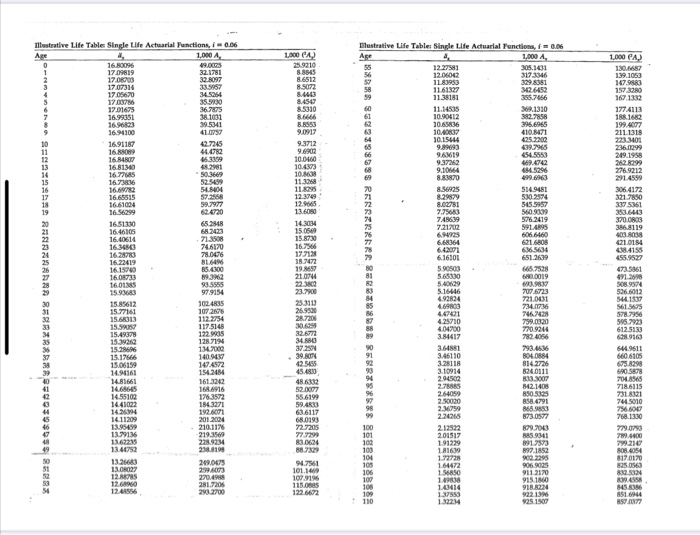

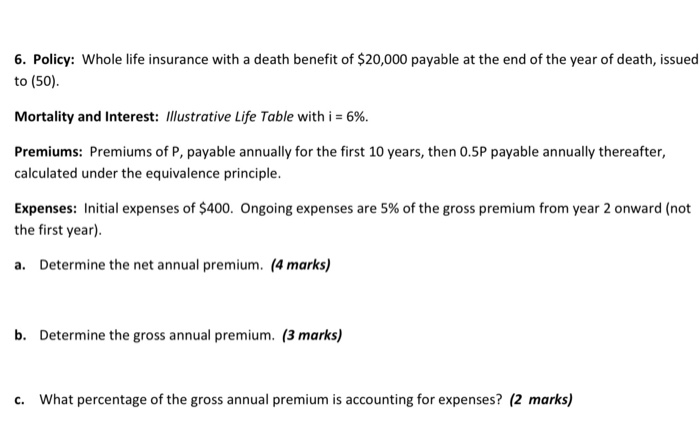

Illustrative Life Table: Single Life Actuarial Functions, 1 0.06 Ullastrative Life Tables Single Life Actuarial Functions, i 0.06 1.00 4. 10% 1 IP6819 1 mm 4) 122.591 6.11 , 1711 JING 11 ]] 11.1455 1. 35%, 1990 heller 13, 1131 5,551 16. 75 249.1958 2 1. 550 1940 375261 69 5) 2014 , 629 24] 11 71P %%%%GUt w w 9 :52 Ann9 26 F21 21 DH11 11 15.9%, F1991 Arra 3,84417 11 2 191 6449511 8040884 11. 17, 1999 14.9996 11 | H 11 294 PTT H29 704 ASIS 14 7445010 11 (15) PAPE FF14 PPP 19122 199 1 1. 9 2 016 ||| 6. Policy: Whole life insurance with a death benefit of $20,000 payable at the end of the year of death, issued to (50) Mortality and Interest: Illustrative Life Table with i = 6%. Premiums: Premiums of P. payable annually for the first 10 years, then 0.5P payable annually thereafter, calculated under the equivalence principle. Expenses: Initial expenses of $400. Ongoing expenses are 5% of the gross premium from year 2 onward (not the first year). a. Determine the net annual premium. (4 marks) b. Determine the gross annual premium. (3 marks) c. What percentage of the gross annual premium is accounting for expenses? (2 marks) Illustrative Life Table: Single Life Actuarial Functions, 1 0.06 Ullastrative Life Tables Single Life Actuarial Functions, i 0.06 1.00 4. 10% 1 IP6819 1 mm 4) 122.591 6.11 , 1711 JING 11 ]] 11.1455 1. 35%, 1990 heller 13, 1131 5,551 16. 75 249.1958 2 1. 550 1940 375261 69 5) 2014 , 629 24] 11 71P %%%%GUt w w 9 :52 Ann9 26 F21 21 DH11 11 15.9%, F1991 Arra 3,84417 11 2 191 6449511 8040884 11. 17, 1999 14.9996 11 | H 11 294 PTT H29 704 ASIS 14 7445010 11 (15) PAPE FF14 PPP 19122 199 1 1. 9 2 016 ||| 6. Policy: Whole life insurance with a death benefit of $20,000 payable at the end of the year of death, issued to (50) Mortality and Interest: Illustrative Life Table with i = 6%. Premiums: Premiums of P. payable annually for the first 10 years, then 0.5P payable annually thereafter, calculated under the equivalence principle. Expenses: Initial expenses of $400. Ongoing expenses are 5% of the gross premium from year 2 onward (not the first year). a. Determine the net annual premium. (4 marks) b. Determine the gross annual premium. (3 marks) c. What percentage of the gross annual premium is accounting for expenses? (2 marks)