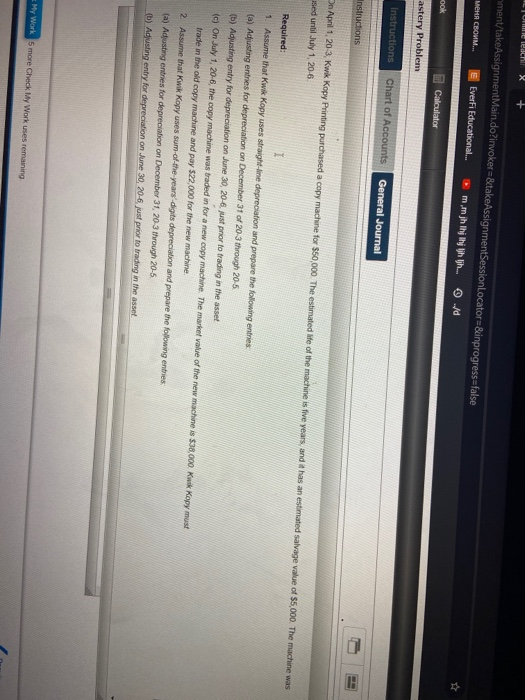

IL ULF PICNI X + mment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false E EverFi Educational... + m m Jh hnh th d ook Calculator astery Problem Instructions Chart of Accounts General Journal Instructions HI On April 1, 20-3, Kwik Kopy Printing purchased a copy machine for $50,000 The estimated life of the machine is five years, and it has an estimated salvage value of $5,000 The machine was sed until July 1, 20-6 1 Required: I Assume that Kwik Kopy uses straight line depreciation and prepare the following entries (a) Adjusting entries for depreciation on December 31 of 20-3 through 20-5 (b) Adjusting entry for depreciation on June 30, 20-6.just prior to trading in the asset (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kik Kopy must trade in the old copy machine and pay $22,000 for the new machine 2 Assume that Kwik Kopy uses sum-of-the-years-digits depreciation and prepare the following entries. (a) Adjusting entries for depreciation on December 31, 203 through 20-5 (b) Adjusting entry for depreciation on June 30, 20-6.just prior to trading in the asset My Work 5 more CheckMy Work uses remaining IL ULF PICNI X + mment/takeAssignment Main.do?invoker=&takeAssignmentSessionLocator=&inprogress=false E EverFi Educational... + m m Jh hnh th d ook Calculator astery Problem Instructions Chart of Accounts General Journal Instructions HI On April 1, 20-3, Kwik Kopy Printing purchased a copy machine for $50,000 The estimated life of the machine is five years, and it has an estimated salvage value of $5,000 The machine was sed until July 1, 20-6 1 Required: I Assume that Kwik Kopy uses straight line depreciation and prepare the following entries (a) Adjusting entries for depreciation on December 31 of 20-3 through 20-5 (b) Adjusting entry for depreciation on June 30, 20-6.just prior to trading in the asset (c) On July 1, 20-6, the copy machine was traded in for a new copy machine. The market value of the new machine is $38,000. Kik Kopy must trade in the old copy machine and pay $22,000 for the new machine 2 Assume that Kwik Kopy uses sum-of-the-years-digits depreciation and prepare the following entries. (a) Adjusting entries for depreciation on December 31, 203 through 20-5 (b) Adjusting entry for depreciation on June 30, 20-6.just prior to trading in the asset My Work 5 more CheckMy Work uses remaining