Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i,ii,&iii please help 18.(18 points) Readington Northern Railroad is trying to decide where to invest between $1,400,000 and $1,600,000 cash in the railroad business. It

i,ii,&iii please

help

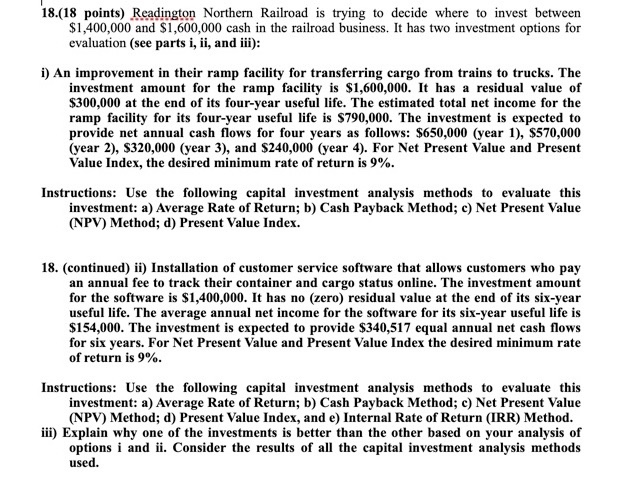

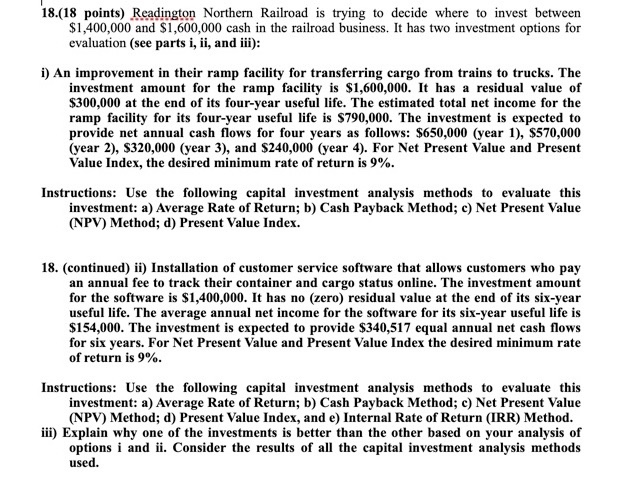

18.(18 points) Readington Northern Railroad is trying to decide where to invest between $1,400,000 and $1,600,000 cash in the railroad business. It has two investment options for evaluation (see parts i, ii, and iii): i) An improvement in their ramp facility for transferring cargo from trains to trucks. The investment amount for the ramp facility is $1,600,000. It has a residual value of $300,000 at the end of its four-year useful life. The estimated total net income for the ramp facility for its four-year useful life is $790,000. The investment is expected to provide net annual cash flows for four years as follows: $650,000 (year 1), S570,000 (year 2), $320,000 (year 3), and $240,000 (year 4). For Net Present Value and Present Value Index, the desired minimum rate of return is 9%. Instructions: Use the following capital investment analysis methods to evaluate this investment: a) Average Rate of Return; b) Cash Payback Method; c) Net Present Value (NPV) Method; d) Present Value Index. 18. (continued) ii) Installation of customer service software that allows customers who pay an annual fee to track their container and cargo status online. The investment amount for the software is $1,400,000. It has no (zero) residual value at the end of its six-year useful life. The average annual net income for the software for its six-year useful life is $154,000. The investment is expected to provide $340,517 equal annual net cash flows for six years. For Net Present Value and Present Value Index the desired minimum rate of return is 9% Instructions: Use the following capital investment analysis methods to evaluate this investment: a) Average Rate of Return; b) Cash Payback Method; c) Net Present Value (NPV) Method; d) Present Value Index, and e) Internal Rate of Return (IRR) Method. iii) Explain why one of the investments is better than the other based on your analysis of options i and ii. Consider the results of all the capital investment analysis methods used Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started