Answered step by step

Verified Expert Solution

Question

1 Approved Answer

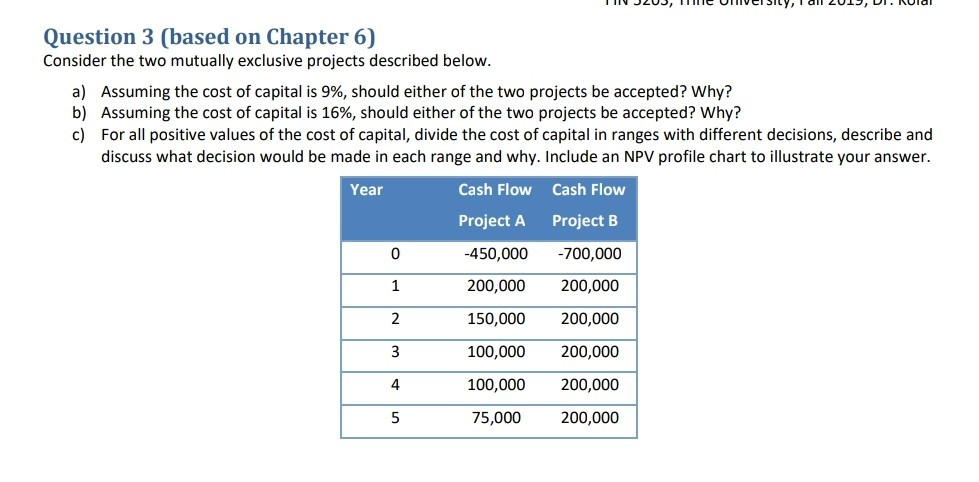

III J2U3, TllIC UNIVCI SILVI all 2UI, UL. Rial Question 3 (based on Chapter 6) Consider the two mutually exclusive projects described below. a) Assuming

III J2U3, TllIC UNIVCI SILVI all 2UI, UL. Rial Question 3 (based on Chapter 6) Consider the two mutually exclusive projects described below. a) Assuming the cost of capital is 9%, should either of the two projects be accepted? Why? b) Assuming the cost of capital is 16%, should either of the two projects be accepted? Why? c) For all positive values of the cost of capital, divide the cost of capital in ranges with different decisions, describe and discuss what decision would be made in each range and why. Include an NPV profile chart to illustrate your answer. Year Cash Flow Cash Flow Project A Project B -450,000 -700,000 1 2 200,000 150,000 100,000 200,000 200,000 200,000 3 4 100,000 75,000 200,000 200,000 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started