Answered step by step

Verified Expert Solution

Question

1 Approved Answer

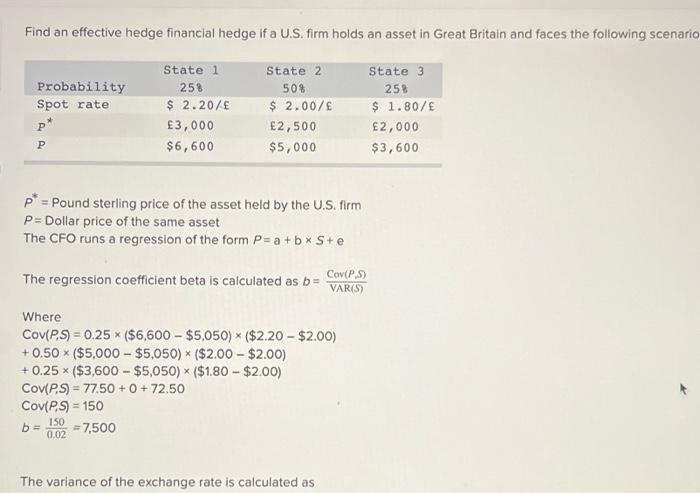

ill leave a like! Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario

ill leave a like!

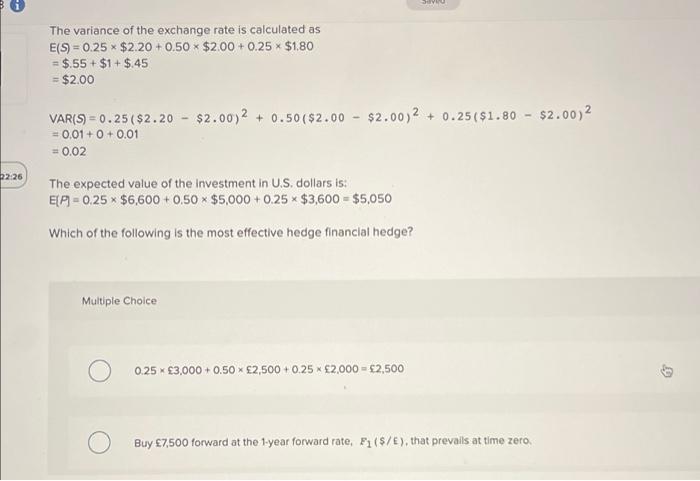

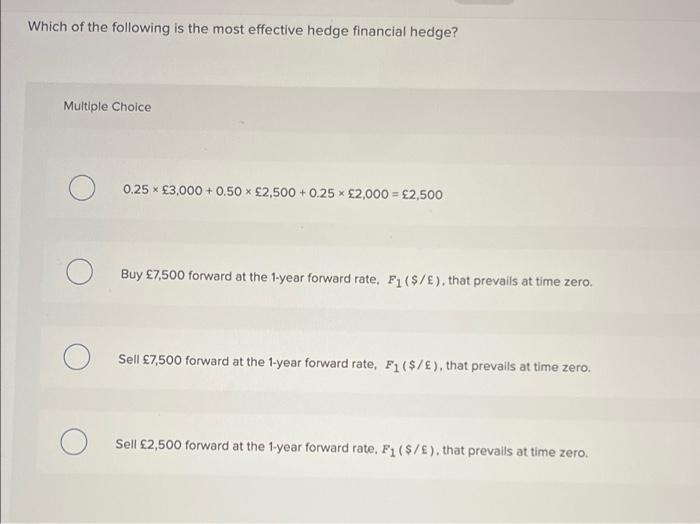

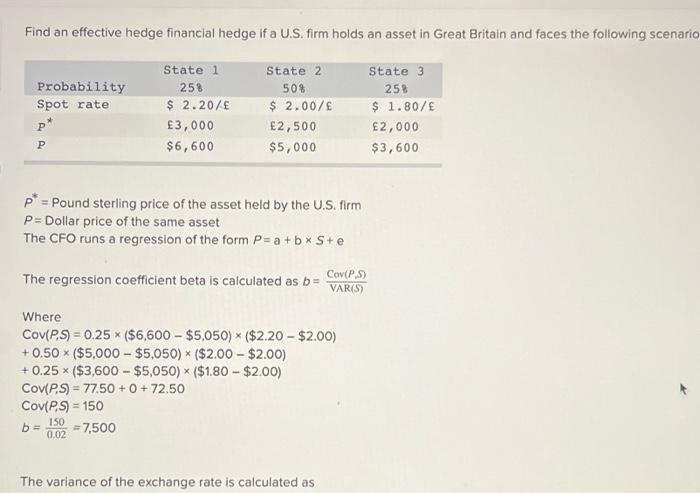

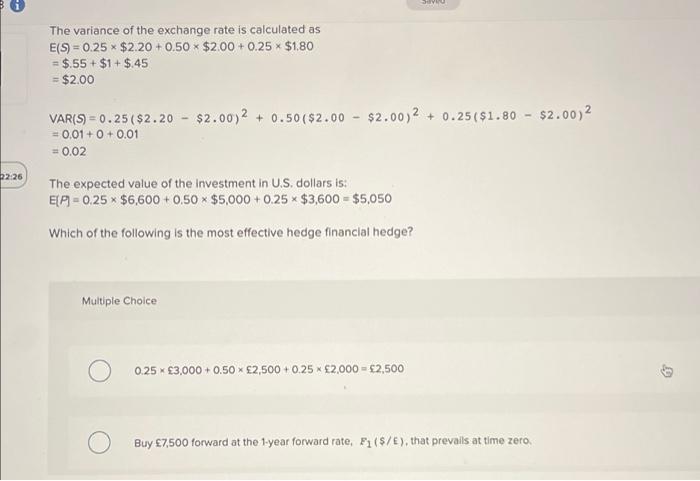

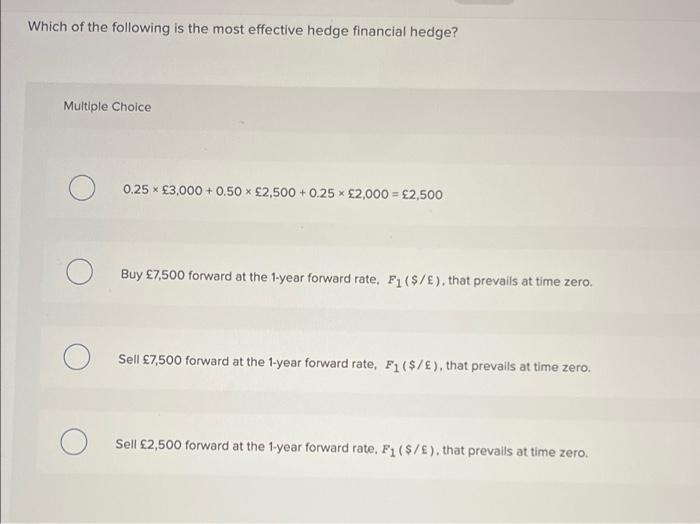

Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario Probability Spot rate State 1 258 $ 2.20/ 3,000 $6,600 State 2 50% $ 2.00/ 2,500 $5,000 State 3 25% $ 1.80/E 2,000 $3,600 P P P = Pound sterling price of the asset held by the U.S. firm P= Dollar price of the same asset The CFO runs a regression of the form P=a + b * S+e The regression coefficient beta is calculated as b = Cov(PS) VAR(S) X x x Where Cov(P.S) = 0.25% ($6,600 - $5,050) * ($2.20 - $2.00) +0.50 * ($5,000 - $5,050) * ($2.00 - $2.00) +0.25 % ($3,600 - $5,050) * ($1.80 - $2.00) Cov(P. 9) = 77.50 + 0 + 72.50 Cov(P. 9) = 150 b= 150 = 7,500 X X 0.02 The variance of the exchange rate is calculated as The variance of the exchange rate is calculated as E(S) = 0.25 * $2.20 +0.50 - $2.00 +0.25 * $1.80 = $.55 + $1 + $.45 = $2.00 $2.00)2 + 0.25($1.80 - $2.00) VAR(S) = 0.25($2.20 - $2.00)2 + 0.50($2.00 = 0.01 + 0 + 0.01 = 0.02 52:26 The expected value of the investment in U.S. dollars is: ELP = 0.25 * $6,600 +0.50 * $5,000+ 0.25 * $3,600 - $5,050 ** Which of the following is the most effective hedge financial hedge? Multiple Choice 0.25 3,000+ 0.50 * 2,500 +0.25 * 2,000 - $2,500 Buy 7,500 forward at the 1-year forward rate, F($/E), that prevails at time zero Which of the following is the most effective hedge financial hedge? Multiple Choice 0.25 * 3,000+ 0.50 * 2,500 +0.25 * 2,000 = 2,500 Buy 7,500 forward at the 1-year forward rate, F1($/), that prevails at time zero. Sell 7,500 forward at the 1-year forward rate, F1($/8), that prevails at time zero. Sell 2,500 forward at the 1-year forward rate, F1($/8), that prevails at time zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started