Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ILLUSTRATION 3 Bryson acquired 75% of the issued share capital of Stoppard on 1 January 2021 for $8,720,000. At that date Stoppard had issued share

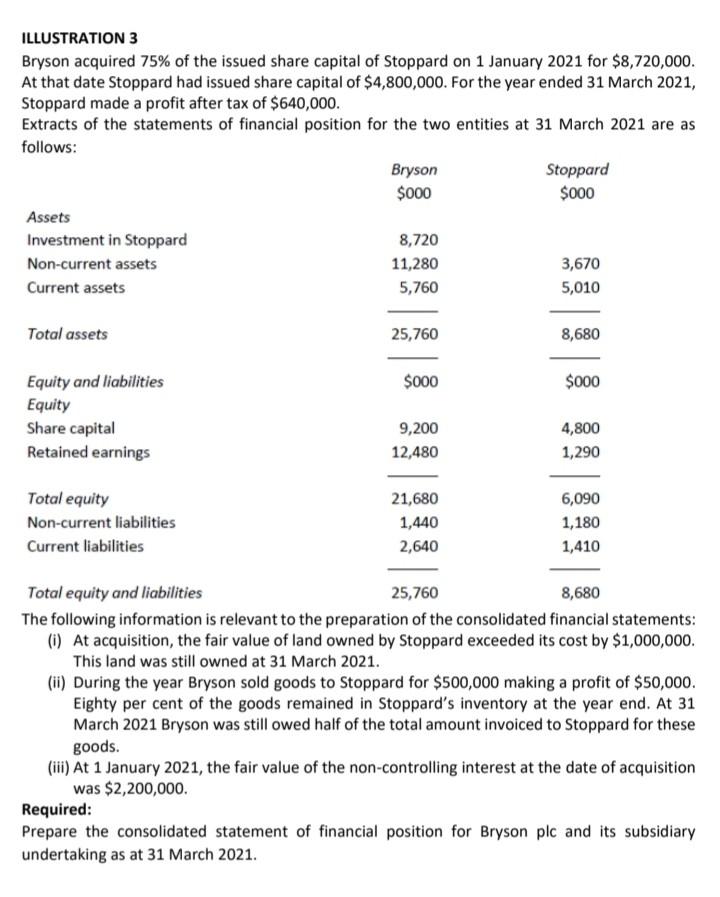

ILLUSTRATION 3 Bryson acquired 75% of the issued share capital of Stoppard on 1 January 2021 for $8,720,000. At that date Stoppard had issued share capital of $4,800,000. For the year ended 31 March 2021, Stoppard made a profit after tax of $640,000. Extracts of the statements of financial position for the two entities at 31 March 2021 are as follows: Bryson Stoppard $000 $000 Assets Investment in Stoppard 8,720 Non-current assets 11,280 3,670 Current assets 5,760 5,010 Total assets 25,760 8,680 $000 $000 Equity and liabilities Equity Share capital Retained earnings 9,200 12,480 4,800 1,290 Total equity Non-current liabilities Current liabilities 21,680 1,440 2,640 6,090 1,180 1,410 Total equity and liabilities 25,760 8,680 The following information is relevant to the preparation of the consolidated financial statements: (i) At acquisition, the fair value of land owned by Stoppard exceeded its cost by $1,000,000. This land was still owned at 31 March 2021. (ii) During the year Bryson sold goods to Stoppard for $500,000 making a profit of $50,000. Eighty per cent of the goods remained in Stoppard's inventory at the year end. At 31 March 2021 Bryson was still owed half of the total amount invoiced to Stoppard for these goods. (iii) At 1 January 2021, the fair value of the non-controlling interest at the date of acquisition was $2,200,000. Required: Prepare the consolidated statement of financial position for Bryson plc and its subsidiary undertaking as at 31 March 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started