Answered step by step

Verified Expert Solution

Question

1 Approved Answer

III . Daisy and Peter want to purchase a new home and need a loan for $130,000 from the local bank. The loan is

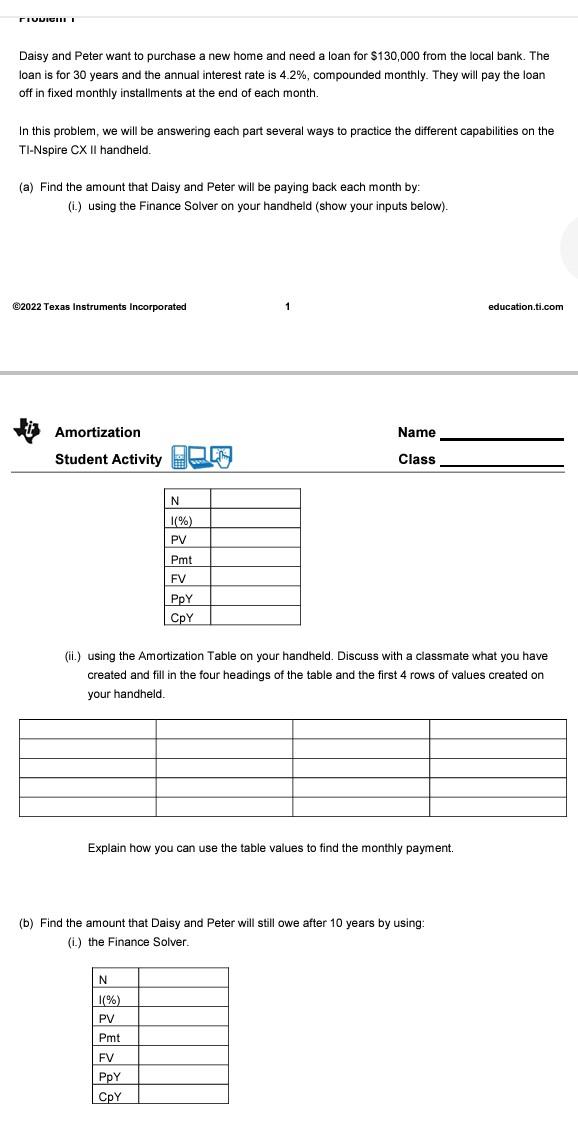

III . Daisy and Peter want to purchase a new home and need a loan for $130,000 from the local bank. The loan is for 30 years and the annual interest rate is 4.2%, compounded monthly. They will pay the loan off in fixed monthly installments at the end of each month. In this problem, we will be answering each part several ways to practice the different capabilities on the TI-Nspire CX II handheld. (a) Find the amount that Daisy and Peter will be paying back each month by: (i.) using the Finance Solver on your handheld (show your inputs below). 2022 Texas Instruments Incorporated Amortization Student Activity N 1(%) PV Pmt FV PpY CpY N 1(%) PV Pmt FV PpY CpY 1 Name Class (ii.) using the Amortization Table on your handheld. Discuss with a classmate what you have created and fill in the four headings of the table and the first 4 rows of values created on your handheld. Explain how you can use the table values to find the monthly payment. (b) Find the amount that Daisy and Peter will still owe after 10 years by using: (i) the Finance Solver.. education.ti.com

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings without question marks a 1 Using the Finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started