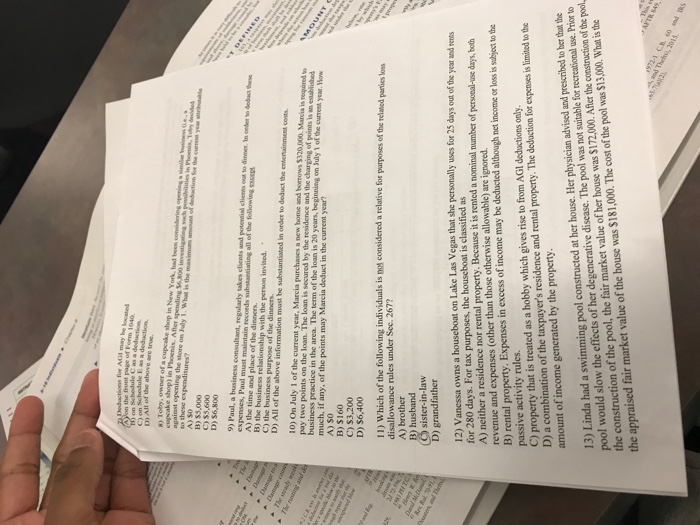

il may be are true 8) Toby, owner of a cupcake shop in New York, had beem consiering opening a sim snss against opening the store on July 1. What is the masimum wmounl of dedustion tor the ounemel ye to these e A) S0 D) $6,800 9) Paul, a business consultant, regalarly ukes clients and potential client" expenses, Paul mast maintain recoeds substaetiating all of the following EE A) the time and place of the dinners. in-oded.ath se B) the business relationship with the person invited. C) the business purpose of the dinners. D) All of the above information mast be substantiated in order to deduct the entertainment cos 10) On July I pay two points on the oan. The loan is secured by the residence and the charging of points is an established business practice in the area T much, if any, of the points may Marcia deduct in the current year? A) so B) $160 C) S3,200 D) $6,400 he term of the loan is 20 years, beginning on July 1 of the current year. How 11) Which of the following individuals is nos considered a relative for purposes of the related peries los disallowance rules under Sec. 267? A) brother husband sister-in-law D) grandfather 12) Vanessa owns a houseboat on Lake Las Vegas that she personally uses for 25 days out of the for 280 days. For tax purposes, the houseboat is classified as A) neither a residence nor rental property. revenue and expenses (other than those otherwise allowable) are ignored. B) rental property. Expenses in excess of income may be deducted although net income or loss is subiject to the passive activity rules. C) property that is treated as a hobby which gives rise to from AGl deductions only D) a combination of the taxpayer's residence and rental property. The deduction for expenses is firmited to the amount of income generated by the property year and rents Because it is rented a nominal number of personal-use days, both pool would slow the effects of her degenerative disease. The pool was not suitable for recreational use. Prior to the construction of the pool, the fair market value of her house was $172,000. After the construction of the pool the appraised fair market value of the house was S181,000. The cost of the pool was $13,000. What is the 13) Linda had a swimming pool constructed at her house. Her physician advised and prescribedto her tha he