Answered step by step

Verified Expert Solution

Question

1 Approved Answer

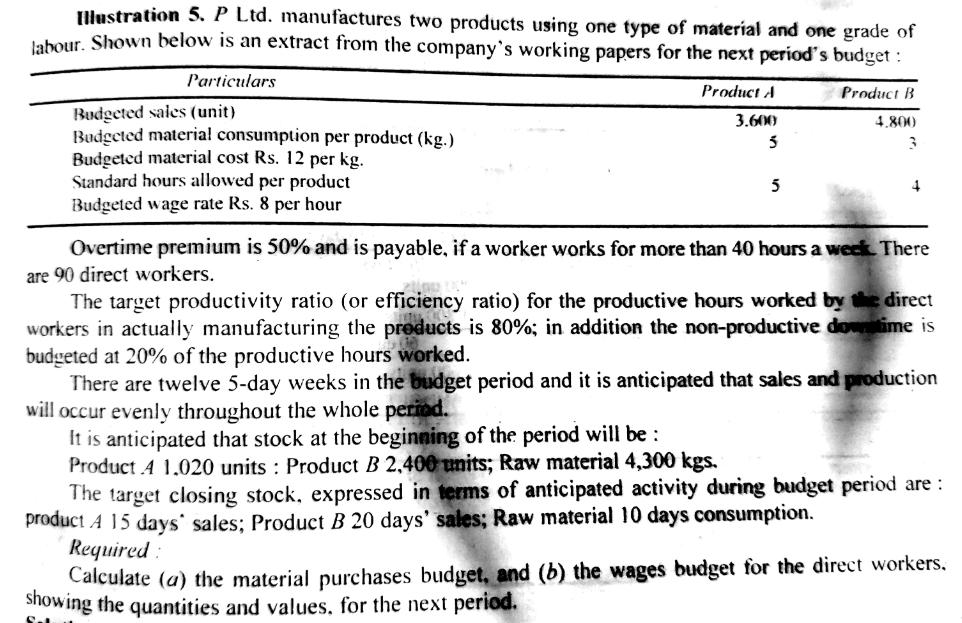

Illustration 5. P Ltd. manufactures two products using one type of material and one grade of labour. Shown below is an extract from the

Illustration 5. P Ltd. manufactures two products using one type of material and one grade of labour. Shown below is an extract from the company's working papers for the next period's budget: Particulars Product A Product B Budgeted sales (unit) 3.600 4.800 3 5 Budgeted material consumption per product (kg.) Budgeted material cost Rs. 12 per kg. Standard hours allowed per product 5 4 Budgeted wage rate Rs. 8 per hour Overtime premium is 50% and is payable, if a worker works for more than 40 hours a week. There are 90 direct workers. 21000 LICH The target productivity ratio (or efficiency ratio) for the productive hours worked by the direct workers in actually manufacturing the products is 80%; in addition the non-productive downtime is budgeted at 20% of the productive hours worked. There are twelve 5-day weeks in the budget period and it is anticipated that sales and production will occur evenly throughout the whole period. It is anticipated that stock at the beginning of the period will be: Product 4 1.020 units : Product B 2,400 units; Raw material 4,300 kgs. The target closing stock, expressed in terms of anticipated activity during budget period are: product A 15 days sales; Product B 20 days' sales; Raw material 10 days consumption. Required: Calculate (a) the material purchases budget, and (b) the wages budget for the direct workers. showing the quantities and values, for the next period.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Raw material purchase budget P ltd Material Purchase Budget For the Next Period of 12 Weeks Produc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started