Stock 1 has a variance of 0.08 , and stock 2 has a variance of 0.035 . The covariance between the stocks is -0.001 . Calculate both the variance and the standard deviation of the portfolio. (4 marks) A. Porestony announced on May I, 2013, that it will pay a dividend of RM0.50 per share on June 15 to all holders on record as of May 31st. The firm's stock price is currently at RM7.69 per share. Assume that all investors are in the 33\% tax bracket. Given that the ex-dividend date is May 29, what should happen to Porestony's stock price on May 29? (3 marks) B. Esmael Group has 24,000 shares of stock outstanding at a market price of RM4.60 a share. What will the market price per share be if the company does a 1 -for- 5 reverse stock split? (3 marks) C. Luziana Ventures Bhd. is considering a project that will cost RM51 million and have a year-end after-tax cost savings of RM7.29 million in perpetuity. The company's before tax cost of debt is 11.5% and its cost of equity is 14.5%. The project has risk similar to that of the operation of the firm, and the target debt-equity ratio is 1.5. What is the NPV for the project if the tax rate is 34% ? B. From the information below, calculate the accounting break-even point for Tan Ban Thye. C You have an investment portfolio which contains the following stocks: ine risk free rate is 0.89%. The expected return for the market is 17.69% and the requirted rate of return for the portfolio above is 24.074%. Using Capital Asset Pricing Model (CAPM), calculate Michi stock's beta. (8 marks) (vi) If the project's after tax annual cash flows decrease by 20% lower than the one forecasted in (ii) throughout the project's life, how can this scenario affect your decision in (v) ? (4 marks) D Explain the conceptual differences in the theoretical development of the CAPM and Arbitrage Pricing Theory (APT). (4 marks) A. Nomy Technology has expected earnings before interest and taxes (EBIT) of RM2,100. an unlevered cost of capital of 14% and a tax rate of 34%. The company also has RM2,800 of debt that carries a 7% coupon. The debt is selling at par value. Calculate the value of this firm (5 marks) B. Emerald Railway's has a cost of equity of 13.8% and a pre-tax cost of debt of 8.5%. The debt-equity ratio is 0.60 and the tax rate is 34%. Calculate the Emerald Railway's unlevered cost of capital. (5 marks) C. Sea King Bhd. has EBIT of RM60,000 and market value debt of RM200,000 outstanding with a 7.69% coupon rate. The cost of equity for an all equity firm would be 15%. Sea King has a 35% corporate tax rate. Investors face a 20% tax rate on debt receipts and a 15% rate on equity. Determine the value of Sea King Bhd. (5 marks) Xantium Bhd. recently installed a new bottling machine. The machine's initial cost is RM2,000, and can be depreciated on a straight line basis to a zero salvage in 5 years. The machine's fixed cost per year is RM1,800, and its variable cost is RM0.50 per unit. The selling price per unit is RM1.50. Xantium's tax rate is 34%, and it uses a 16% discount rate. Calculate the accounting break-even point on the new machine, as well as the present value break-even point on the new machine. (6 marks) A. Based on the information given, (i) calculate the project's total initial outlay. (2 marks) (ii) calculate the project's after tax annual cash flows. (6 marks) A. List and explain FOUR (4) main items that one should consider in determining the capital structure. (4 marks) Zero Radius has a cost of equity of 13.84% and an unlevered cost of capital of 12%. The company has RM5,000 in debt that is selling at par value. The levered value of the firm is RM12,000 and the tax rate is 34%. What is the pre-tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started