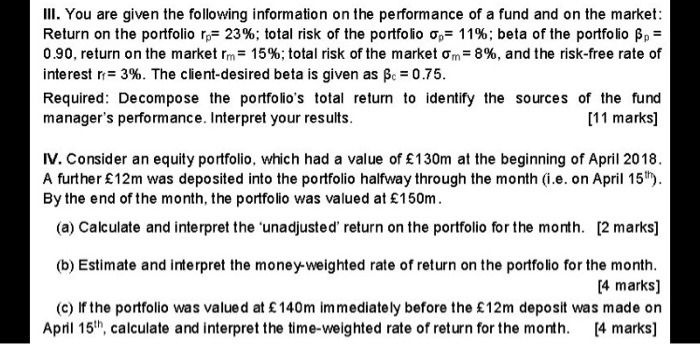

III. You are given the following information on the performance of a fund and on the market: Return on the portfolio rp= 23%; total risk of the portfolio 0= 11%; beta of the portfolio p = 0.90, return on the market rm = 15%; total risk of the market om=8%, and the risk-free rate of interest r= 3%. The client-desired beta is given as Be = 0.75. Required: Decompose the portfolio's total return to identify the sources of the fund manager's performance. Interpret your results. (11 marks] IV. Consider an equity portfolio, which had a value of 130m at the beginning of April 2018. A further 12m was deposited into the portfolio halfway through the month (i.e. on April 15"). By the end of the month, the portfolio was valued at 150m. (a) Calculate and interpret the 'unadjusted' return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month. [4 marks] (c) If the portfolio was valued at 140m immediately before the 12m deposit was made on April 15", calculate and interpret the time-weighted rate of return for the month. [4 marks] III. You are given the following information on the performance of a fund and on the market: Return on the portfolio rp= 23%; total risk of the portfolio 0= 11%; beta of the portfolio p = 0.90, return on the market rm = 15%; total risk of the market om=8%, and the risk-free rate of interest r= 3%. The client-desired beta is given as Be = 0.75. Required: Decompose the portfolio's total return to identify the sources of the fund manager's performance. Interpret your results. (11 marks] IV. Consider an equity portfolio, which had a value of 130m at the beginning of April 2018. A further 12m was deposited into the portfolio halfway through the month (i.e. on April 15"). By the end of the month, the portfolio was valued at 150m. (a) Calculate and interpret the 'unadjusted' return on the portfolio for the month. [2 marks] (b) Estimate and interpret the money-weighted rate of return on the portfolio for the month. [4 marks] (c) If the portfolio was valued at 140m immediately before the 12m deposit was made on April 15", calculate and interpret the time-weighted rate of return for the month. [4 marks]