Answered step by step

Verified Expert Solution

Question

1 Approved Answer

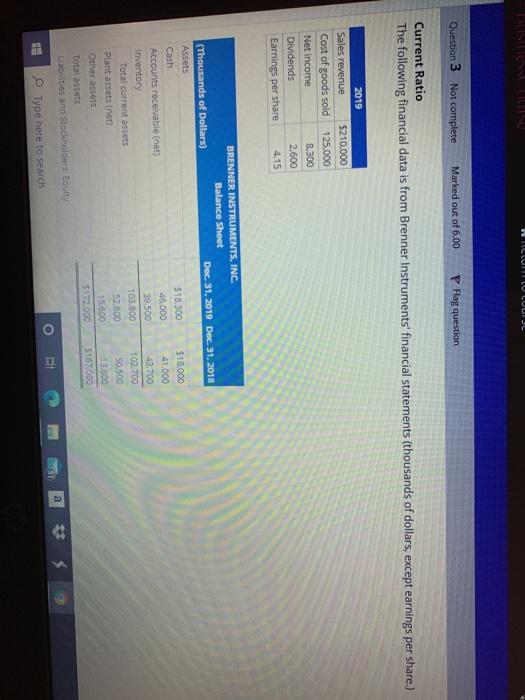

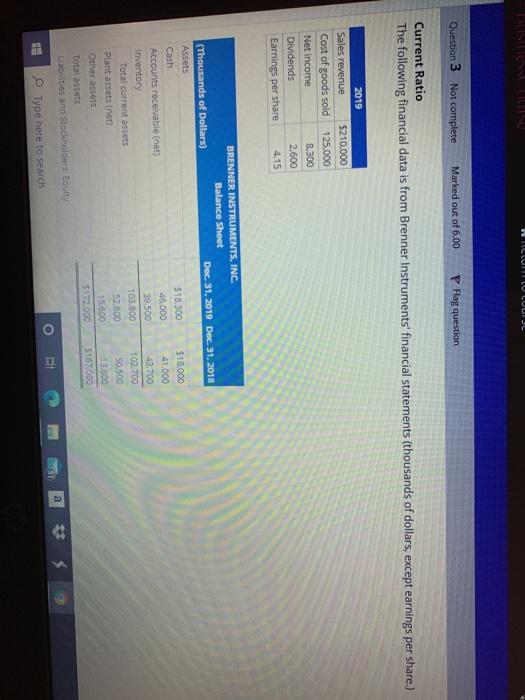

ILLU LUUIJL Question 3 Not complete Marked out of 6.00 Flag question Current Ratio The following financial data is from Brenner Instruments' financial statements (thousands

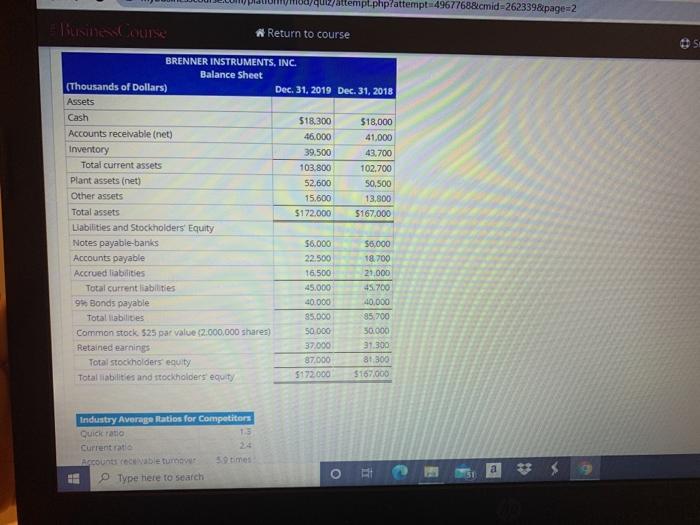

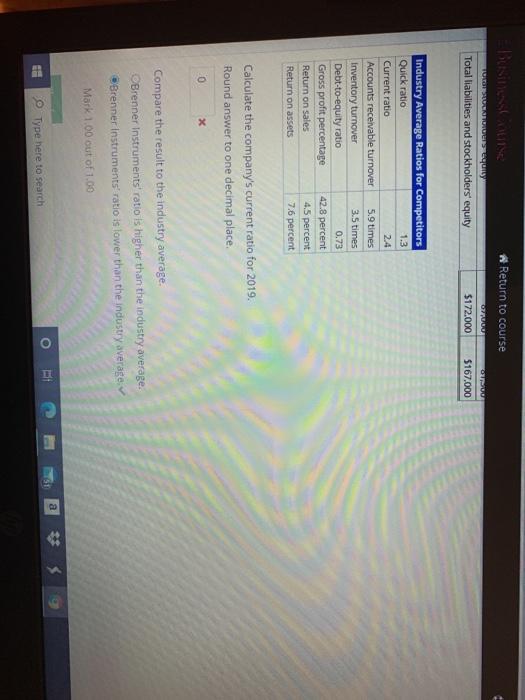

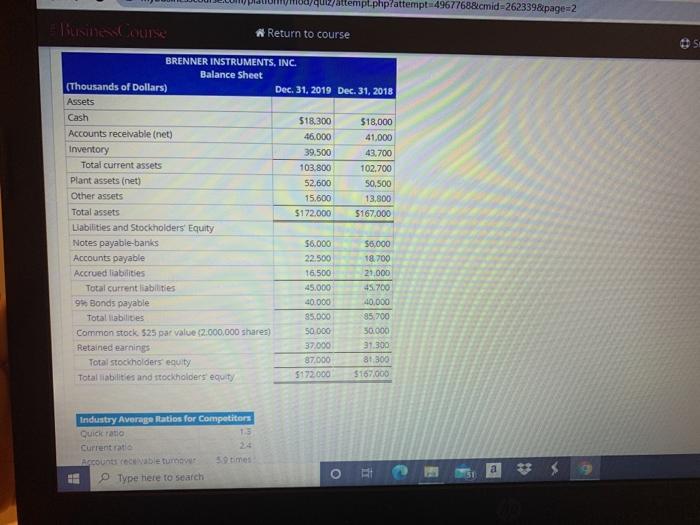

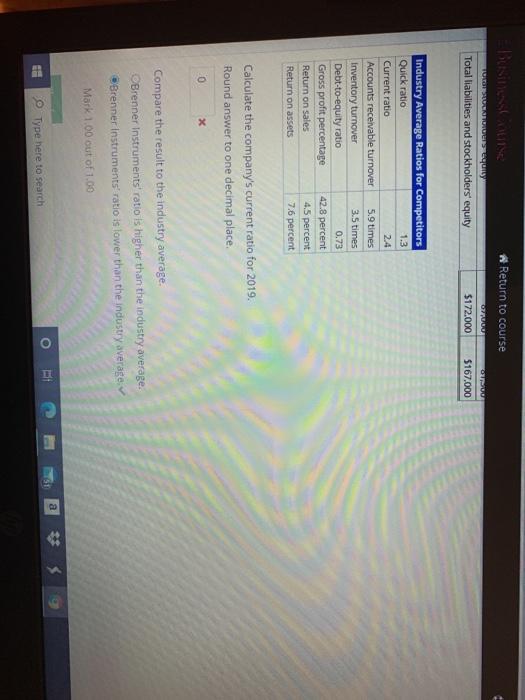

ILLU LUUIJL Question 3 Not complete Marked out of 6.00 Flag question Current Ratio The following financial data is from Brenner Instruments' financial statements (thousands of dollars, except earnings per share.) 2019 Sales revenue Cost of goods sold Net Income Dividends Earnings per share $210,000 125.000 8.300 2600 4.15 BRENNER INSTRUMENTS, INC. Balance Sheet (Thousands of Dollars) Dec 31, 2019 Dec 31, 2018 Assets Cash $18.300 $18.000 Accounts receivable (nets 46.000 41.000 Inventory 39.500 43.700 Total current assets 103.800 102.700 Plantasets (ne 52500 50 500 15.600 12 300 Other assets Total assets 5472.000 5167,000 Liates and Stod holders Equity a ST Type here to search uiz/attempt.phplattempt 4967768&cmid=262339&page=2 Business Return to course SI BRENNER INSTRUMENTS, INC. Balance Sheet (Thousands of Dollars) Dec. 31, 2019 Dec 31, 2018 Assets Cash $18.300 $18,000 Accounts receivable (net) 46,000 41.000 Inventory 39,500 43.700 Total current assets 103.800 102.700 Plant assets (net) 52.600 50,500 Other assets 15,600 13,800 Total assets $172.000 5167,000 Liabilities and Stockholders Equity Notes payable-banks 56.000 56,000 Accounts payable 22.500 18.700 Accrued liabilities 16.500 21.000 Total current liabilities 45.000 45.700 95 Bonds payable 40.000 40.000 Total liabilities 35.000 95.700 Common stock. 525 par value 2.000.000 shares) 50 000 50.000 Retained earnings 37.000 31300 Total stockholders equity 87.000 81300 Total abilities and stockholders' equity 5172.000 $167.000 Industry Average ratios for Competitors Quick ratio 13 Current ratio Accounts recevable turco 39 times Type here to search a Return to course Torequy Total liabilities and stockholdersequity 077 $172.000 $167.000 Industry Average Ratios for Competitors Quick ratio 1.3 Current ratio 2.4 Accounts receivable turnover 5.9 times Inventory turnover 3.5 times Debt-to-equity ratio 0.73 Gross profit percentage 42.8 percent Return on sales 4.5 percent Return on assets 7.6 percent Calculate the company's current ratio for 2019. Round answer to one decimal place. 0 X Compare the result to the industry average. Brenner Instruments' ratio is higher than the industry average. Brenner Instruments' ratio is lower than the industry average Mark 1.00 out of 1.00 a * Type here to search

ILLU LUUIJL Question 3 Not complete Marked out of 6.00 Flag question Current Ratio The following financial data is from Brenner Instruments' financial statements (thousands of dollars, except earnings per share.) 2019 Sales revenue Cost of goods sold Net Income Dividends Earnings per share $210,000 125.000 8.300 2600 4.15 BRENNER INSTRUMENTS, INC. Balance Sheet (Thousands of Dollars) Dec 31, 2019 Dec 31, 2018 Assets Cash $18.300 $18.000 Accounts receivable (nets 46.000 41.000 Inventory 39.500 43.700 Total current assets 103.800 102.700 Plantasets (ne 52500 50 500 15.600 12 300 Other assets Total assets 5472.000 5167,000 Liates and Stod holders Equity a ST Type here to search uiz/attempt.phplattempt 4967768&cmid=262339&page=2 Business Return to course SI BRENNER INSTRUMENTS, INC. Balance Sheet (Thousands of Dollars) Dec. 31, 2019 Dec 31, 2018 Assets Cash $18.300 $18,000 Accounts receivable (net) 46,000 41.000 Inventory 39,500 43.700 Total current assets 103.800 102.700 Plant assets (net) 52.600 50,500 Other assets 15,600 13,800 Total assets $172.000 5167,000 Liabilities and Stockholders Equity Notes payable-banks 56.000 56,000 Accounts payable 22.500 18.700 Accrued liabilities 16.500 21.000 Total current liabilities 45.000 45.700 95 Bonds payable 40.000 40.000 Total liabilities 35.000 95.700 Common stock. 525 par value 2.000.000 shares) 50 000 50.000 Retained earnings 37.000 31300 Total stockholders equity 87.000 81300 Total abilities and stockholders' equity 5172.000 $167.000 Industry Average ratios for Competitors Quick ratio 13 Current ratio Accounts recevable turco 39 times Type here to search a Return to course Torequy Total liabilities and stockholdersequity 077 $172.000 $167.000 Industry Average Ratios for Competitors Quick ratio 1.3 Current ratio 2.4 Accounts receivable turnover 5.9 times Inventory turnover 3.5 times Debt-to-equity ratio 0.73 Gross profit percentage 42.8 percent Return on sales 4.5 percent Return on assets 7.6 percent Calculate the company's current ratio for 2019. Round answer to one decimal place. 0 X Compare the result to the industry average. Brenner Instruments' ratio is higher than the industry average. Brenner Instruments' ratio is lower than the industry average Mark 1.00 out of 1.00 a * Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started