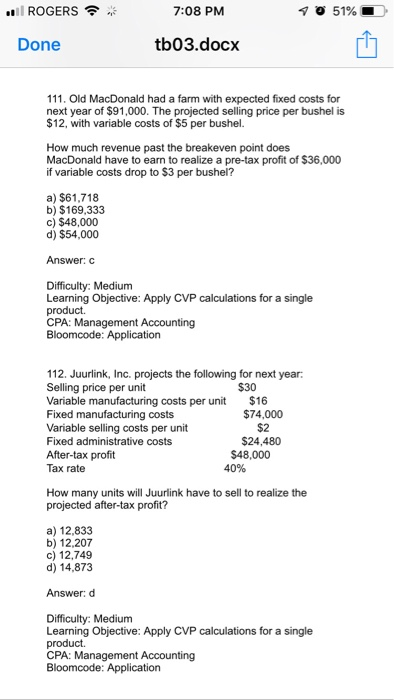

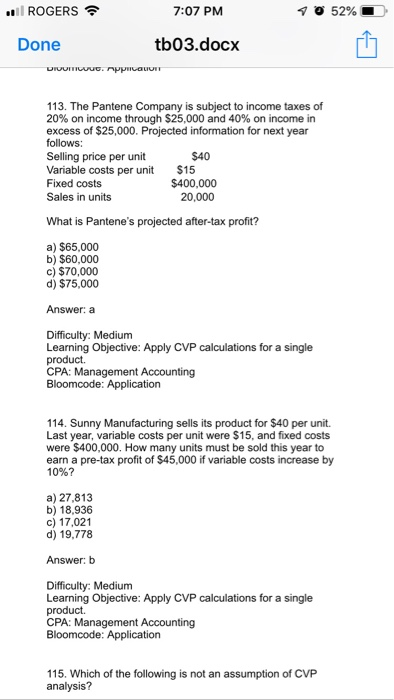

.'Il ROGERS.. 7:08 PM Done tb03.docx 111. Old MacDonald had a farm with expected fixed costs for next year of $91,000. The projected selling price per bushel is $12, with variable costs of $5 per bushel. How much revenue past the breakeven point does MacDonald have to earn to realize a pre-tax profit of $36,000 if variable costs drop to $3 per bushel? a) $61,718 b) $169,333 c) $48,000 d) $54,000 Answer: c Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 112. Juurlink, Inc. projects the following for next year Selling price per unit Variable manufacturing costs per unit $16 Fixed manufacturing costs Variable selling costs per unit Fixed administrative costs After-tax profit Tax rate S30 $74,000 $2 $24,480 $48,000 40% How many units will Juurlink have to sell to realize the projected after-tax profit? a) 12,833 b) 12,207 c) 12,749 d) 14,873 Answer: d Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting ROGERS 7:07 PM Done tb03.docx 113. The Pantene Company is subject to income taxes of 20% on income through $25,000 and 40% on income in excess of $25,000. Projected information for next year follows: Selling price per unit Variable costs per unit $15 Fixed costs Sales in units $40 $400,000 20,000 What is Pantene's projected after-tax profit? a) $65,000 b) $60,000 c) $70,000 d) $75,000 Answer: a Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 114. Sunny Manufacturing sells its product for $40 per unit. Last year, variable costs per unit were $15, and fixed costs were $400,000. How many units must be sold this year to earn a pre-tax profit of $45,000 if variable costs increase by 10%? a) 27,813 b) 18,936 c) 17,021 d) 19,778 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 115. Which of the following is not an assumption of CVP analysis? .'Il ROGERS.. 7:08 PM Done tb03.docx 111. Old MacDonald had a farm with expected fixed costs for next year of $91,000. The projected selling price per bushel is $12, with variable costs of $5 per bushel. How much revenue past the breakeven point does MacDonald have to earn to realize a pre-tax profit of $36,000 if variable costs drop to $3 per bushel? a) $61,718 b) $169,333 c) $48,000 d) $54,000 Answer: c Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 112. Juurlink, Inc. projects the following for next year Selling price per unit Variable manufacturing costs per unit $16 Fixed manufacturing costs Variable selling costs per unit Fixed administrative costs After-tax profit Tax rate S30 $74,000 $2 $24,480 $48,000 40% How many units will Juurlink have to sell to realize the projected after-tax profit? a) 12,833 b) 12,207 c) 12,749 d) 14,873 Answer: d Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting ROGERS 7:07 PM Done tb03.docx 113. The Pantene Company is subject to income taxes of 20% on income through $25,000 and 40% on income in excess of $25,000. Projected information for next year follows: Selling price per unit Variable costs per unit $15 Fixed costs Sales in units $40 $400,000 20,000 What is Pantene's projected after-tax profit? a) $65,000 b) $60,000 c) $70,000 d) $75,000 Answer: a Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 114. Sunny Manufacturing sells its product for $40 per unit. Last year, variable costs per unit were $15, and fixed costs were $400,000. How many units must be sold this year to earn a pre-tax profit of $45,000 if variable costs increase by 10%? a) 27,813 b) 18,936 c) 17,021 d) 19,778 Answer: b Difficulty: Medium Learning Objective: Apply CVP calculations for a single product. CPA: Management Accounting 115. Which of the following is not an assumption of CVP analysis