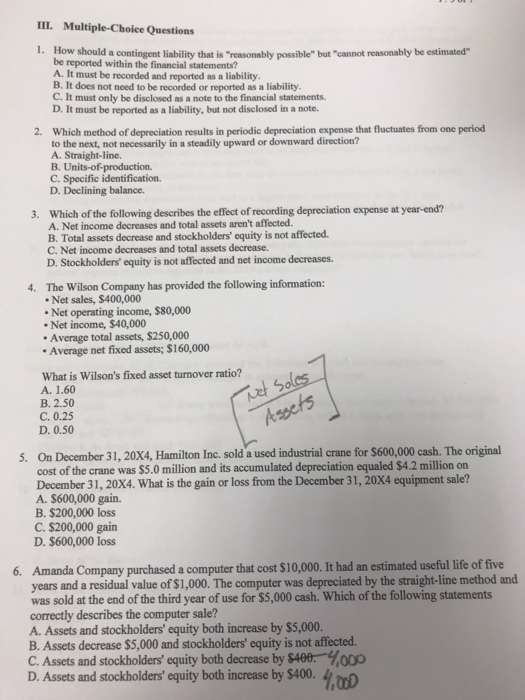

III. Multiple-Choice Questions 1. How should a contingent liability that is "reasonably possible" but "cannot reasonably be estimated" be reported within the financial statements? A. It must be recorded and reported as a liability B. It does not need to be recorded or reported as a liability C. It must only be disclosed as a note to the financial statements. D. It must be reported as a liability, but not disclosed in a note. 2. Which method of depreciation results in periodic depreciation expense that fluctuates from one period to the next, not necessarily in a steadily upward or downward direction? A. Straight-line. B. Units-of-production C. Specific identification. D. Declining balance. 3. Which of the following describes the effect of reconding depreciation expense at year-end? A. Net income decreases and total assets aren't affected B. Total assets decrease and stockholders' equity is not affected. C. Net income decreases and total assets decrease. D. Stockholders' equity is not affected and net income decreases. 4. The Wilson Company has provided the following information: Net sales, $400,000 Net operating income, $80,000 Net income, $40,000 Average total assets, $250,000 Average net fixed assets; $160,000 What is Wilson's fixed asset turnover ratio? A. 1.60 B. 2.50 C. 0.25 D. 0.50 Arsets On December 31, 20X4, Hamilton Inc. sold a used industrial crane for $600,000 cash. The original cost of the crane was $5.0 million and its accumulated depreciation equaled $4.2 million on December 31, 20X4. What is the gain or loss from the December 31, 20X4 equipment sale? A. $600,000 gain. B. $200,000 loss C. $200,000 gain D. $600,000 loss 5. Amanda Company purchased a computer that cost $10,000. It had an estimated useful life of five years and a residual value of $1,000. The computer was depreciated by the straight-line method and was sold at the end of the third year of use for $5,000 cash. Which of the following statements 6. correctly describes the computer sale? A. Assets and stockholders' equity both increase by $5,000. B. Assets decrease $5,000 and stockholders' equity is not affected. C. Assets and stockholders' equity both decrease by $400 00o D. Assets and stockholders' equity both increase by $400. 1,00