I'll make sure to give thumb up'

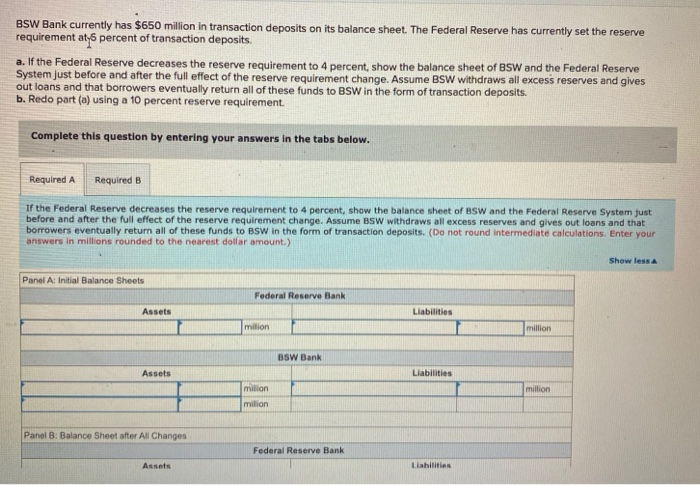

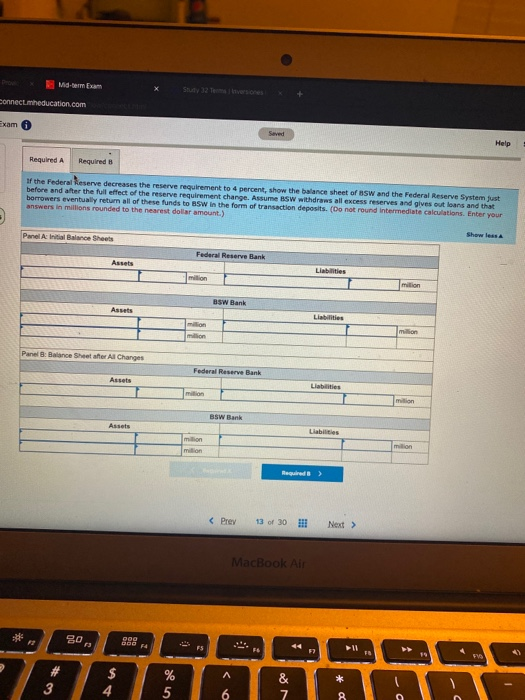

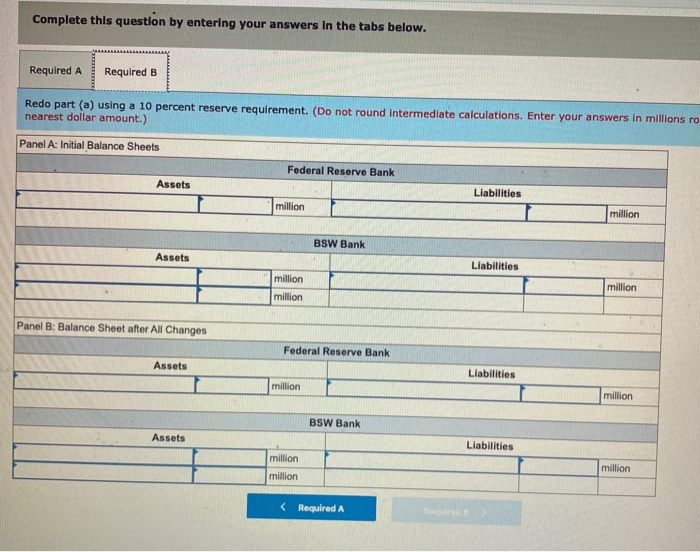

BSW Bank currently has $650 million in transaction deposits on its balance sheet. The Federal Reserve has currently set the reserve requirement at 6 percent of transaction deposits. a. If the Federal Reserve decreases the reserve requirement to 4 percent, show the balance sheet of BSW and the Federal Reserve System just before and after the full effect of the reserve requirement change. Assume BSW withdraws all excess reserves and gives out loans and that borrowers eventually return all of these funds to BSW in the form of transaction deposits. b. Redo part (a) using a 10 percent reserve requirement. Complete this question by entering your answers in the tabs below. Required A Required B If the Federal Reserve decreases the reserve requirement to 4 percent, show the balance sheet of BSW and the Federal Reserve System just before and after the full effect of the reserve requirement change. Assume BSW withdraws all excess reserves and gives out loans and that borrowers eventually return all of these funds to BSW in the form of transaction deposits. (Do not round intermediate calculations. Enter your answers in millions rounded to the nearest dollar amount.) Show less Panel A: Initial Balance Sheets Federal Reserve Bank Assets Liabilities Imation BSW Bank Assets million milion Panel B: Balance Sheet after All Changes Federal Reserve Bank Liabilities Assets nect. meducation.com am Required A Required If the Federal Reserve decreases the reserve requirement to 4 percent, show the balance sheet of sw and the Federal Reserve System just before and after the full effect of the reserve requirement change. Assume as withdrawal excess reserves and gives out loans and that borrowers eventually return all of these funds to sw in the form of transaction deposits. (Do not round intermediate calculations. Enter your answers in millions rounded to the nearest dollar amount.) Panel A: Initial Balance Sheets Assets Liabilities Panel: Balance Sheet after All Changes Federal Reserve Bank MacBook Air Complete this question by entering your answers in the tabs below. Required A Required B Redo part (a) using a 10 percent reserve requirement. (Do not round intermediate calculations. Enter your answers in millions ro nearest dollar amount.) Panel A: Initial Balance Sheets Federal Reserve Bank Assets Liabilities million million BSW Bank Assets Liabilities million million million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities million million BSW Bank Assets Liabilities million million million MacBook Air Complete this question by entering your answers in the tabs below. Required A Required B Redo part (a) using a 10 percent reserve requirement. (Do not round intermediate calculations. Enter your answers in millions ro nearest dollar amount.) Panel A: Initial Balance Sheets Federal Reserve Bank Assets Liabilities million million BSW Bank Assets Liabilities million million million Panel B: Balance Sheet after All Changes Federal Reserve Bank Assets Liabilities million million BSW Bank Assets Liabilities million million million