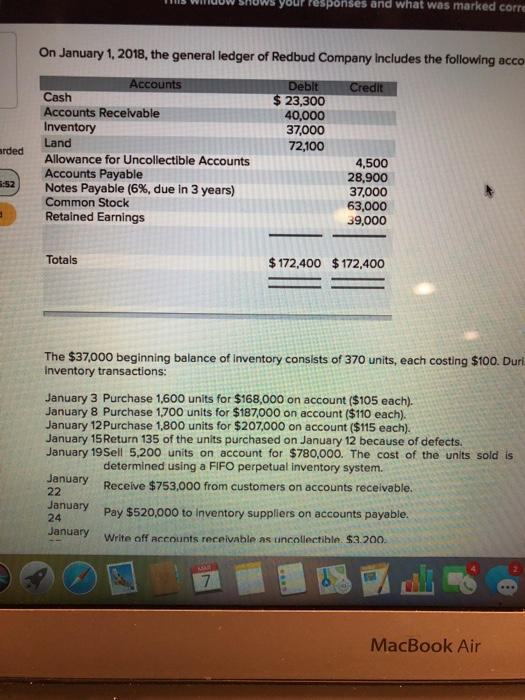

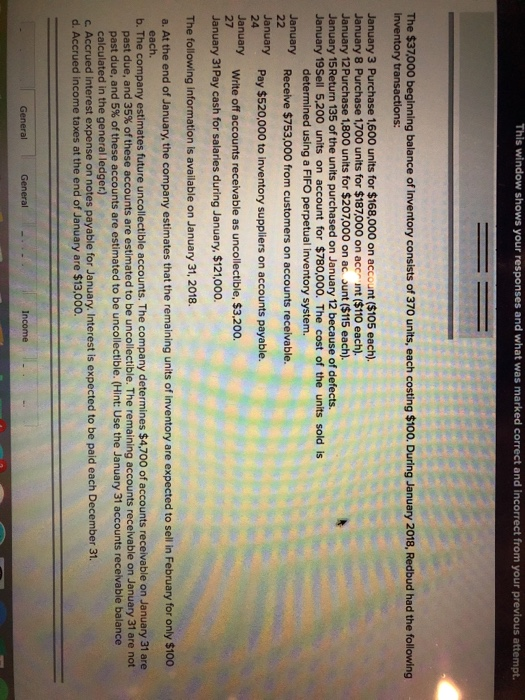

iis winuuw Shows your Pesposes and what was marked corre On January 1,2018, the general ledger of Redbud Company Includes the following acco Cash Accounts Recelvable Inventory Land Allowance for Uncollectible Accounts Accounts Payable Notes Payable (6%, due in 3 years) Common Stock Retained Earnings $23,300 40,000 37,000 72,100 4,500 28,900 37,000 63,000 39,000 Totals $172,400 $172,400 The $37,000 beginning balance of inventory consists of 370 units, each costing $100. Duri inventory transactions: January 3 Purchase 1,600 units for $168,000 on account ($105 each). January 8 Purchase 1,700 units for $187,000 on account ($110 each). January 12Purchase 1,800 units for $207000 on account ($115 each). January 15Return 135 of the units purchased on January 12 because of defects January 19Sell 5,200 units on account for $780,000. The cost of the units sold is determined using a FIFO perpetual inventory system. Receive $753,000 from customers on accounts receivable. Pay $520,000 to inventory suppliers on accounts payable. Write off accounts receivable as uncollectible. $3.20o. January 24 MacBook Air This window shows your responses and what was marked correct and incorrect from your previous attempt. The $37,000 beginning balance of inventory consists of 370 units, each costing $100. During January 2018, Redbud had the following Inventory transactions: January 3 Purchase 1,600 units for $168,000 on account ($105 each) January 8 Purchase 1,700 units for $187,000 on acc int ($110 each). January 12Purchase 1,800 units for $207,000 on ac ount ($115 each). January 15Return 135 of the units purchased on January 12 because of defects. January 19Sell 5,200 units on account for $780,000. The cost of the units sold is determined using a FIFO perpetual inventory system. Receive $753,000 from customers on accounts receivable. Pay $520,000 to inventory suppliers on accounts payable. January Sanuary 24 anuary Write off accounts receivable as uncollectible, $3,200 27 January 31Pay cash for salaries during January, $121,000. The following information is available on January 31, 2018 a. At the end of January, the company estimates that the remaining units of inventory are expected to sell in February for only $100 each. b. The company estimates future uncollectible accounts. The company determines $4,700 of accounts receivable on January 31 are past due, and 35% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) c. Accrued interest expense on notes payable for January. Interest is expected to be paid each December 31. d. Accrued income taxes at the end of January are $13,000. General