Answered step by step

Verified Expert Solution

Question

1 Approved Answer

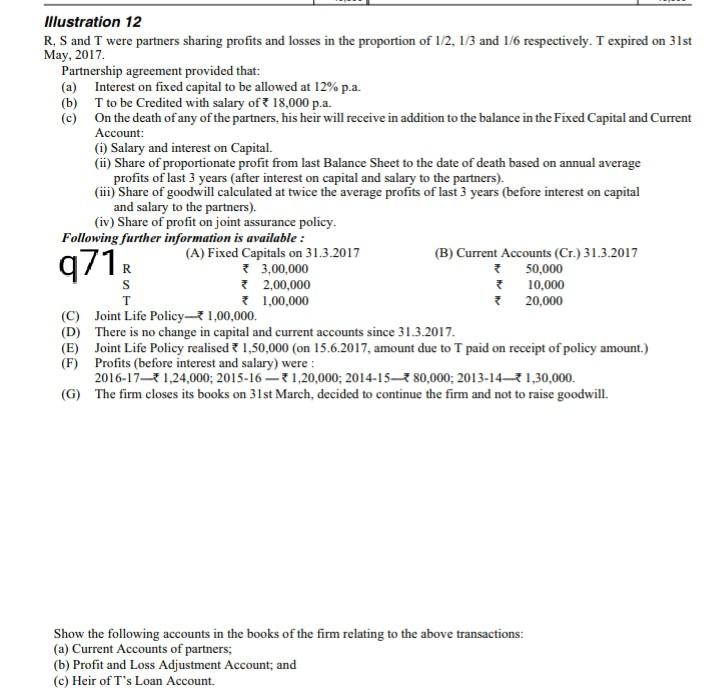

Illustration 12 R. S and T were partners sharing profits and losses in the proportion of 12, 1/3 and 1/6 respectively. T expired on 31st

Illustration 12 R. S and T were partners sharing profits and losses in the proportion of 12, 1/3 and 1/6 respectively. T expired on 31st May, 2017 Partnership agreement provided that: (a) Interest on fixed capital to be allowed at 12% p.a. (b) T to be Credited with salary of 18,000 p.a. (c) On the death of any of the partners, his heir will receive in addition to the balance in the Fixed Capital and Current Account: (1) Salary and interest on Capital. (ii) Share of proportionate profit from last Balance Sheet to the date of death based on annual average profits of last 3 years after interest on capital and salary to the partners). (i) Share of goodwill calculated at twice the average profits of last 3 years (before interest on capital and salary to the partners). (iv) Share of profit on joint assurance policy. Following further information is available: (A) Fixed Capitals on 31.3.2017 (B) Current Accounts (Cr.) 31.3.2017 3,00,000 50,000 S 2,00,000 * 10,000 * 1,00,000 * 20,000 (C) Joint Life Policy 1,00,000 (D) There is no change in capital and current accounts since 31.3.2017. (E) Joint Life Policy realised 1,50,000 (on 15.6.2017, amount due to T paid on receipt of policy amount.) (F) Profits before interest and salary) were : 2016-17 1,24,000; 2015-16 -31,20,000; 2014-15380,000: 2013-14% 1,30,000. (6) The firm closes its books on 31st March, decided to continue the firm and not to raise goodwill. 0712 Show the following accounts in the books of the firm relating to the above transactions: (a) Current Accounts of partners; (b) Profit and Loss Adjustment Account, and (c) Heir of T's Loan Account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started