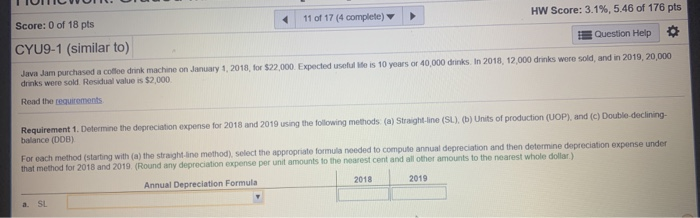

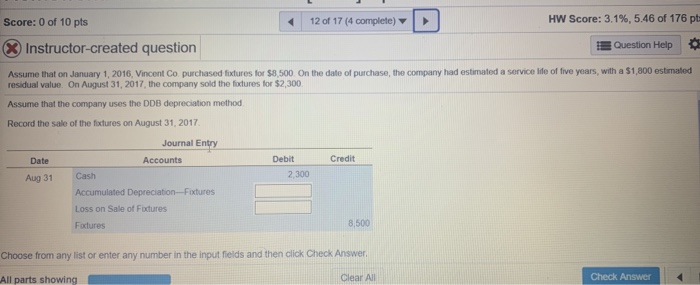

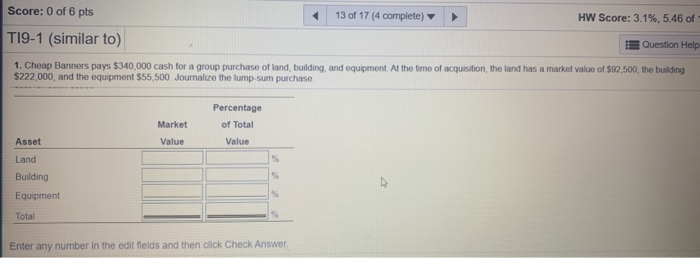

IIULIC VOID HW Score: 3.1%, 5.46 of 176 pts 11 of 17 (4 complete) Score: 0 of 18 pts CYU9-1 (similar to) Question Help Java Jam purchased a coffee drink machine on January 1, 2018, for $22.000 Expected useful te is 10 years or 40,000 drinks. In 2018, 12,000 drinks were sold, and in 2019, 20,000 drinks were sold Residual value is $2,000 Read the requirements Requirement 1. Determine the depreciation expense for 2018 and 2019 using the following methods (a) Straight-line (SL). (b) Units of production (UOP), and (c) Double-declining- balance (DB) For each method (starting with (a) the straight line method) select the appropriate formula needed to compute annual depreciation and then determine depreciation expense under that method for 2018 and 2019. (Round any depreciation expense per unit amounts to the nearest cent and all other amounts to the nearest whole dollar) 2018 2019 Annual Depreciation Formula a SL Score: 0 of 10 pts | 120176 completo) D HW Score: 3.1%, 5.46 of 176 pt X Instructor-created question Question Help Assume that on January 1, 2016. Vincent Co purchased fodtures for $8.500 on the date of purchase, the company had estimated a service life of five years, with a $1,800 estimated residual value. On August 31, 2017, the company sold the foxtures for $2,300 Assume that the company uses the DDB depreciation method Record the sale of the factures on August 31, 2017 Date Credit Journal Entry Accounts Cash Accumulated Depreciation-Fixtures Loss on Sale of Foctures Debit 2300 Aug 31 Factures 8,500 Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Check Answer Score: 0 of 6 pts 13 of 17 (4 complete) HW Score: 3.1%, 5.46 of - T19-1 (similar to) Question Help 1. Cheap Banners pays $340,000 cash for a group purchase of land, building, and equipment. Al the time of acquisition, the land has a market value of $2,500, the building $222,000, and the equipment $55,500. Journalize the lump sum purchase Percentage of Total Market Asset Value Value Land Building Equipment Total Enter any number in the edit fields and then click Check Answer IIULIC VOID HW Score: 3.1%, 5.46 of 176 pts 11 of 17 (4 complete) Score: 0 of 18 pts CYU9-1 (similar to) Question Help Java Jam purchased a coffee drink machine on January 1, 2018, for $22.000 Expected useful te is 10 years or 40,000 drinks. In 2018, 12,000 drinks were sold, and in 2019, 20,000 drinks were sold Residual value is $2,000 Read the requirements Requirement 1. Determine the depreciation expense for 2018 and 2019 using the following methods (a) Straight-line (SL). (b) Units of production (UOP), and (c) Double-declining- balance (DB) For each method (starting with (a) the straight line method) select the appropriate formula needed to compute annual depreciation and then determine depreciation expense under that method for 2018 and 2019. (Round any depreciation expense per unit amounts to the nearest cent and all other amounts to the nearest whole dollar) 2018 2019 Annual Depreciation Formula a SL Score: 0 of 10 pts | 120176 completo) D HW Score: 3.1%, 5.46 of 176 pt X Instructor-created question Question Help Assume that on January 1, 2016. Vincent Co purchased fodtures for $8.500 on the date of purchase, the company had estimated a service life of five years, with a $1,800 estimated residual value. On August 31, 2017, the company sold the foxtures for $2,300 Assume that the company uses the DDB depreciation method Record the sale of the factures on August 31, 2017 Date Credit Journal Entry Accounts Cash Accumulated Depreciation-Fixtures Loss on Sale of Foctures Debit 2300 Aug 31 Factures 8,500 Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Check Answer Score: 0 of 6 pts 13 of 17 (4 complete) HW Score: 3.1%, 5.46 of - T19-1 (similar to) Question Help 1. Cheap Banners pays $340,000 cash for a group purchase of land, building, and equipment. Al the time of acquisition, the land has a market value of $2,500, the building $222,000, and the equipment $55,500. Journalize the lump sum purchase Percentage of Total Market Asset Value Value Land Building Equipment Total Enter any number in the edit fields and then click Check