Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ILL Ram, Shyam and Mohan were in partnership sharing profits and losses in the proportions of 3:2:1. On 1st April, 2011, Shyam retires from

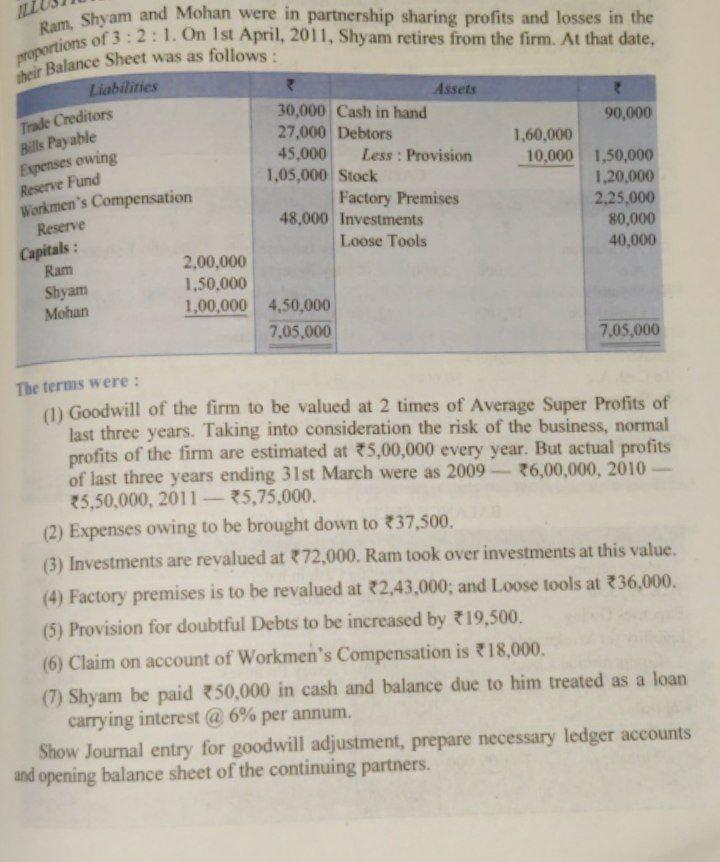

ILL Ram, Shyam and Mohan were in partnership sharing profits and losses in the proportions of 3:2:1. On 1st April, 2011, Shyam retires from the firm. At that date, their Balance Sheet was as follows: Liabilities Trade Creditors Bills Payable Expenses owing Reserve Fund Workmen's Compensation Reserve Capitals: Ram Shyam Mohan 2,00,000 1,50,000 1,00,000 30,000 Cash in hand 27,000 Debtors 45,000 1,05,000 Stock 4,50,000 7,05,000 Assets Less: Provision 48,000 Investments Loose Tools Factory Premises 1,60,000 10,000 90,000 1,50,000 1,20,000 2,25,000 80,000 40,000 7,05,000 The terms were: (1) Goodwill of the firm to be valued at 2 times of Average Super Profits of last three years. Taking into consideration the risk of the business, normal profits of the firm are estimated at 5,00,000 every year. But actual profits of last three years ending 31st March were as 2009-26,00,000, 2010 25,50,000, 2011-5,75,000. (2) Expenses owing to be brought down to 37,500. (3) Investments are revalued at 72,000. Ram took over investments at this value. (4) Factory premises is to be revalued at 22,43,000; and Loose tools at 36,000. (5) Provision for doubtful Debts to be increased by *19,500. (6) Claim on account of Workmen's Compensation is *18,000. (7) Shyam be paid 50,000 in cash and balance due to him treated as a loan carrying interest @ 6% per annum. Show Journal entry for goodwill adjustment, prepare necessary ledger accounts and opening balance sheet of the continuing partners.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started