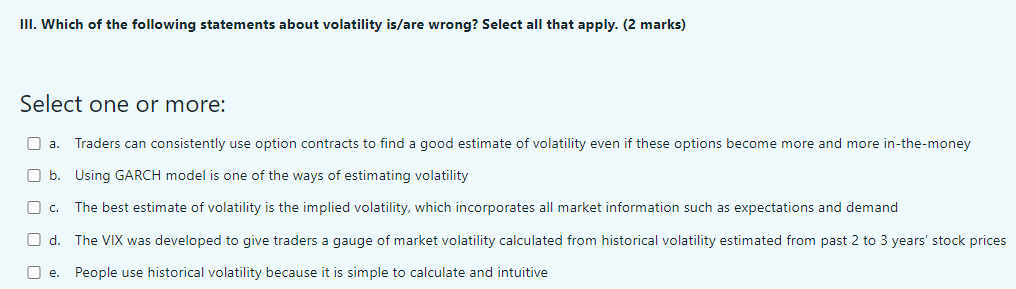

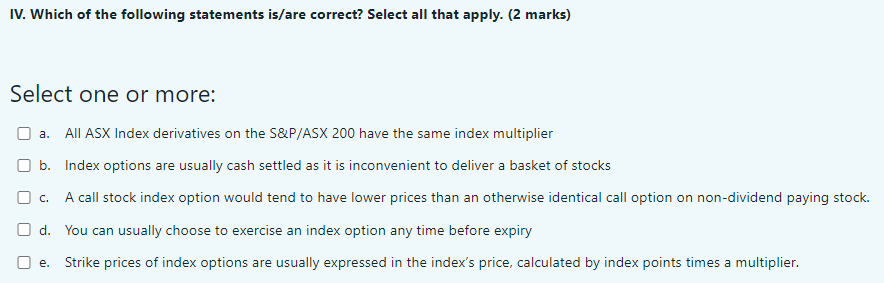

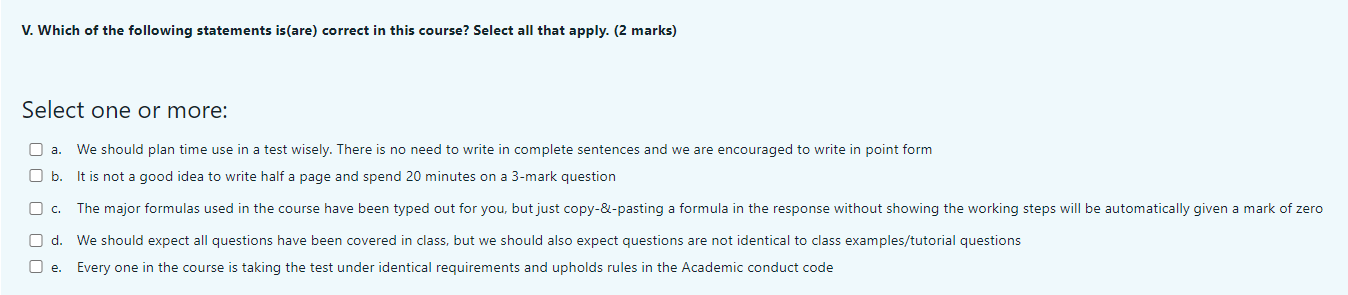

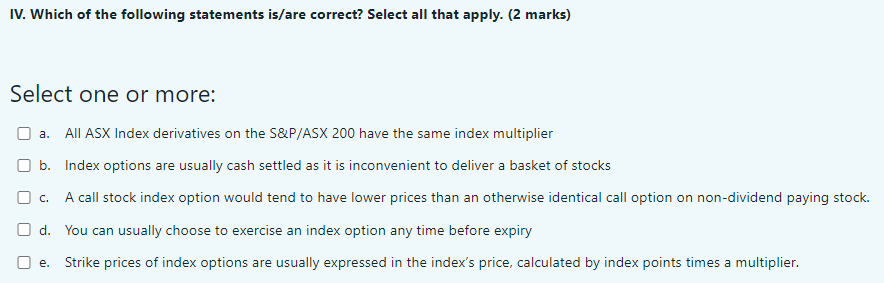

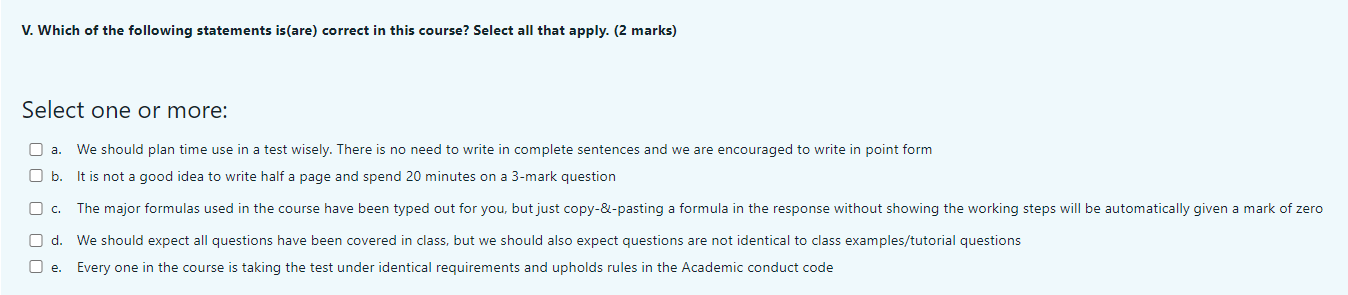

III. Which of the following statements about volatility is/are wrong? Select all that apply. (2 marks) Select one or more: O a. Traders can consistently use option contracts to find a good estimate of volatility even if these options become more and more in-the-money O b. Using GARCH model is one of the ways of estimating volatility O c. The best estimate of volatility is the implied volatility, which incorporates all market information such as expectations and demand O d. The VIX was developed to give traders a gauge of market volatility calculated from historical volatility estimated from past 2 to 3 years' stock prices e. People use historical volatility because it is simple to calculate and intuitive IV. Which of the following statements is/are correct? Select all that apply. (2 marks) Select one or more: a. All ASX Index derivatives on the S&P/ASX 200 have the same index multiplier b. Index options are usually cash settled as it is inconvenient to deliver a basket of stocks O c. A call stock index option would tend to have lower prices than an otherwise identical call option on non-dividend paying stock. Od. You can usually choose to exercise an index option any time before expiry Strike prices of index options are usually expressed in the index's price, calculated by index points times a multiplier. e. V. Which of the following statements is(are) correct in this course? Select all that apply. (2 marks) Select one or more: a. We should plan time use in a test wisely. There is no need to write in complete sentences and we are encouraged to write in point form O. It is not a good idea to write half a page and spend 20 minutes on a 3-mark question O c. The major formulas used in the course have been typed out for you, but just copy-&-pasting a formula in the response without showing the working steps will be automatically given a mark of zero O d. We should expect all questions have been covered in class, but we should also expect questions are not identical to class examples/tutorial questions Oe. Every one in the course is taking the test under identical requirements and upholds rules in the Academic conduct code