Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ill Homework: Chapter 9. The Cost of Capital Question 11, P9-14 (book/static) Part 1 of 3 HW Score: 0%, 0 of 15 points O Points:

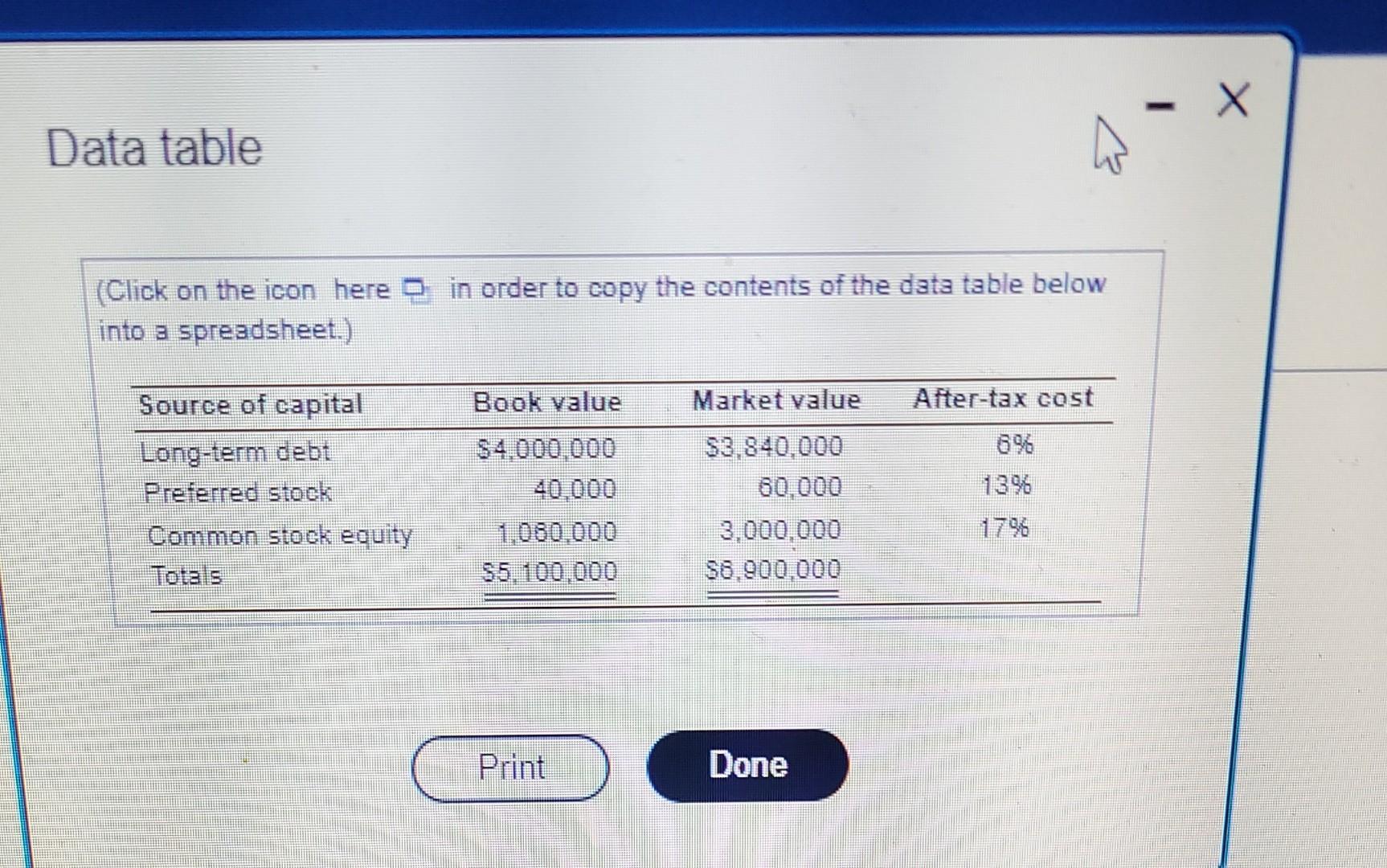

ill Homework: Chapter 9. The Cost of Capital Question 11, P9-14 (book/static) Part 1 of 3 HW Score: 0%, 0 of 15 points O Points: 0 of 1 Save WACC-Book weights and market weights Webster Company has compiled the information shown in the following table ? a. Calculate the weighted average cost of capital using book value weights b. Calculate the weighted average cost of capital using market value weights, e. Compare the answers obtained in parts a and b. Explain the differences a. The firm's weighted average cost of capital using book value weights is 0% (Round to two decimal places) - Data table (Click on the icon here 0 in order to copy the contents of the data table below into a spreadsheet.) Book value Market value After-tax cast $ 4 000 000 Source of capital Long-term debt Preferred stock Common stock equity Totals 1396 $3,840.000 60.000 3.000.000 $8.900.000 1.000.000 $5.100.000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started