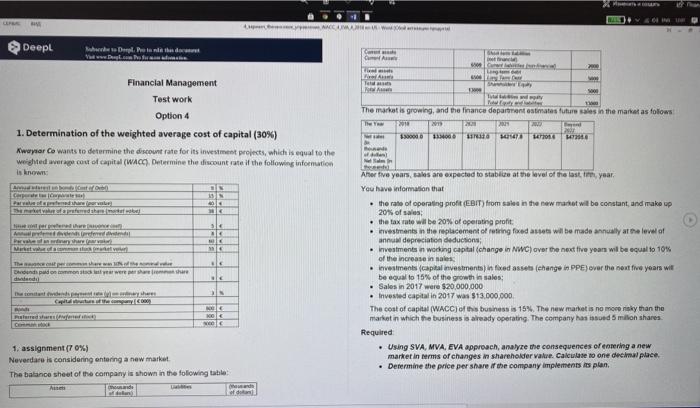

IL CA Deepl Fade CA Lom A Feld Financial Management Test work Option 4 1. Determination of the weighted average cost of capital (30%) wysor Co wants to determine the discount rate for its investment projects, which is equal to the weighted were cortof capital (WACC). Determine the discount rate if the following information The market is growing, and the Inance department states future sales in the market as follows The 200 10000 O Parapented report ketok a predakan merasa Anderdel Pee Mart Donds padon monster were sheshire ded Ansor five years, sales are expected to stable at the level of the last year, You have information that the rate of operating profit (EBIT) from sale in the new market will be constant and make up 20% of sales: the tax rate wil be 20% of operating profit testants in the replacement of seng fed aets will be made annually at the love of annual depreciation deductions Investments in wording capital change in NWC) over the next five years will be equal to 10% of the increase in sales investments (capital investments in foed assets (change in PPE over the next five years will be equal to 15% of the growth in sales: Sales in 2017 were $20.000.000 . Invested capital in 2017 was $13,000,000 The cost of capital (WACC) of this business is 15%. The new market is no more risky than the market in which the business is already operating. The company has od 5 milion shares Required . Using SVA, MVA, EVA approach, analyze the consequences of entering a new market in terms of changes in shareholder valve. Calculate to one decimal place Determine the price per share if the company implements is plan where 1. assignment (70%) Neverdare is considering entering a new market The balance sheet of the company is shown in the following table A de of del IL CA Deepl Fade CA Lom A Feld Financial Management Test work Option 4 1. Determination of the weighted average cost of capital (30%) wysor Co wants to determine the discount rate for its investment projects, which is equal to the weighted were cortof capital (WACC). Determine the discount rate if the following information The market is growing, and the Inance department states future sales in the market as follows The 200 10000 O Parapented report ketok a predakan merasa Anderdel Pee Mart Donds padon monster were sheshire ded Ansor five years, sales are expected to stable at the level of the last year, You have information that the rate of operating profit (EBIT) from sale in the new market will be constant and make up 20% of sales: the tax rate wil be 20% of operating profit testants in the replacement of seng fed aets will be made annually at the love of annual depreciation deductions Investments in wording capital change in NWC) over the next five years will be equal to 10% of the increase in sales investments (capital investments in foed assets (change in PPE over the next five years will be equal to 15% of the growth in sales: Sales in 2017 were $20.000.000 . Invested capital in 2017 was $13,000,000 The cost of capital (WACC) of this business is 15%. The new market is no more risky than the market in which the business is already operating. The company has od 5 milion shares Required . Using SVA, MVA, EVA approach, analyze the consequences of entering a new market in terms of changes in shareholder valve. Calculate to one decimal place Determine the price per share if the company implements is plan where 1. assignment (70%) Neverdare is considering entering a new market The balance sheet of the company is shown in the following table A de of del