Answered step by step

Verified Expert Solution

Question

1 Approved Answer

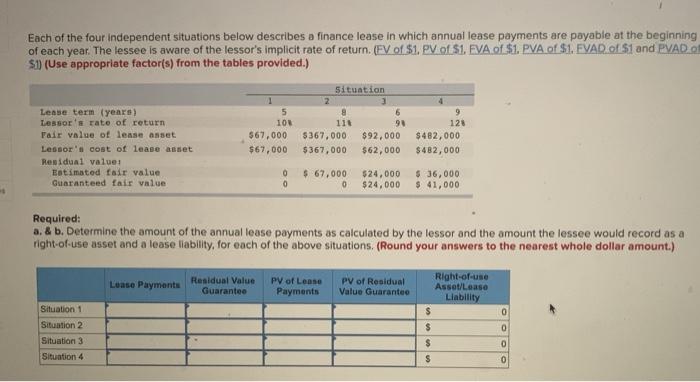

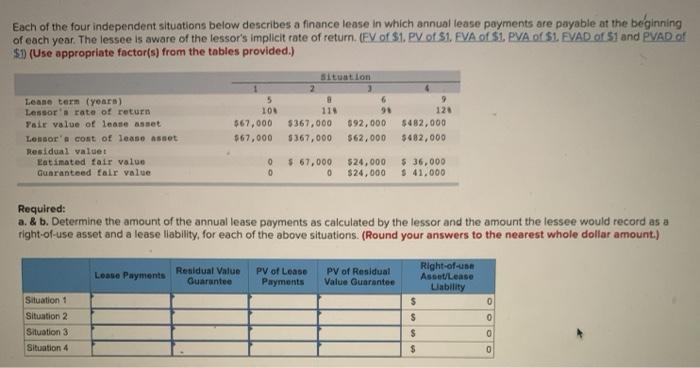

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year.

Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation 3 Lease term (years) 5 Lessor's rate of return 10% 114 91 9 128 Fair value of lease asset $67,000 Lessor's cost of lease asset $67,000 $367,000 $367,000 $92,000 $482,000 $62,000 $482,000 Residual value: Estimated fair value 0 $ 67,000 $24,000 $ 36,000 Guaranteed fair value 0 0 $24,000 $ 41,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar amount.) Right-of-use Asset/Lease Lease Payments Residual Value Guarantee PV of Lease Payments PV of Residual Value Guarantee Liability Situation 1 $ 0 Situation 21 $ Situation 3 $ 0 Situation 4 $ 0 Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. (EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Situation Leane term (years) 5 Lessor's rate of return 10% B 119 9 128 Fair value of lease asset $67,000 $367,000 $92,000 $482,000 Lessor a cost of lease asset $67,000 $367,000 $62,000 $482,000 Residual value: Estimated fair value o $ 67,000 Guaranteed fair value 0 $24,000 $24,000 $ 36,000 $41,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. (Round your answers to the nearest whole dollar amount.) Right-of-use Asset/Lease Lease Payments Residual Value Guarantee PV of Lease Payments PV of Residual Value Guarantee Liability Situation 1 $ 0 Situation 2 $ 0 Situation 31 $ 0 Situation 4 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate two main things for each situation 1 Annual Lease Payments The annual payment amount using the given implicit rate of return and the fair value of the lease asset 2 Rightofuse AssetLease Liability The present value of these lease payments plus any residual value guarantee Lets go through the calculations stepbystep for each situation using the provided factors you would typically get these factors from a table but since theyre not provided Ill show the general method General Approach 1 Determine the Present Value Annuity Due PVAD Factor Use the formula for PVAD P V A D n 1 t 0 1 1 r t P V A D t 0 n 1 1 1 r t where r r is the rate and n n is the lease term 2 Calculate Lease Payments Present Value of Lease Payments PV of Payments Fair Value of Lease Asset Annual Lease Payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started