Answered step by step

Verified Expert Solution

Question

1 Approved Answer

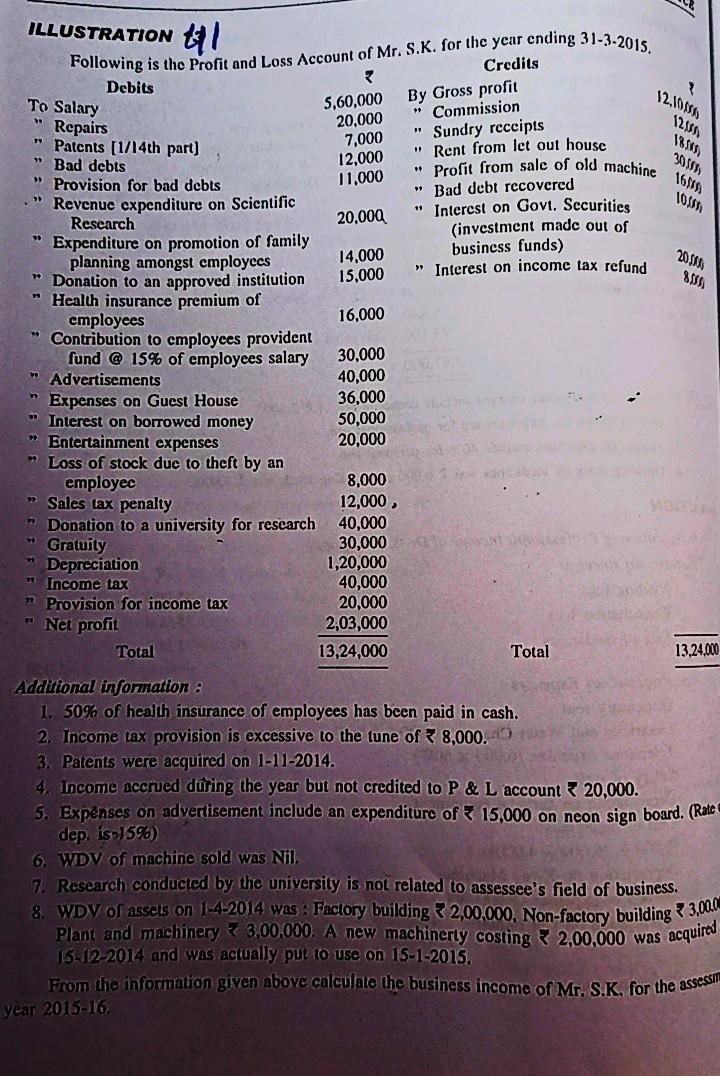

ILLUSTRATION 1 5,60,000 20,000 7,000 12,000 11,000 12.1095 1235 18548) 7 1638 2099 14,000 15,000 16,000 Following is the Profit and Loss Account of Mr.

ILLUSTRATION 1 5,60,000 20,000 7,000 12,000 11,000 12.1095 1235 18548) 7 1638 2099 14,000 15,000 16,000 Following is the Profit and Loss Account of Mr. S.K. for the year ending 31-3-2015. Credits Debits To Salary By Gross profit * Commission Repairs Patents (1/14th part) " Sundry receipts " Rent from let out house " Bad debts Profit from sale of old machine Provision for bad debts " Bad debt recovered Revenue expenditure on Scientific Research 20,000 " Interest on Govt. Securities (investment made out of Expenditure on promotion of family business funds) planning amongst employees Interest on income tax refund Donation to an approved institution Health insurance premium of cmployees * Contribution to cmployees provident fund @ 15% of employees salary 30,000 Advertisements 40,000 Expenses on Guest House 36,000 Interest on borrowed money 50,000 Entertainment expenses 20,000 Loss of ock due to by an employec 8,000 Sales tax penalty 12,000, Donation to a university for research 40,000 Gratuity 30,000 Depreciation 1,20,000 Income tax 40,000 Provision for income tax 20,000 Net profit 2,03,000 Total 13,24,000 Total 13.24,000 Additional information: 1. 50% of health insurance of employees has been paid in cash. 2. Income tax provision is excessive to the tune of 8,000. 3. Patents were acquired on 1-11-2014. 4. Income accrued during the year but not credited to P & L account 20,000. 5. Expenses on advertisement include an expenditure of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started