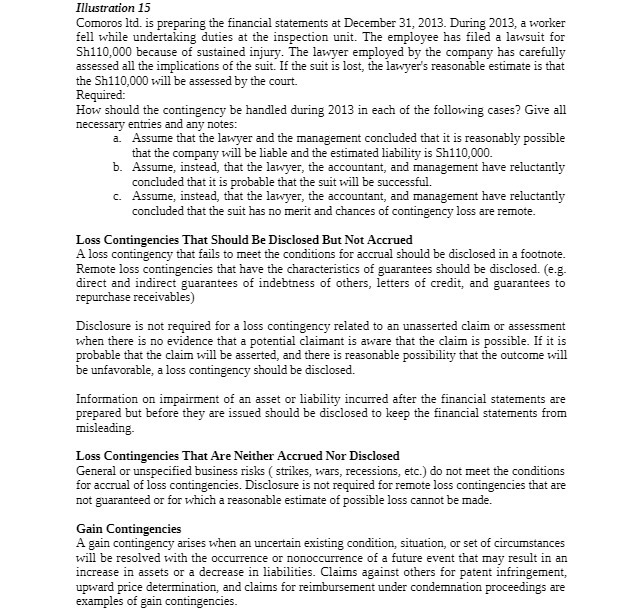

Illustration 15 Comoros Itd. is preparing the financial statements at December 31, 2013. During 2013, a worker fell while undertaking duties at the inspection unit. The employee has filed a lawsuit for Sh110,000 because of sustained injury. The lawyer employed by the company has carefully assessed all the implications of the suit. If the suit is lost, the lawyer's reasonable estimate is that the Sh110,000 will be assessed by the court. Required: How should the contingency be handled during 2013 in each of the following cases? Give all necessary entries and any notes: a. Assume that the lawyer and the management concluded that it is reasonably possible that the company will be liable and the estimated liability is Sh110,000. b. Assume, instead, that the lawyer, the accountant, and management have reluctantly concluded that it is probable that the suit will be successful. C. Assume, instead, that the lawyer, the accountant, and management have reluctantly concluded that the suit has no merit and chances of contingency loss are remote. Loss Contingencies That Should Be Disclosed But Not Accrued A loss contingency that fails to meet the conditions for accrual should be disclosed in a footnote. Remote loss contingencies that have the characteristics of guarantees should be disclosed. (e.g. direct and indirect guarantees of indebtness of others, letters of credit, and guarantees to repurchase receivables) Disclosure is not required for a loss contingency related to an unasserted claim or assessment when there is no evidence that a potential claimant is aware that the claim is possible. If it is probable that the claim will be asserted, and there is reasonable possibility that the outcome will be unfavorable, a loss contingency should be disclosed. Information on impairment of an asset or liability incurred after the financial statements are prepared but before they are issued should be disclosed to keep the financial statements from misleading- Loss Contingencies That Are Neither Accrued Nor Disclosed General or unspecified business risks ( strikes, wars, recessions, etc.) do not meet the conditions for accrual of loss contingencies. Disclosure is not required for remote loss contingencies that are not guaranteed or for which a reasonable estimate of possible loss cannot be made. Gain Contingencies A gain contingency arises when an uncertain existing condition, situation, or set of circumstances will be resolved with the occurrence or nonoccurrence of a future event that may result in an increase in assets or a decrease in liabilities. Claims against others for patent infringement, upward price determination, and claims for reimbursement under condemnation proceedings are examples of gain contingencies