Answered step by step

Verified Expert Solution

Question

1 Approved Answer

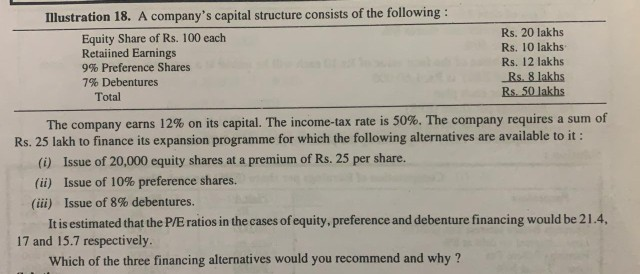

Illustration 18. A company's capital structure consists of the following: Equity Share of Rs. 100 each Retained Earnings 9% Preference Shares 7% Debentures Total Rs.

Illustration 18. A company's capital structure consists of the following: Equity Share of Rs. 100 each Retained Earnings 9% Preference Shares 7% Debentures Total Rs. 20 lakhs Rs. 10 lakhs Rs. 12 lakhs Rs. 8 lakhs Rs. 50 lakhs The company earns 12% on its capital. The income tax rate is 50%. The company requires a sum of Rs. 25 lakh to finance its expansion programme for which the following alternatives are available to it (1) Issue of 20.000 equity shares at a premium of Rs. 25 per share. (ii) Issue of 10% preference shares. (iii) Issue of 8% debentures. It is estimated that the P/E ratios in the cases of equity, preference and debenture financing would be 21.4, 17 and 15.7 respectively. Which of the three financing alternatives would you recommend and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started