Answered step by step

Verified Expert Solution

Question

1 Approved Answer

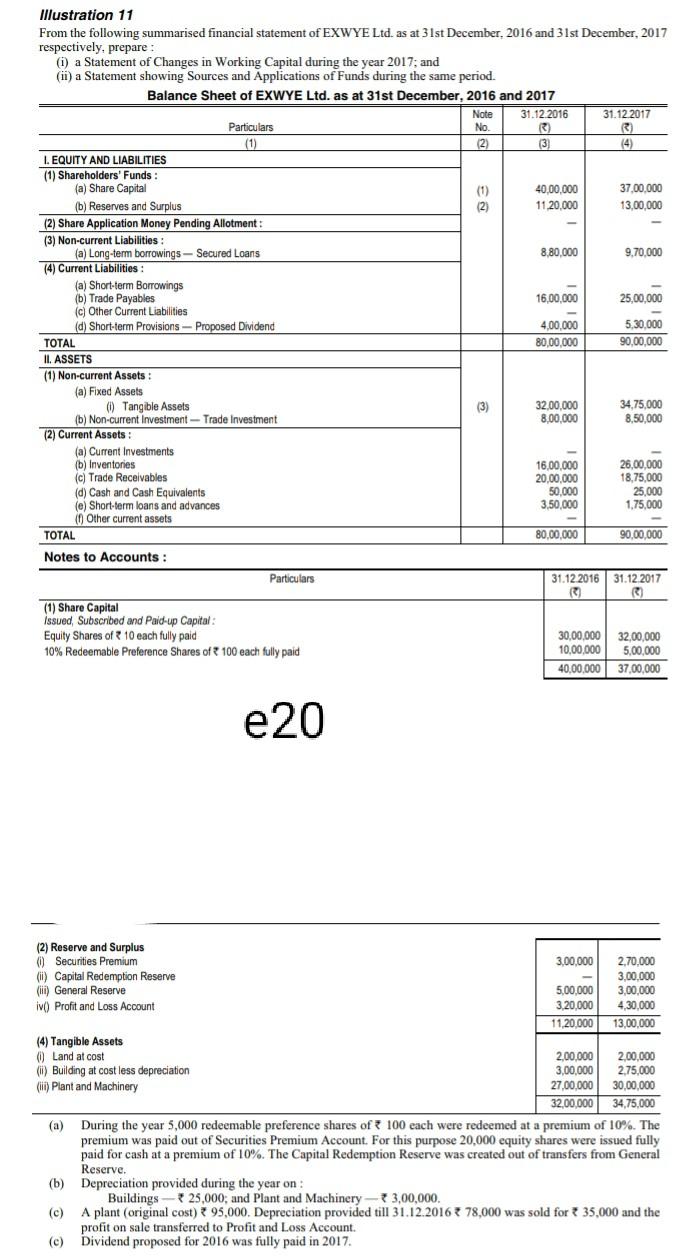

Illustration 11 From the following summarised financial statement of EXWYE Ltd. as at 31st December, 2016 and 31st December, 2017 respectively, prepare : i) a

Illustration 11 From the following summarised financial statement of EXWYE Ltd. as at 31st December, 2016 and 31st December, 2017 respectively, prepare : i) a Statement of Changes in Working Capital during the year 2017, and (ii) a Statement showing Sources and Applications of Funds during the same period. Balance Sheet of EXWYE Ltd. as at 31st December, 2016 and 2017 Note 31.12.2016 31.12.2017 Particulars No. R) (1) (2) (3) (4) LEQUITY AND LIABILITIES (1) Shareholders' Funds: (a) Share Capital (1) 40.00.000 37,00.000 (b) Reserves and Surplus (2) 11.20,000 13,00,000 (2) Share Application Money Pending Allotment (3) Non-current Liabilities: (a) Long-term borrowings-Secured Loans 8,80,000 9.70,000 (4) Current Liabilities (a) Short-term Borrowings (b) Trade Payables 16,00,000 25,00,000 (c) Other Current Liabilities (d) Short-term Provisions - Proposed Dividend 4,00.000 5,30,000 TOTAL 80,00,000 90,00,000 IL ASSETS (1) Non-current Assets : (a) Fixed Assets (1) Tangible Assets (3) 32,00,000 34,75,000 (b) Non-current Investment - Trade Investment 8,00,000 8.50,000 (2) Current Assets (a) Current Investments (b) Inventories 16,00,000 26,00,000 (c) Trade Receivables 20,00,000 18,75,000 (d) Cash and Cash Equivalents 50,000 25,000 (e) Short-term loans and advances 3,50,000 1,75,000 ( Other current assets TOTAL 80,00,000 90,00,000 Notes to Accounts: Particulars 31.12.2016 31.12.2017 (1) Share Capital Issued, Subscribed and Paid-up Capital: Equity Shares of 10 each fully paid 10% Redeemable Preference Shares of 100 each fully paid 30,00,000 32,00,000 10,00.000 5.00.000 40,00,000 37,00,000 e20 (2) Reserve and Surplus () Securities Premium 3,00,000 2.70,000 () Capital Redemption Reserve 3,00,000 (iii) General Reserve 5,00,000 3,00.000 iv) Profit and Loss Account 3.20,000 4,30,000 11,20,000 13,00,000 (4) Tangible Assets Land at cost 2,00,000 2,00,000 (0) Building at cost less depreciation 3,00,000 2,75,000 (iii) Plant and Machinery 27,00.000 30,00.000 32,00,000 34,75,000 (a) During the year 5,000 redeemable preference shares of 100 each were redeemed at a premium of 10%. The premium was paid out of Securities Premium Account. For this purpose 20,000 equity shares were issued fully paid for cash at a premium of 10%. The Capital Redemption Reserve was created out of transfers from General Reserve. (b) Depreciation provided during the year on Buildings -- +25,000, and Plant and Machinery -- +3,00,000 (c) A plant (original cost) 95,000. Depreciation provided till 31.12.2016 78,000 was sold for 35,000 and the profit on sale transferred to Profit and Loss Account. (c) Dividend proposed for 2016 was fully paid in 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started