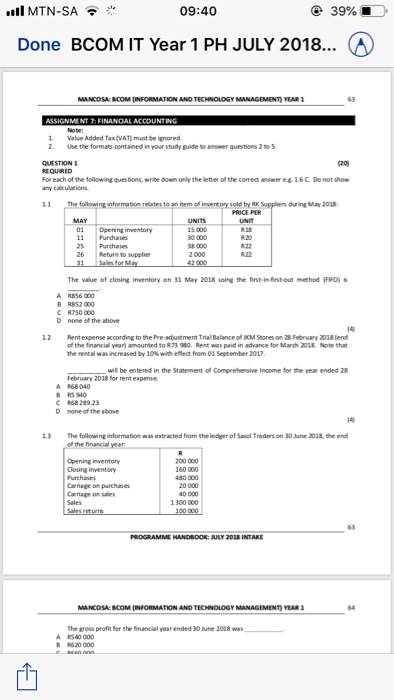

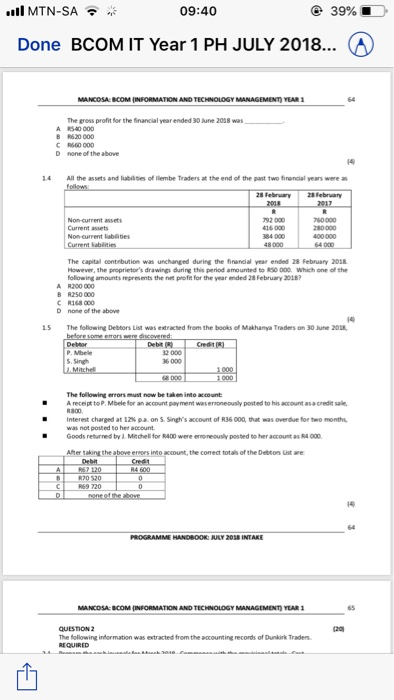

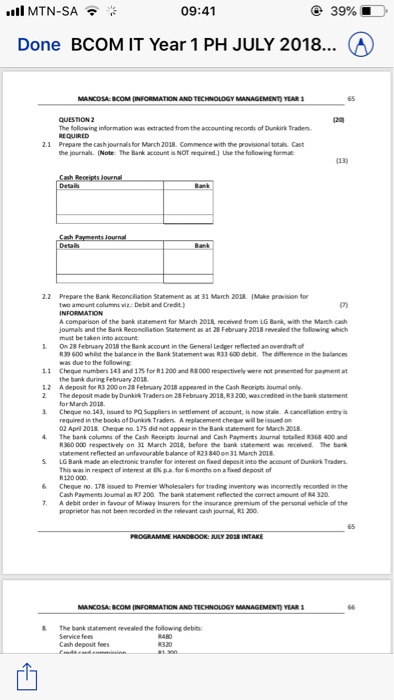

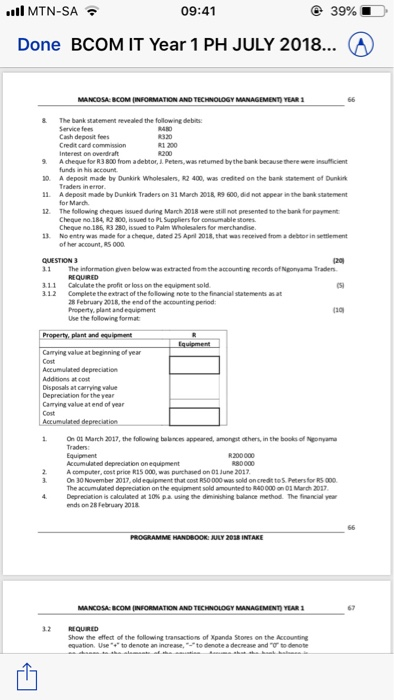

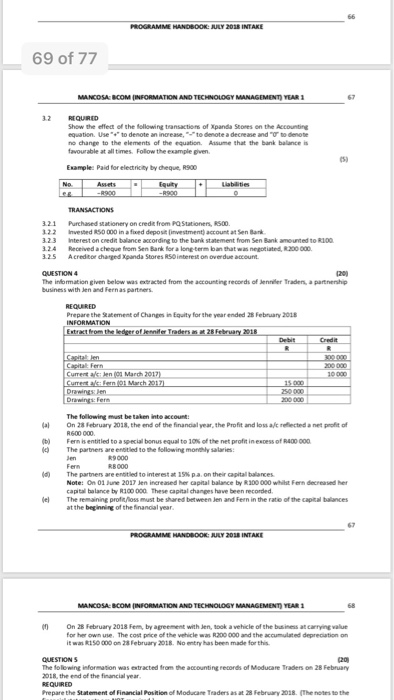

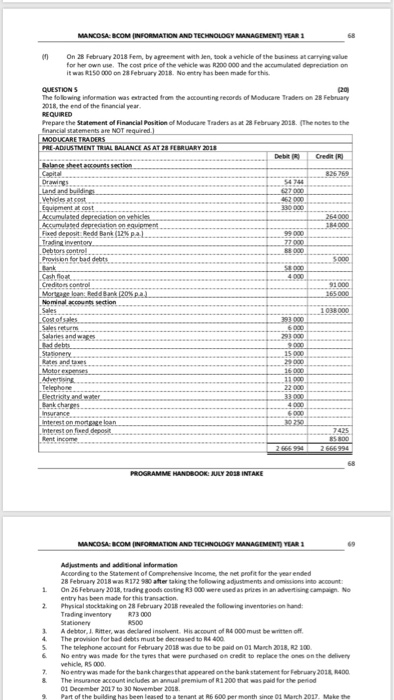

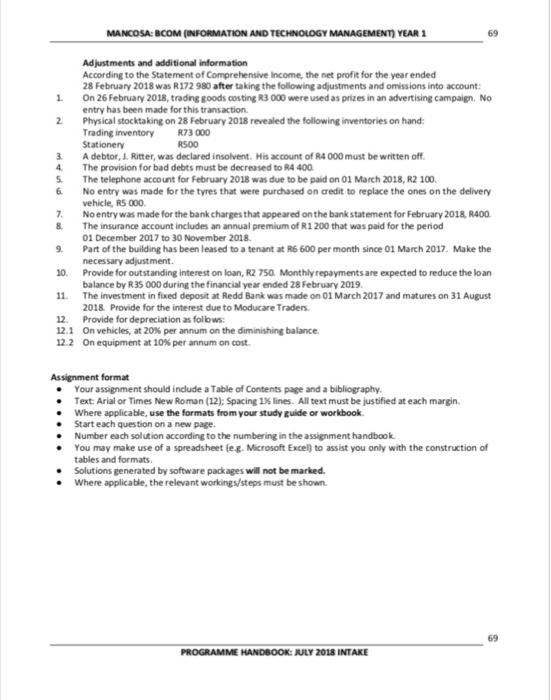

.ill MTN-SA 09:40 39% Done BCoM IT Year 1 PH JULY 2018... (A EAR Value Added Tax(VAT) must be ignored Use the formats contained in your study puide to answer questions 2 05 2. QUESTION 20 For each of the following questions, write down only the letter of the corect answer eg 16C. Do not show following information relates to an emo during May 2018 PRICE PER 01 Opening inventory 11 Purchases 25 Purchases 26 Reture to supplier 00O The value of closing inventory on 31 May 2018 using the first-is irst-out mechod (FIFO) B 12 Rent expense according to the Pre-adjustment Trial Balance of KM Stores on 28 February 2018(end of the financial year) amounted to R73 980, Rent was paid in advance for March 2018. Note that the rental was increased by 10% with effect from 01 September 2017. will be entered in the Statement of Comprehensive Income for the year ended 28 February 2018 for rent expense RS940 none of the above D 4 3 The following information was extracted from the ledger of Sasol Traders on 30 June 2018, the end the financial ye Opening inventory Closing inventory Carriage on purchases Carriage on sales The gress profit for the financial year ended 30 June 2038 was A RS40 00o B R620 000 Il MTN-SA 09:40 39% Done BCoM IT Year 1 PH JULY 2018... (A The gress profit for the financial year ended 30 June 2038 was A R540 000 R660 000 14 Al the assets and labilses of lembe Traders at the end of the past two financial years were as 28 Februaryebruary 792 000 60000 Non current lablities The capital contrbution was unchanged during the finandial year ended 28 February 2018 However, the proprietor's drawings during this period amounted to 50 000 Which one of the folowing amounts represents the net profe for the year ended 28 February 2018 C R168 000 15 The folowing Debtors List was extracted from the books of Makhanya Traders on 30 June 208, Debit (R , Singh The following errors must now be takem into aceount A receipt toP. Mbele for an account payment wasersoneously posted to his account as.acredit sale SOO interest charged at 12% p.a or, S. Singh's account of R36 000, that was overdue for two months, was not posted to Goods returned by J Madhell for 8400 were eroreously posted to her account as 4 000 Ater taking the above erors imo the comect totails of 4 (20 The following information was extracted from the acounting records of Dunkirk Tradens II MTN-SA 09:41 39% Done BCoM IT Year 1 PH JULY 2018... (A (20 The following information was extracted from the accounting records of Dunkirk Tradens 21 Prepare the cash journals for March 2018. Commence with the provisional totals. Cast the journas Note: The Bank account is NOT equired.) Use the folowing format (13) 22 Prepare the Bank Reconcliation Statement as at 31 March 2018. (Make provision for two amount columns viz: Debit and Credt 018, received from LG joumals and the Bank Reonciliation Statement as at 28 February 2038 revealed the foliowing which 1 On 28 Febnuary 2018 the Bank account in the General Ledger reflected an overdraft of R39 600 whist the balance in the Bank Statement was R33 600 debit, The difference in the balances mas due te the folowing 1 Cheque numbers 143 and 175 for R1 200 and RB 000 respectively were not presented for payment at the bank during Febnuary 2038 12 Adeposit for R3 200 on 28 February 2018 appeared in the Cash Receipts oumal only 2. The deposit made by Dunkirk Traderson 28 February 2018, R3200, wascredted in the bank statement Cheque no.143, nsued to Pa Suppliers in settlement of account, is now stale. A cancellation entryis 02 Apri 2018 The bank columns of the Cash Recripts lournal and Cash Payments Journal totaled R3t8 400 and R360 000 respectively on t March 2018, before the bank statement was received The bank Cheque no. 175 did notappear in the Bank statement for March 2018 4. S. LG Bank made an electronic transfer for interest on fixed deposit into the account oll Dunkirk Traders This was in respect of interest at 0% pfor 6 months onfined deposit of 6 Cheque no. 178 issued to Premier Wholesalers for trading inventory was incorrectly recorded in the Cash Payments Joumal as R7 200 The bank statement reflected the correct amount of 84 320 A debit order in favour of Miway Insurens for the insurance premium of the personal vehicle of the proprietor has not been recorded in the relevant cash journal' k1 . MANCOSA: BCOM EAR The bank statement revealed the foilowing debits Cash deposit fees 09:41 39% Done BCoM IT Year 1 PH JULY 2018... (A & The bank statement revealed the folowing debits Cash depout fees Credit card commission Interest on A cheque for R3 800 from adebtor, L Peters, was retumed by the bank because there were insufficient funds in his A deposit made by Dunkirk Wholesalers, R2 400, was credited on the bank statement of Dunkik 1 200 ovendraft 9. 11 Adeposit made by Dunkirk Traders on 31 Marh 2018, R9 600, didnot appear in the bank statement for March 12. The following cheques issued during March 2018 were still not presented to the bank for payment Cheque no.184, R2 800, is sued to PL Suppliers for consumable stores Cheque no.186, R3 280, issued to Palm Wholesalers for merchandise. Noentry was made for a cheque, dated 25 Apri 2018, that was received from a debtor in settiement of her acoount, RS 000 1 The information given below was extracted from the accounting records of Ngonyama Tradens REQUIRED 11 Calculate the profit or loss on the equioment sold 312 Complete the extact of the lolowing note to the fiancial statemenes as at 28 February 2018, the end of the accounting period Property, plant and equipment Use the folowing format Property, plant and Camying value at beginning off year Disposals at carrying value Depreciation for the year Carrying value at end of year 1. , 01 March 2017, the following babeces appeared, amongst ofhers, in the books of Npmpama R200000 A computer, cost price R25 000, wan puchned on 03 June 2017 On 30 November 2017, old equipment that cost R50 000 was sold on credt to S Peters for R5 000 The acoumulated depreciation on the equipment sold amounted to RADO00 on D1 Mardh 2017 Depredation is cakulated at 10% pa using thie denrishing balance method The financial year ends on 28ebruary 2018 HANDBOOK: JULY 2018 67 12 REQUIRED Show the effect of the following transactiors of Xpanda Stores on the Accounting equation, Useto denote an increase,to denote a decrease and O to denote 69 of 77 Show the effet of the fellowing transactions of Xpanda Stores on the Accounting an inrease,to denote a no change to the elements of the equation. Assume that the bank balance is favourable at all times Follow the example piven Example: Paid for electricity by dheque, R900 Equity 321 Purchased stationery on credit frem Pa Stationers, RS00. 122 Invested R50 000 in a fxed deposit [investment) acrount at Sen Bank 323 Interest on credit balance according to the bank statement from Sen Bank amounted to R100 24 Received a cheque from Sen Bank for a long-term ban that was negotiated, R.200 000 325 A credtor dharged Xpanda Stores R5Ointerest on overdue atcount (200 The intormation given below was extracted from the accounting records of Jennler Tradens, a partnenship UESTION 4 business with Jen and Fernas partners REQUERED Prepare the atement of Changes in Equity for the year ended 28 February 2018 Current al:Jen (04 March 2017 The following must be taken into account: al On 28 February 2038, the end of the financial year, the Profit and los ajc reflected a net profit of Fern isentitled to a special bonus equal to 10% of the net profit inexcessof R40000 The partners are enbitled to the fellowing mondly salaries R9000 The partners are entled to interest at 15% pa on their agital balances. Note: On 01 June 2017 Jen increased her capital balance by R300 000 whist Fern decreased her capital balance by R100 000 These capital changes have been recorded el The remaining proftloss must be shared between Jen and Fern in the ratie of the capital balances at the beginning of the financial year. 67 On 28 February 2018 Ferm, by agreement with Jen, took a vehicle of the business at carryingvalue for her own use. The cost price of the vehicle was R200 000 and the accumulated deprecation on it was 150 000 on 23February 2018. No entry has been made for this QUESTIONS The folowing information was extracted from the accounting records of Meducare Traders on 28 February 2018, the end of the financial year. REQUIRED Prepare the Statement e Financial Position of Moducare Traders as at 28 February 2028.(The notes to the 20 On 28 February 2018 Fem, by agreement with Jen, took a vehicle of the bainess at carrying value for her own use. The cost price of the vehicle was R200 000 and the accumulated deprecation on it wans 150 000 on 23February 2018. No entry has been made for this QUESTIONS The folewing information was extracted from the accounting records of Meducare Traders om 28 Febnuary 2018, the end of the financial year. 20 Prepare the Statement of Financial Position of Moducare Traders as atFebrury 2018 (The notes to the tatements are MODUCARE TRADERS Vehidles atpet Eguiment t cost mlated depreciatien on Redd Bank (12%P Cash flor Nominal ccounts section alaries and wases nurance 425 Acoording to the Statement of Compretensive Income, the net profit for the year ended 28 February 2018 as R372 980 after taking the following adjustments and omissions into account entry has been made for this trans action Trading inventory73 000 On 26 February 2018, trading goods costing R3 000 were used as prizes in an advertising campaign. No Physical stocktaking on 28 February 2038 revealed the following inventories on hand 1 A debbor, J, Ritter, was declared insolvent His account of R4 000 must be written off 4 The provision for bad debts must be decreased to R4 400 The telephone account for February 2038 was due to be paid on 01 March 2018, R2 100 No entry was made for the tyres that were purchased on credit to replace the ones on the delivery Noentry was made for the bank charges that appeared on the bank statement for February 2018, 40 01 December 2017 to & The insurance account includes an annual premium of R1 200 thatwas paid for the peniod per month since 01 March 2037 MANCOSA: BCOM (INFORMATION AND TECHNOLOGY MANAGEMENT) YEAR 1 69 Adjustments and additional information According to the Statement of Comprehensive Income, the net profit for the year ended 28 February 2018 was R172 980 after taking the following adjustments and omissions into account On 26 February 2018, tradng goods costing R3 entry has been made for this transaction. Physical stocktaking on 28 February 2018 revealed the following inventories on hand: Trading inventory Stationery 1. were used as prizes in an advertising campaign. No 2. R73 000 R500 3. A debtor, J. Ritter, was declared insolvent. His account of R4 000 must be written off 4. The provision for bad debts must be decreased to R4 400 S. The telephone account for February 2018 was due to be paid on 01 March 2018, R2 100 6 No entry was made for the tyres that were purchased on credit to replace the ones on the delivery vehicle, R5 000 Noentry was made for the bank charges that appeared on the bank statement for February 2018, R400 The insurance account includes an annual premium of R1 200 that was paid for the period 01 December 2017 to 30 November 2018. 7. 8 Part of the building has been leased to a tenant at R6 600 per month since 01 March 2017. Make the 10. Provide for outstanding interest on loan, R2 750 Monthly repaymentsare expected to reduce the loan 11. The investment in fixed deposit at Redd Bank was made on 01 March 2017 and matures on 31 August necessary adjustment. balance by R35 000 during the financial year ended 28 February 2019 2018 Provide for the interest due to Moducare Traders. 12 Provide for depreciation as fol lows 12.1 On vehicles, at 20% per annum on the diminishing balance. 12.2 On equipment at 10% per annum on cost. Assignment format Your assignment should include a Table of Contents page and a bibliography. * Text Arial or Times New Roman (12); Spacing 1% lines. All text must be justified at each margin. Where applicable, use the formats from your study guide or workbook. e Start each question on a new page. Number each solution according to the numbering in the assignment handbook You may make use of a spreadsheet (e g. Microsoft Excel) to assist you only with the construction of tables and formats. Solutions generated by software packages will not be marked Where applicable, the relevant workings/steps must be shown. . 69 PROGRAMME HANDBOOK: JULY 2018 INTAKE